Cholamandalam Investment and Finance Company share price jumped over 4 percent intraday on March 26. The stock has surged over 255 percent in the last 1 year.

India Ratings and Research (Ind-Ra) has rated Cholamandalam Financial Holdings' Rs 200-crore non-convertible debentures (NCDs) as ‘IND AA+’ with stable outlook.

Domestic research and broking firm Motilal Oswal has a buy rating on the stock with target of Rs 640 per share. "While the stock has re-rated over the past few months, it trades close to its five-year average. Given CIFC's strong RoE and growth potential, we believe there is scope for a further re-rating," it said.

The stock was trading at Rs 560.85, up Rs 22.90, or 4.26 percent at 10:26 hours. It has touched an intraday high of Rs 562.70 and an intraday low of Rs 544.25.

The company reported net sales at Rs 2.30 crore in December 2020 down 94.22 percent from Rs 39.81 crore in December 2019. It reported quarterly net loss at Rs 3.48 crore in December 2020 down 109.04 percent from Rs 38.48 crore in December 2019.

Global research firm Credit Suisse has maintained outperform call on the stock with target raised to Rs 630 per share. "FY22-23 estimates increase by 4 percent on higher growth and lower credit costs. Expect the company to deliver sector-high RoE of 23 percent in FY22," the research firm said, according to a CNBC-TV18 report.

"The company's disbursement growth is seen at 30 percent and margin may expand 50 bps," it added.

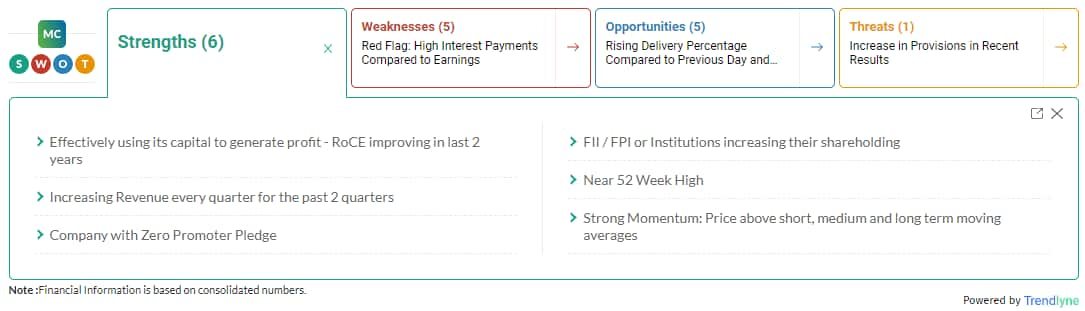

According to Moneycontrol SWOT Analysis powered by Trendlyne, the stock is showing strong momentum: price above short, medium and long term moving averages. The company has zero promoter pledge with FII / FPI or institutions increasing their shareholding.

Moneycontrol technical rating is very bullish with moving averages and technical indicators being being bullish.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own, and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.