Madhuchanda DeyMoneycontrol Research

Control Print – the home-grown player in coding and marking industry - continues to impress us with a steady quarterly performance. We had earlier reposed faith in the company and the performance so far has been nothing short of impressive.

Quarter at a glance

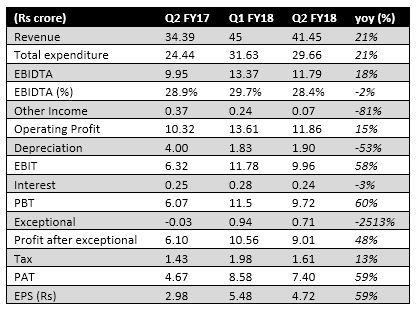

In the quarter gone by, the company reported a steady show with 21 percent growth in top line along with a stable margin that aided 18 percent surge in EBIDTA (earnings before interest depreciation & tax).

The decline in depreciation and interest led to 59 percent surge in after-tax-profit.

For Control Print, we like the oligopolistic nature of the business (dominated by four players), the legal requirement to provide various printed information to the customers, the secular growth outlook tied to GDP and the stickiness of the clients for the company.

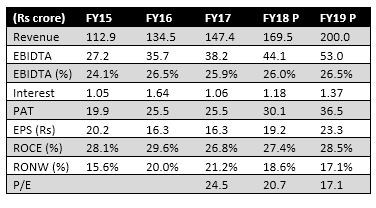

It is reassuring to see that in the first half of the fiscal, the company has achieved little over 50 percent of our full-year revenue and profit estimates. The stock has risen by a modest 4 percent in the past three months and has actually underperformed the FMCG packaging universe. Given the healthy return ratios, the valuation at 17.1X FY19 earnings beckons attention.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.