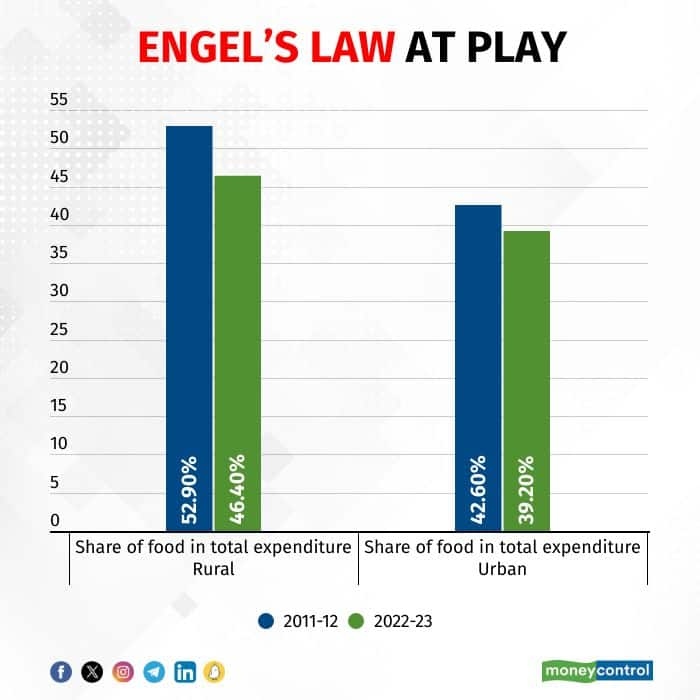

Latest Household Consumption Expenditure Survey data for 2022-23 clearly elucidates the classic Engel’s Law at play in India, wherein the share of spending on food declines as income rises. Of course, higher income means increased spending on food of superior quality that costs more, but this is unlikely to reverse the overall decline of the share of food in the consumption basket.

Source: Mospi

Why is it great news for the markets?

The theory can be extended to a country-wide scale and shows that countries with higher average household income see a lower proportion of income spent on food – which is measured by the Engel coefficient that reflects its economic status. A decreasing Engel coefficient usually indicates economic growth with a rising income level in the country.

That should be music to the ears of anyone doing business in India and seems like a no-brainer for the fifth largest economy marching its way for the coveted third spot within a decade.

Interestingly, the long-term data from 1999-00 to 2022-23 shows a compounded annual growth of over 9 percent in average monthly per capita expenditure for both rural and urban, highlighting the importance and growth potential of both the markets.

Source: Mospi

Source: Mospi

While the first cut data points to India taking baby steps to the path of prosperity, is it more equitable? Although the answer isn’t straightforward from average monthly expenditure data, the gap between the expenditure of top 5 percent and bottom 5 percent shows greater inequality in urban areas than rural, with significant ramification for consumption companies targeting large urban markets.

Source: Mospi

Where is India spending and what are people discarding from their shopping baskets?

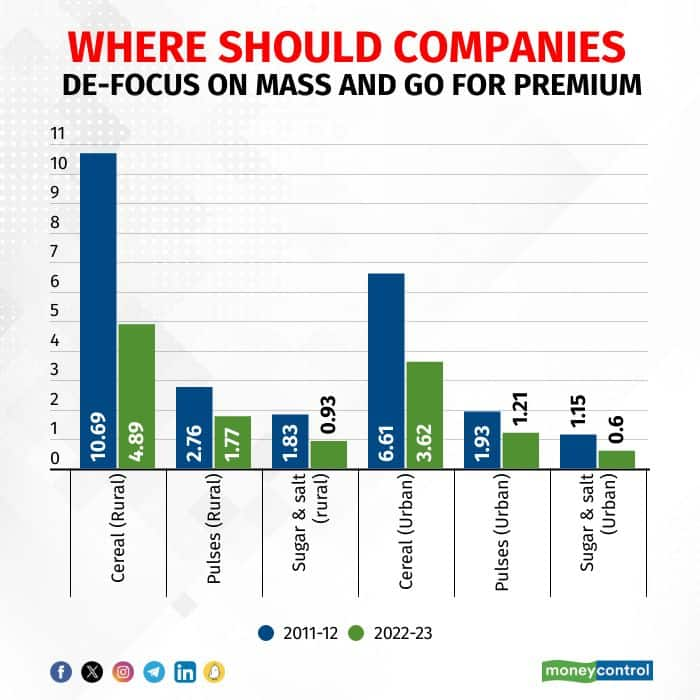

Following copybook Engel’s law both urban and rural consumers are spending less on cereals, pulses, sugar and salt as a percentage of total expenditure. That doesn’t mean all is lost for staples companies. Within the categories, there is a subtle but sure shift towards premium products. For instance, in both rural and urban areas, the categories that are maintaining or improving share are milk and milk products, fruits, proteins (egg, fish & meat) as well as processed food.

Source: Mospi

Source: Mospi

The change in consumption basket spells good news for the organized food companies.

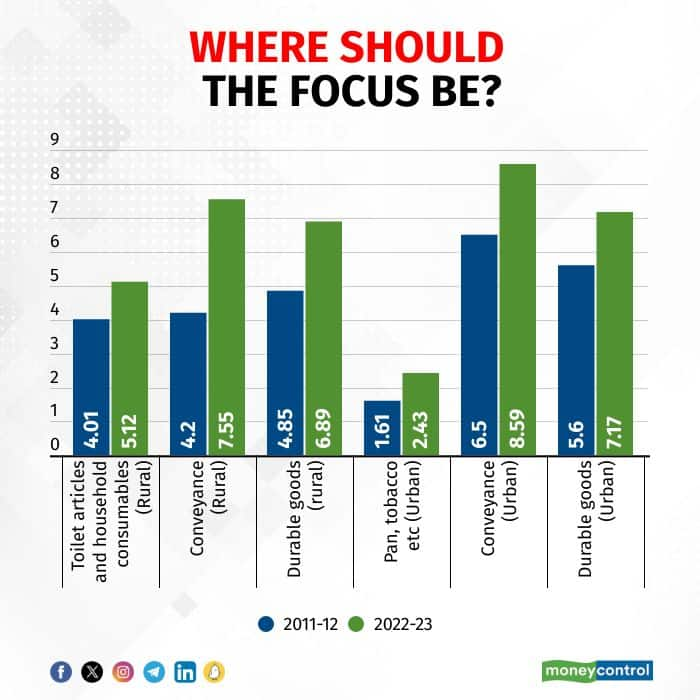

There seems to be a common theme on where India wants to put its incremental expenditure. Both rural and urban have strong inclination for spending on addiction items such as pan, tobacco and intoxicants, toilet articles and other consumables, conveyance and durable goods. Overall, discretionary categories are leading from the front in urban areas and are also making their presence felt in rural. In the equity markets, companies focused on discretionary consumption/premiumization have done well and should only do better as the country travels the path of becoming a middle-income nation.

Source: Mospi

Which Indian states look promising from a consumption demand viewpoint?

Finally, a word on the state-level data shows Chandigarh as the most promising urban market and Sikkim the wealthiest rural market. Chattisgarh is at the bottom, for both. Going strictly by the expenditure data, the size of average urban expenditure is 1.7x that of rural for the country as a whole. However, the skew of expenditure in favour of urban is more in states like Meghalaya, Chattisgarh, Assam, Odisha, Gujarat and Karnataka.

Overall, the data is a nascent indicator of India’s long but steady journey towards becoming a wealthier nation with implications for varied consumption categories, companies that are likely to lead from the front in this journey and how investors should participate in this growth story.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.