Jitendra Kumar Gupta

Moneycontrol Research

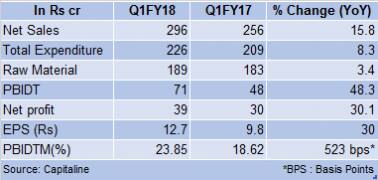

IG Petrochemicals, the largest manufacturer of phthalic anhydride (PAN), controlling 47 percent of India’s production capacity, reported 30 percent growth in net profit at Rs 39.1 crore. This was led by 16 percent growth in the revenue to Rs 296 crore. Apart from the top line growth the company also benefitted from expansion in the margins. During the quarter ended June 2017, the company saw a strong 530 basis points improvement in the operating margins to 23.85 percent. Improvement in the margins was driven by lower raw material prices. The company’s raw materials include petrochemicals like orthoxylene, which is a derivative of crude oil.

While the company grew sales by 16 percent, raw material consumed increased by merely 3 percent leading to huge savings at the operating level.

“Domestic PAN demand is quite high and this we believe must have led to higher prices leading to increase in the spread between the raw material prices and finished products. This has resulted in higher operating margins as well. Because of the higher realisations, sales have grown at a higher rate as there is very little scope for the volumes to go up since the company is already operating at capacity utilisation of close to 95 percent. This is also evident from the fact that its competitor Thirumalai Chemicals, which is operating at 70-75 percent capacity utilisation benefited the most,” said Nikhil Shetty who is tracking the company at B P Equities.

It is also likely that the integration of recently acquired 3500 tonnes facility of Maleic Anhydride (MA) from Mysore Petrochemicals (for Rs 74.5 crore) has started to contribute to revenues and profitability of the company. This facility is supposed to have close to 55 percent operating margins which on a blended basis has helped in the overall improvement of operating margins. MA is used for producing fiberglass plastics which find applications in the fixture and others like automobile, pipe, roofing and tanks.

Outlook and ValuationsGrowth in revenues and margins is certainly above expectations. The market was expecting 8-10 percent growth in revenues and about 200 basis points improvement in the margins for the full year. In FY17, the company witnessed 68 percent year-on-year growth in net profit to Rs 102 crore. In FY18, it was expected to post a net profit in the region of Rs 133 crore.

If the performance of Q1 18 continues, FY18 could be another good year with the company reporting even higher profits. If one were to annualize Q1FY18 profit, the full year profit works out to Rs 156 crore as against Rs 102 crore net profit in FY17. However, it would be prudent to wait for the second quarter numbers and management commentary. Since the time Moneycontrol Research covered the stock (at Rs 402), the stock has had a decent run. Even after the recent spike, with the net profit estimate for FY18 at around Rs 132-133 crore, the stock is still reasonably valued at 11 times FY18 expected earnings.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.