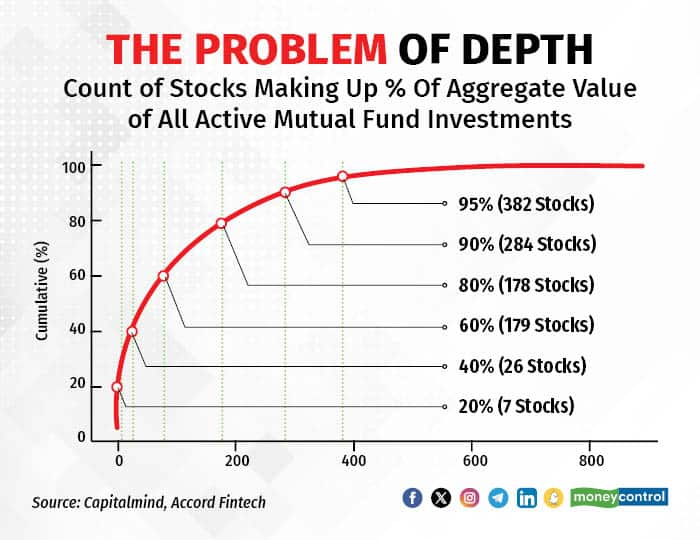

About 95 percent of 427 active mutual funds' corpus is invested in only 382 stocks. To put this number into context, there are more than 4,000 stocks listed on the Bombay Stock Exchange and active fund managers are choosing less than 10 percent of the listed universe.

As per data compiled by Accord Fintech and shared by Capitalmind, 95 percent of active MF (mutual fund) AUM is invested in 382 stocks, 80 percent of AUM in just 178 stocks and about 60 percent in just 79 stocks.

Speaking to Moneycontrol, Deepak Shenoy, founder of Capitalmind, said, “This just shows that our mutual fund industry has a problem of low depth. Very little incremental AUM is flowing into small stocks. Most fund managers choose to invest in the large companies. The major reason behind this is liquidity.”

Explaining further, Shenoy said, "The largest smallcap fund in India has a corpus of about Rs 37,000 crore. The largest smallcap today has a market cap of ~Rs 17,000 crore.

"Even if the fund manager decides to invest 1 percent of corpus in this company, they would end up owning 2 percent stake. These companies also tend to have high promoter stake and exit becomes difficult."

Adding to this, Vashishtha Iyer of Capitalmind said that the larger the AUM, the more difficult it is to generate alpha. "I'm not saying that it is a skill problem. I think it's an operational problem. The median number of stocks in an active mutual fund is roughly 50. If 80 percent of the total active industry AUM is in 180-200 stocks, that means that each fund is kind of buying 20-25 percent of the market," he said.

The solutionThe Capitalmind team believes that the solution to this problem of depth is more participation. Currently, investing in India is competing with trading. Futures and options trading in India has seen an unprecedented rise in recent years with derivatives volumes now over 400 times of cash trading volumes.

Also Read: Khelo India | Mapping the boom in derivatives volumes and the rush towards F&O

"With weekly options contracts and extended trading hours, the fight for turnover between trading and long-term investing instruments only gets more intense," said Iyer.

Meanwhile, Shenoy is of the view that India should allow the setting up of more structures that only invest in listed stocks. "Today, if four of my friends and I want to create a structure together and invest in companies, after a certain threshold, it will be classified as an NBFC. Then, the regulator will start monitoring it. Such regulations are restrictive in a way," he said.

As of March 2023, mutual funds had only 8.7 percent ownership of the India Inc listed universe, foreign institutional investors owned 19 percent, and retail investors had 9.4 percent. Meanwhile, private promoters held 41.9 percent.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.