The Indian equities markets have witnessed a severe correction, with the Nifty Midcap100 index declining 10 percent and the benchmark Nifty sliding 5 percent over the past month.

The sharp volatility – the VIX index up 27 percent since 31st January 2018 – over the past few weeks can be ascribed to unsupportive global developments as well as domestic policy events (especially the Union Budget), Motilal Oswal said in a report.

What’s more disappointing is that the gloom comes after a smooth upward ride in CY17, when the markets did not once witness a drawdown of even 5 percent.

Hardening of bond yields globally is one of the key factors driving the market correction. Bond yields in India have hardened from 6.3% in July 2017 to 7.6% now.

“In our recent note that post the rise in bond yields, the markets (especially midcaps) were looking expensive on our P/B versus excess RoE framework and needing earnings support in the absence of cushion from the lower cost of capital,” Motilal Oswal said in a report.

Midcaps are trading at a premium of 40 percent to large-caps – an all-time high. The recent correction, however, has moderated this premium.

The domestic brokerage firm highlights the narrowing gap between earnings and bond yields in both developed markets (the US) and India, and the necessity of earnings pick-up to maintain current valuations.

Stocks to Buy in the correction: a mix of growth & valueThe sharp correction in midcaps makes stock-picking a bit less challenging, as valuation premiums have moderated from the recent highs.

While MOSL does not rule out a further correction, we believe, given our earnings recovery thesis for FY19, this correction offers a good opportunity to accumulate quality ideas where valuations had turned expensive.

The domestic brokerage firm favors a mix of growth and value plays benefitting from the key themes of (a) Consumption Recovery – both urban and rural, (b) Financialization of Savings, and (iii) structural trends like Formalization of Economy post-GST implementation.

“On the value side, we suggest names that are relatively unpopular but where underlying dynamics are turning favorable, and also those where valuations are at a significant discount to the sector,” it said.

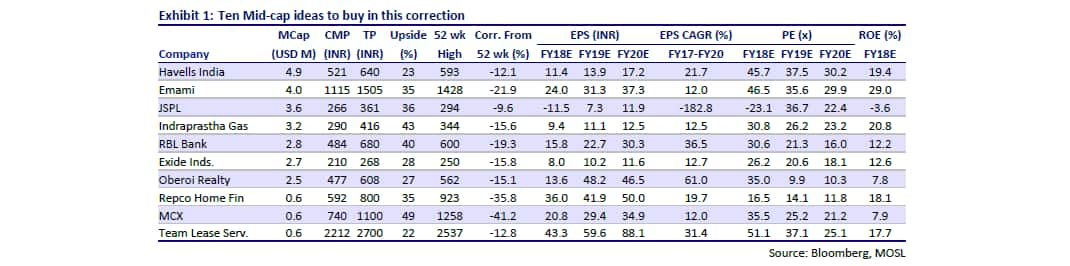

Motilal Oswal highlights 10 stocks from their universe, where they believe that (a) growth visibility is healthy and the outlook is strong and (b) there has been at least 15% correction from 52-week highs, and our target upside offers a healthy return potential.

MOSL preferred ideas are: Havells, Emami, JSPL, IGL, RBL Bank, Exide, Oberoi Realty, Repco Home Finance, MCX and Team Lease.

Among the large-caps, we like HDFC, ICICI Bank, Larsen & Turbo, M&M, Motherson Sumi, Titan, HPCL, and NMDC.

Disclaimer: The views and investment tips expressed by investment expert from Motilal Oswal on moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.