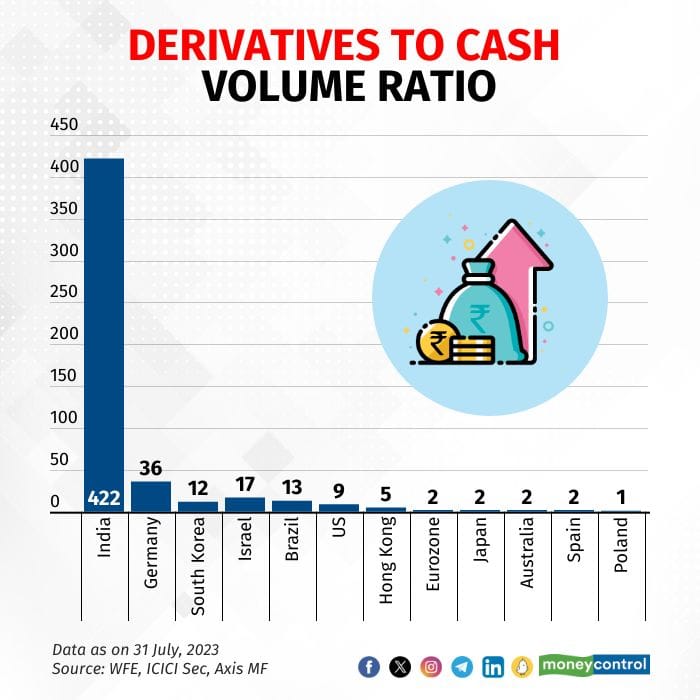

Futures and options trading in India has seen an unprecedented rise in recent years with derivatives volumes now over 400 times of cash trading volumes. In a report titled Gamification of Indian Equities, Axis Mutual Fund Chief Investment Officer Ashish Gupta has warned that the outsized derivatives markets can be a source of additional macro and market risk.

"In most markets, derivatives volumes account for 5-15x their cash market volumes. In India today, however, derivative volumes are more than 400x higher than that of the underlying cash market today, having grown from 3x in 2010," Gupta noted in the report.

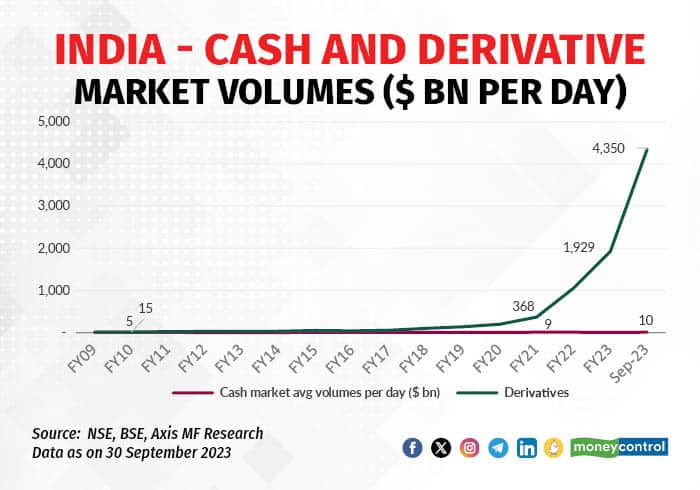

What's more? Total derivatives volumes at over $4.3 trillion per day are roughly 125 percent of the underlying companies’ market capitalisation, the report added.

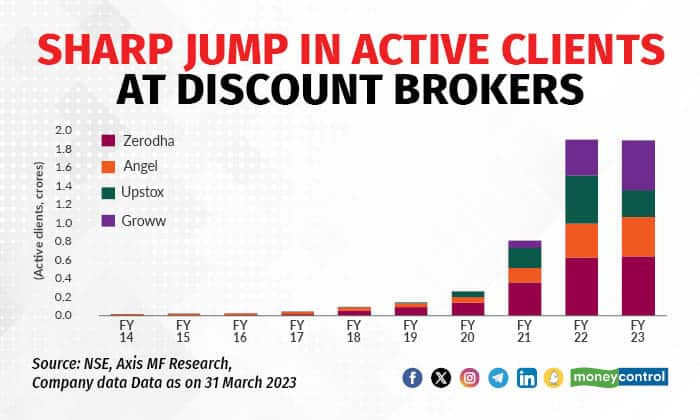

According to Gupta, a number of reasons have contributed to this boom, especially change in contract structure, leverage combined with the ease of client onboarding and interface of the new generation trading apps.

Also Read: MC Explains: Once profitable out-of-money options now a trap for F&O traders on expiry dayCurrently, India has at least one weekly F&O contract expiring every day. Monday - Nifty Midcap Select and BSE Bankex; Tuesday - Nifty Financial Services; Wednesday - Bank Nifty; Thursday - Nifty 50 and Friday - Sensex.

Of the over 5,000 companies listed in India, derivatives contracts are available for 193 stocks and indices. Axis Mutual Fund's research suggests that there are ~46,000 individual contracts available at any point spanning across futures, options, tenor and strike prices.

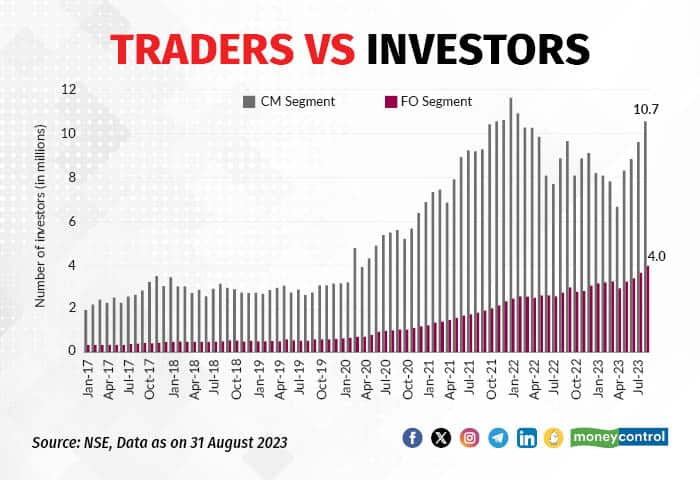

This has led to 'gamification' of F&O trading. "This has led to the number of active derivatives traders jumping 8 times to 4 million from less than 0.5 million in 2019. In comparison, in the cash market, the number has grown 3 times - from ~3 million in 2019 to 11 million," Gupta higlighted.

Furthermore, shorter duration options have effectively “sachet-ized” trading, said Gupta. This is evident by the rush of younger investors into trading as they can take bigger risks with less capital.

The average age of an equity retail investor is 35 years, whereas those with digital discount brokers is 29 years, similar to 31 years for online gaming companies.

"Weekly options are cheaper compared to monthly contracts, and buyers gain exposure to the full notional value by paying only 0.5-5 percent for the same," as per Gupta.

In conclusion, while derivates were initially designed as hedging tools, they now stand to exacerbate volatility. "Black swan events and resultant spike in volatility, in particular, can drive exaggerated moves in stock prices and result in market dislocation," said Gupta.

After all, a SEBI report has found that 9 out of 10 traders lose money, with ~Rs 56,000 loss per person on average.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.