Jitendra Kumar Gupta Moneycontrol Research

CG Power and Industrial Solutions has finally broken its silence in the wake of alleged financial lapses. And the story it’s selling to investors can be straight out of a Hollywood movie laced with all the thrill and suspense.

In an exchange filing, the company said it found some unrelated suspicious transactions while going through normal financing assessment. After investigations, it figured out a few unidentified transactions by its employees.

But how did things come to such a pass? First, a financing company issued a letter of failure of interest payment to CG Power, which could not be “traced”. A cheque replacement request followed. The managing director then realised that the company had no role to play.

So, there were fears of something amiss and an audit committee was set up to probe the issue. The panel’s findings are now out and the figure at stake is really huge.

A rip-off?

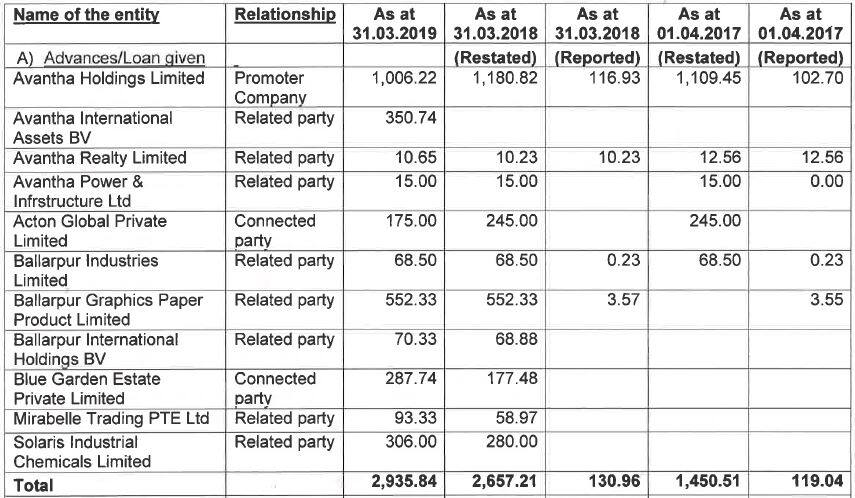

According to the risk and audit committee (RAC), total liabilities at the group level may have been understated to the extent of Rs 1,608 crore and advances to the related parties potentially understated to the tune of Rs 2,807 crore by FY18.

These are huge numbers for a company whose total market capitalisation is merely some Rs 757 crore. No wonder, its shares are locked at 20 percent lower circuit. This is hard to digest, considering the magnitude of the amount involved and the nature of transactions.

The maze of complexities

The report further stated that these transactions appear to have been carried out by various means, including inappropriate netting off, using unrelated third parties, routing transactions through subsidiaries, promoter affiliate companies and other connected parties. These “may have potentially resulted in misstatement of past financial statements”.

What is disconcerting is divergence of such magnitude could not be spotted by the auditors and the management earlier. These transactions were found to have been routed through subsidiaries that took the shelter of accounting under contingent liabilities.

What should investors do?

Post 2008 crisis, many Indian companies spent a fortune to salvage what they already invested or plug the holes in their balance sheets.

CG Power is already feeling the pinch. Its failure to restructure business both in overseas and domestic markets, delay in asset monetisation, shrinking liquidity, absence of true and timely financial information, drop in credit ratings and mounting debt in books could cause a prolonged pain, which may or may not ever ease.

As they say “buy the rumour, sell the news”. The stock has already fallen this year to the current Rs 11.80, from about Rs 50 earlier.

Under the circumstances, the best case scenario appears to suggest that investors should exit. The worst possibility is to catch the falling knife.

For more research articles, visit our Moneycontrol Research Page.

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.