Krishna KarwaMoneycontrol Research

A choppy market may cause pain, but also provides investors with good opportunities to go bargain hunting.

To identify new investment avenues while staying defensive, most investors prefer to choose names with robust fundamentals and favourable prospects. One such stock to keep on the radar is Whirlpool, one of India’s leading brands in the consumer durables space.

The path ahead

Revenue drivers

Distribution: In FY18, Whirlpool’s billing points across India grew 25 percent year-on-year (YoY). The company is working to expand its trade channel in semi-urban and rural India, where the pace of growth is likely to be faster vis-à-vis metros and tier 1 cities because of a low base, improved electrification coverage and growing necessity of white goods in households.

Products: The manufacturing capacity of refrigerators and washing machines may be increased in due course, considering the positive demand levers. Reduction in GST rates in these 2 categories from 28 percent to 18 percent is also added advantage.

Refrigerators: Whirlpool is focusing on direct cool single-door (DCSD) variants after a strong 23 percent year-to-date (YTD) growth. Capex of Rs 180 crore has been outlined to increase DCSD manufacturing volumes from 2.1 million units per annum (mupa) to 2.7 mupa.

Mix: After carving out a niche in the mass premium domain, Whirlpool is focusing on mass and premium products. Since mass products are priced at lower levels, sales growth will be volume-driven. In contrast, premium products, by way of their higher realisations, will aid value-based top-line growth.

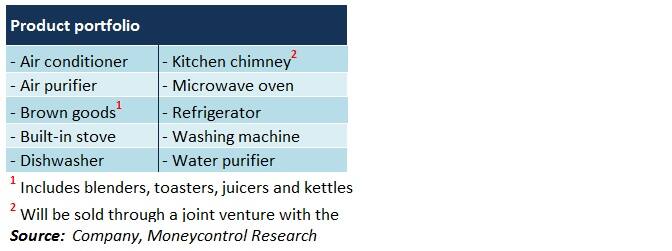

Whirlpool’s recent product launches include semi-automatic and large-size washing machines, 4-door premium refrigerators, internet-of-things air conditioners and dishwashers. To refresh the portfolio, new models across the entire product range will be introduced at regular intervals.

Cooking: Whirlpool acquired 49 percent stake in ‘Elica PB India’ for Rs 160 crore in June 2018. This will enable the company to sell ‘Elica’ brand of kitchen products (chimneys, built-in ovens and hobs, fryers) pan-India.

Cooking product revenues of ‘Elica’ are 6 times higher and distribution network is 4 times larger compared to Whirlpool. Besides leveraging Elica’s manufacturing, design and sales capabilities, Whirlpool’s products will gain better visibility since the same will be promoted at Elica outlets too.

Festivities: Onset of the festive season in the second half of a fiscal year is a major demand trigger for white goods. Easier and faster availability of financing options has been pivotal in driving consumer discretionary spends upward. Whirlpool hopes to capitalise on these trends.

Exports: In FY18, Whirlpool registered 16 percent YoY sales volume growth. This was because of good offtake in existing geographies (south and south-east Asia, Australia) and inroads in the relatively under-penetrated African markets (laundry appliance sales in South Africa and Morocco, for instance). The outlook on this front appears promising.

Online: The contribution of marketplaces (Flipkart, Amazon) to Whirlpool’s yearly turnover is expected to gradually go up from the current mark of 7-9 percent on the back of wider reach and faster adoption of digital platforms by shoppers. The company plans to increase its digital marketing expenses, in addition to managing its online ‘W’ store.

Margin drivers

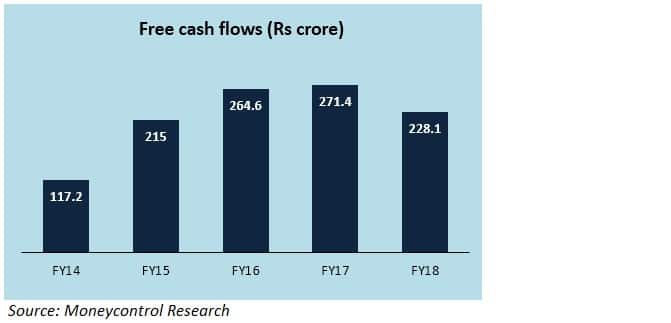

Healthy financials: Whirlpool, besides being a consistent cash flow generator, has also managed to improve its margin trajectory over the years. With zero debt, future capex is anticipated to take place from internal accruals.

Cost savings: To rationalise overheads, Whirlpool has been laying emphasis on directly dispatching products from its manufacturing units to points of sale in all markets.

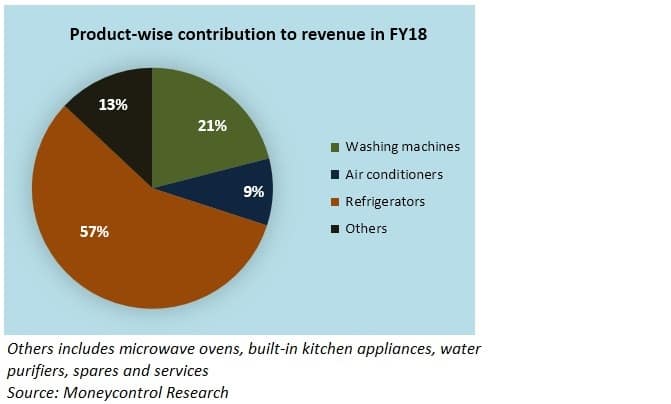

No customs duty hike: The government, in a recent announcement, increased the basic customs duty on imports of some white goods. Whirlpool’s manufacturing processes for its core products (refrigerators and washing machines jointly constitute almost 80 percent of annual revenue) are almost entirely based out of domestic locations (Faridabad, Puducherry, Pune). Therefore, it will not have to bear any additional costs in this regard.

Selective approach: Even though gaining a larger pie of the market is important in the context of consumer durables, Whirlpool believes in bottom-line maximisation rather than compromising margins to attain volume growth. The company makes periodic changes in its product offerings accordingly to ensure that to every extent possible, average selling prices of products increase more than the rise in costs.

Risks

Though Whirlpool’s products are competitively priced vis-à-vis other brands, consumers have not been shying away from paying a premium charged by foreign brands. This is more evident in larger cities, where price sensitivity is lower as compared to smaller regions.

An uptick in commodity prices and the rupee depreciation has resulted in input costs going up, which is typically passed on to the customer. However, extended discount periods, coupled with aggressive pricing strategies followed by e-commerce portals, may result in margin compression.

Valuation and outlook

Benefits of brand appeal, adequate cash resources, high asset turns, efficient working capital practices and parental guidance on research/technical know-how (from Whirlpool Corporation) should help Whirlpool re-rate noticeably in the long-run.

At 32 times its 2-year forward earnings, the stock, despite being optically expensive, offers value and can be a good and reliable bet to consider on dips.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.