The mood of Indian fans is sombre after India’s unexpected loss to Australia on Sunday. The same feeling was echoed by the Moneycontrol Pro Cricindex that declined by 0.5% on Monday, underperforming the Nifty’s decline of 0.2%.

While emotions will run high for few days, what will remain etched in the memory of cricket lovers across the globe is that of a grand cricketing spectacle, spanning over six views that captivated fans with high quality exhibition of the game of cricket. So the game had its last laugh and so has our Cricindex, which rose by over 3 percent from end September to last Friday, outperforming a nearly flat Nifty over this period.

![]()

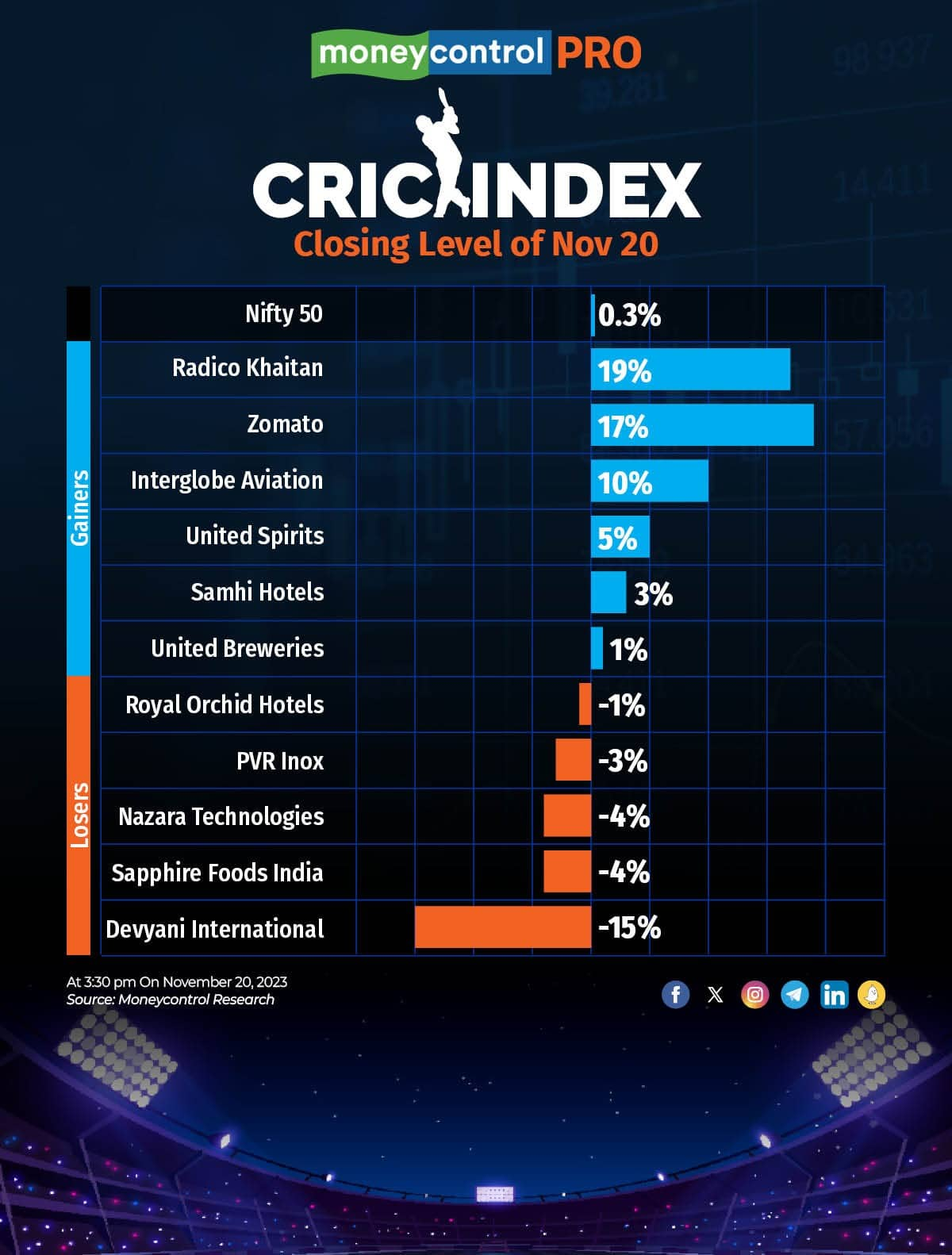

In the eleven-member stock squad, six outperformed the Nifty while five lagged. The sector of the tournament was the alcoholic beverage stocks – Radico Khaitan, United Spirits and United Breweries. They all fared well, and why not? Their products would have been a constant companion for fans to celebrate victories and drown their sorrows.

However, for Radico, an analyst would give kudos not to cricket but to an impressive Q2 results underpinned by strong volumes, pricing, and execution.

As the batters kept hitting fours and sixes, so did fans with their phones – ordering multiple meals through Zomato, ignoring service fees in the euphoria. While the mood may have helped its stock market performance, investors would have been more impressed by Zomato achieving profitability in its operations with better than expected earnings in Q2.

Travel is on a new high and young India doesn’t mind overpaying to catch a glimpse of their favourite men in blue in action. That would have helped the largest domestic carrier Interglobe Aviation. While fans were burning pockets with soaring airfares, investors were celebrating stellar numbers from Indigo in a seasonally soft Q2.

Enthusiastic supporters of India didn’t mind over-stretching with astronomical hotel room rates and the rally in hotel stocks was therefore nothing unexpected. But what played spoilsport on the bourses were divergent quarterly numbers. While the turnaround play Samhi Hotels held its head high, Royal Orchid Hotels (ROHL) gave up some its gains post weak earnings although the medium term outlook is decent.

Despite the expected momentum in food ordering, Devyani International lost after a subdued Q2, marked by weak same-store sales growth (SSSG) in both KFC and Pizza Hut on account of higher inflation and the extended Shravan period. Sapphire Foods India, too, had a relatively weak show.

PVR Inox hosted match screenings in more than 50 cities for the world cup final which should have partially helped offset any adverse impact of lower footfalls during the matches. PVR Inox also delivered its best ever quarterly result in Q2. However, it seems like the bottle was popped much before the finale as all the fizz was lost after the Street started having concerns around the Company's ability to sustain similar performance in the second half, competition from OTTs and delayed Ad revenue recovery.

Nazara Technologies which owns the sports web portal ‘sportskeeda’ should have benefited from the cricket world cup, but it did not. Disney+ Hotstar’s master stroke of offering free ad-supported streaming of the Cricket World Cup to mobile users in India resulted in ~59 million concurrent viewers on the final day, thereby winning over Nazara.

While the eleven stocks might have binged on the cricket fever, all good things must come to an end. After the World Cup, it is back to the basics with their financial performance charting the stock market journey for our eleven-member Cricindex squad.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.