In 2019, mutual fund managers have raised their stake in over 100 smallcap companies. More than 60 percent of them have given negative, data from AceEquity showed.

This year, frontliners outperformed the broader market, but experts say that the tide could slowly be turning towards undervalued small & midcap names which are likely to outperform as the economy starts recovering.

The S&P BSE Sensex is up 15 percent and the Nifty50 has risen nearly 13 percent so far in 2019, data collated up to December 27 showed. In comparison, S&P BSE Midcap index fell over 3 percent and S&P Smallcap index declined nearly 8 percent.

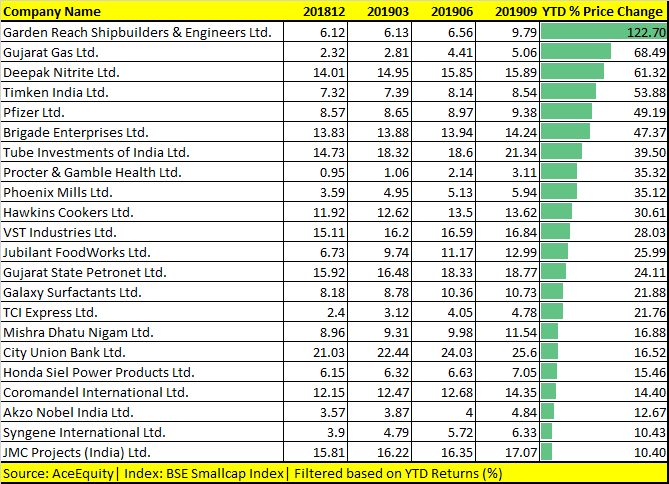

Fund managers raised stake in 108 companies in the last three quarters, data collated from December quarter 2018 to September quarter 2019 showed.

These include Garden Reach, Gujarat Gas, Deepak Nitrate, Timken India, Tube Investments and VST Industries.

Out of 108 companies, 22 rose 10-122% in the year 2019.

More than 60 percent, or 71 companies, from the fund managers' shopping list gave negative returns in 2019. These include Coffee Day, IG Petrochemicals, Tejas Network, NRB Bearing and Chennai Petro.

Experts feel that after two years of underperformance, the small & midcaps should catch up with the frontliners in 2020. But, a runaway rally might not be possible in the midst of a muted demand environment.

“Of late, it could be seen that many smallcap and midcap stocks have corrected sharply and are available at attractive valuations now in the market. Come 2020, small and midcaps could continue to be in focus, as there is an expectation of economic and earnings growth,” D K Agarwal Chairman & MD, SMC Investments and Advisors Ltd told Moneycontrol.

“To some extent, the money has already started following selectively in the mid and small-cap category stocks. Fund managers do keep looking for great stories at right pricing to make maximum out of it,” he said.

If we look at the anecdotal evidence small & midcaps usually fly ahead of the Budget, hence any dips should be used to buy into quality stocks that have sound fundamentals, and visible growth prospects.

“If we check the records seasonal shift are observed every year in the month of January & February where midcaps and smallcaps have a tendency to outperform the key benchmark index. From the past couple of days we have seen some momentum in small caps & midcaps,” Ritesh Asher – Chief Strategy Officer (CSO) at KIFS Trade Capital told Moneycontrol.

“We have seen that from past 1 year small caps & Midcaps have corrected near about 40-45 percent from the recent top and this can be grabbed as a great opportunity to enter into midcap stocks. Rather going for a directional view one should go for stock-specific action,” he said.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!