Highlights:

- Sequential top line growth suggests improving market share

- Operating margin contraction due to end market headwinds

- Lower raw material prices to provide respite- Strong balance sheet and dominant market presence remain key positives

Bhansali Engineering Polymer (BEPL) registered a weak set of numbers for the March quarter, chiefly on the margin front. High-cost inventory and the end market slowdown seem to have squeezed the operating margin.

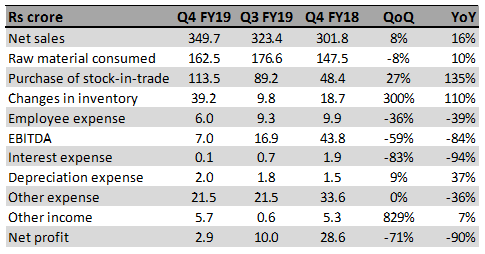

Chart: Q4 financials

Source: Moneycontrol Research

Key positive

BEPL posted sequential improvement in sales in Q4FY19, which is remarkable, considering the softness in the end market. It is noteworthy that the automobile industry constitutes nearly 50 percent of the end user industry.

Big negatives

The company witnessed a sharp erosion in gross margin. In January-March, it posted a gross margin of 9.9 percent, against 14.8 percent in the preceding quarter and 28.9 percent a year ago. The higher cost of goods sold appears to be a combination of pricey inventory and limited scope to pass on the cost to end clients.

Consequently, EBITDA margin dropped to 2 percent and a sharp decline in employee cost by 36 percent QoQ helped it stay afloat.

Profit before tax was down 30 percent sequentially as lower operating profit was partially offset by higher other income and lower interest expense.

Key observations

Key raw materials – butadiene and acrylonitrile – have traded lower in recent times. Butadiene prices, in particular, seem to have been impacted by weaker domestic demand in China, leading to a higher supply in exports markets like India. Fushun Petrochemical (PetroChina division) particularly has reported higher export volumes in recent times.

Styrene prices have been volatile. Management commentary from Apcotex highlighted the lower raw material price trend, which has posed a challenge in terms of managing the raw material inventory.

It’s noteworthy that while butadiene can be sourced from the domestic market, acrylonitrile and styrene are imported. In fact, the company imports 85 percent of its raw materials (styrene and acrylonitrile), which makes it vulnerable to global oil derivative price levels and currency movements.

Acrylonitrile is sourced from distant markets like the US and hence, higher lead time requires longer inventory days.

On account of the above factor and the challenges in the end market, the company’s inventory and trade receivables have jumped YoY -- though not alarming as a percentage of sales. Inventories to sales stood at 8 percent (against 6.5 percent in FY18) and trade receivables to sales at 18.2 percent compared to 15 percent earlier.

Outlook

BEPL’s positioning for the long term remains on a solid footing. What remains supportive is its strong balance sheet. It’s a zero debt company despite periodic capacity expansions.

Notably, it added 20,000 tonnes of capacity in FY18, taking the overall figure to 100,000 tonnes. According to a report, the company intends to ramp up its capacity to 137,000 tonnes, from 1,00,000 tonnes. Once completed, the capacity would meet almost 50 percent of its domestic demand.

What’s more, BEPL is looking at a mega capacity expansion plan of 200,000 tonnes in 2020-21, which is expected to bridge the domestic demand-supply gap.

However, the current trends are not encouraging. While the raw material price trajectory suggests a limited concern for the company, end market slowdown is the key headwind.

As the domestic auto industry major Maruti has guided to a mid-single digit volume growth, this remains a key business challenge. As of now, BEPL seems to be going in for a strategy of defending or increasing market share at the cost of margin.

Going forward, we expect margins to improve gradually, but EBITDA margin is unlikely to hit a mid-teen level in a hurry.

The stock is trading at 12x FY20e (estimated) earnings estimates. While valuations have turned reasonable, we suggest investors keep a wait and watch approach and accumulate at lower levels.

In the longer term, we remain positive on the company’s dominant position in the duopoly market of ABS, end client stickiness and growing expertise in speciality grades.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.