Mutual funds are betting big on consumption as a theme as the segment is witnessing significant growth, driven by increasing per capita income and a shift in consumer spending patterns.

While fund managers across the industry are bullish on the segment, Axis Mutual Fund is the latest to jump on the bandwagon by launching a consumption theme NFO, which opened in August 22.

The last one year has seen Kotak AMC and Quant Mutual Fund also launching schemes focused on consumption as a theme.

As per data from Ace MF, Baroda BNP Paribas India Consumption Fund and Tata India Consumer Fund reported one-year returns of 43.76 percent and 43.87 percent, respectively.

Further, over a period of three years, Nippon India Consumption Fund and SBI Consumption Opportunity Fund-Reg(IDCW) outperformed their benchmarks with returns of 25.07 percent and 28.65 percent.

Over five years, Nippon India Consumption Fund led with a 27.63 percent return.

While announcing the launch of their NFO, Shreyas Devalkar, Head of Equity at Axis AMC highlighted the sector's expanding relevance. “The consumption index has shown resilience during economic downturns,” he said while adding that "falling less than the broader market during draw downs.”

Over the last one year, the Nifty Consumption Index has gained over 44 percent and over 150 percent in the last five years.

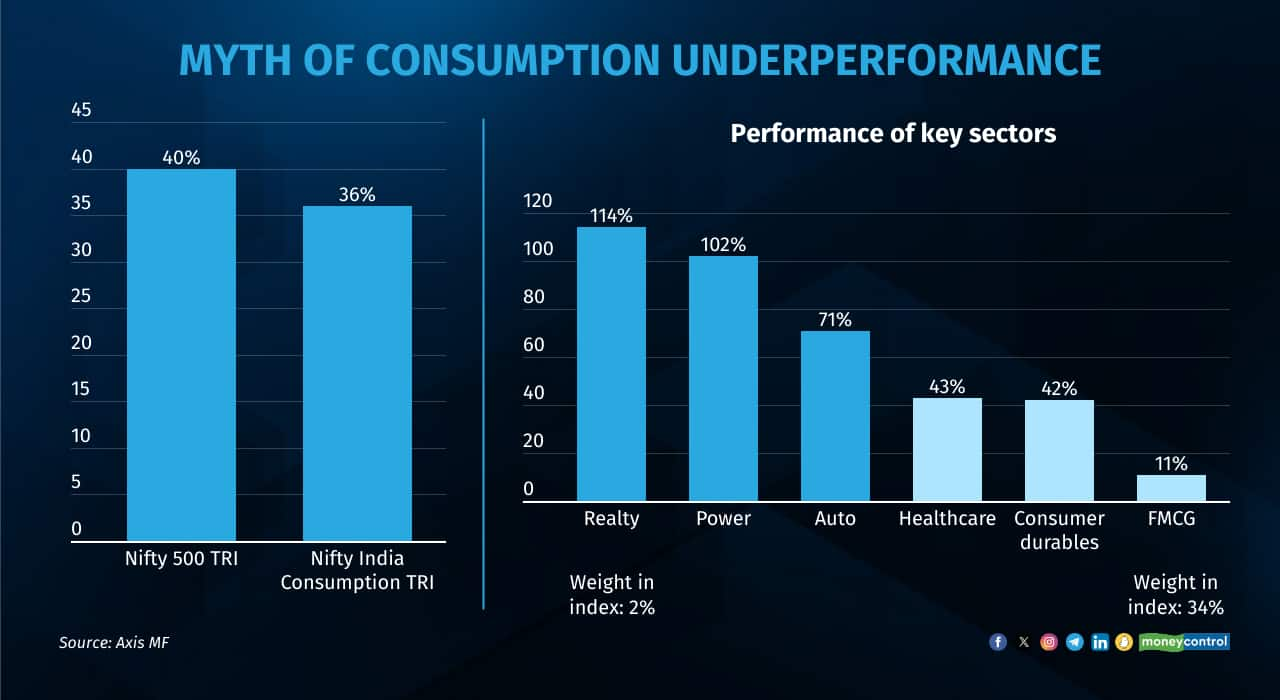

Devalkar also believes that there are some misconceptions about sector performance. “Consumption as a theme has given 36 percent risk returns compared to a broader market return of 40 percent over the past year.” Despite FMCG sector returns being lower, other sectors like real estate, auto, and power have delivered stronger returns ranging from 70 percent to 100 percent.

In a similar context, Siddhant Chhabria, Research Analyst & Fund Manager, Mirae Asset Investment Managers (India) said that companies catering to upper middle class have witnessed strong demand in the recent years.

"We believe growth rates for discretionary sector is at an inflection point and these companies have the potential to grow at 1.5-2x GDP," he said. Another driver in the sector, he believes, has been the formalisation element that has been a key theme playing out in recent years which is driving accelerated market share gains for organised players either in grocery, jewellery and building materials.

“As India progresses to become a middle-income economy, the focus on consumption will intensify,” Devalkar added.

Over the last one year, the top 10 stocks (by weightage) in the Nifty Consumption Index have gained between 12 percent and 85 percent, with biggest gains seen amongst auto players like Eicher Motors (49.37 percent), Mahindra & Mahindra (77.46 percent) and Hero MotoCorp Ltd (85.57 percent)

While some challenges persist, experts and fund managers largely remain optimistic.

Amar Kalkundrikar, Fund Manager - Equity Investments, Nippon India Mutual Fund notes that while mass consumption has been relatively subdued over the last two years, some signs of recovery have emerged such as the strong growth in two wheelers post last Diwali and the recently observed uptick in rural FMCG demand.

“These trends could sustain and spread to more categories with support coming from easing inflation, better agri outlook and state government schemes in some states, etc.,” he noted.

In a previous conversation with Moneycontrol, Kalkundrikar had highlighted that recent years have witnessed a reduction in the sector's relative premium compared to the broader market. Coupled with emerging green shoots and relatively moderated valuations, this segment appears poised for a reasonable recovery ahead.

In a recent panel discussion on consumption growth organised by Axis MF, Sanjeev Moghe, President and Head - Cards & Payments, Axis Bank had said that India’s credit card market has experienced notable growth, surpassing 10 crore cards recently. He added that there has also been a significant shift in the geographical distribution of credit card issuance beyond top cities like Mumbai, Delhi, and Bangalore.

“Now, more than 60 percent of new cards are being issued outside the top eight cities,” he said adding that digital payments have also surged as well.

Another area that has seen growth is the real estate sector driven by premiumisation and a younger demographic entering the housing market. Shobhit Agarwal, MD & CEO, Anarock Capital said, “The first house purchase age has dropped significantly, from an average of 45 years pre-COVID to the early 30s now.” Additionally, branded developers now account for 35 percent of home sales, up from less than 20 percent pre-COVID.

Meanwhile, rising incomes are fueling increased discretionary spending and investment.

“As per capita income rises, there’s a significant increase in discretionary spending," says Axis AMC CIO Ashish Gupta.

This has led to more robust growth in sectors like real estate and luxury goods, as well as a larger savings pool, enabling more investments in equities and mutual funds.

Chabbria added that with this income growth, more sectors are participating in the consumption landscape in India leading to newer opportunities emerging even in the listed space in the recent years. For example, new age, stationery, QSR and specialised retailers.

"We believe exciting opportunities such as companies which can grow at 1.5-2x GDP will continue to emerge in this theme over the medium to long term," he said adding that they believe that consumption is due for a broad-based recovery where overall valuations of the sector are not at a significant premium versus pre-Covid valuation.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.