When Rapido introduced bike taxis in Bengaluru in 2015, few could have predicted that within a decade, it would grow into a unicorn.

The startup not only pioneered bike taxis in India but also inspired other large mobility players like Uber, Ola and inDrive as well as newer players like Namma Yatri to explore this segment in the world’s largest two-wheeler market.

However, the popularity did not last long. Since 2021, the bike-taxi segment has witnessed multiple hurdles like regulatory and policy hurdles, backlash from auto drivers and lack of trust among women riders.

Enter 2025, the demand for bike taxis has come back stronger, especially in congested urban centres. This growing demand has fuelled a resurgence in the segment which is pushing traditional and newer players to relaunch bike-taxis with newer campaigns and features.

Hurdles and relief

India's bike taxis have faced several roadblocks including regulatory challenges as well as on-ground challenges for drivers and riders.

Auto-rickshaw unions opposed their expansion, fearing income losses, while regulatory hurdles around the commercial use of private (white-board) two-wheelers led to their ban in several states, including Delhi, Maharashtra, Karnataka, and Assam.

Many early movers in the sector, such as HeyTaxi, Baxi, Bikxie, and M-Taxi, either shut down or scaled back due to regulatory challenges.

Karnataka initially became the first state to introduce an electric bike taxi policy in 2021, but under pressure from auto unions, it withdrew the policy in March 2024.

However, relief came in February 2024 when the Union Ministry of Road Transport and Highways issued an advisory, stating that motorcycles qualify as contract carriages under the Motor Vehicles (MV) Act, 1988.

This advisory urged states and union territories to process contract carriage permits for motorcycles, potentially opening up the market further.

Why bike taxis continue to thrive

Poor last-mile connectivity and refusal by auto drivers to ply by the meter are the two chief reasons.

Additionally, affordable rides, starting as low as Rs 10 per km, make bike taxis an attractive choice.

“We see many riders, especially in congested cities like Bengaluru, choosing to travel by bike-taxis. While many women are still concerned about safety, we see healthy growth too,” said one of the mobility aggregators, requesting anonymity.

Moreover, bike taxis provide employment opportunities for young individuals looking for flexible work with minimal investment.

“This is just an average but bike-taxi drivers earn anywhere between Rs 15,000 - 20,000 a month,” said an industry expert. “This pushes many youngsters to join the segment to get their part-time income”.

InDrive’s spokesperson said that their moto rides are now well-received by citizens.

“Our moto rides have been well-received by users as they are a convenient and affordable option, especially for short-distance trips. Overall, moto rides have become an integral part of urban transportation in cities now, catering to the needs of a growing population and providing a viable alternative to traditional transport options,” said Pavit Nanda Anand, communication lead (APAC), inDrive.

In fact, several ride-hailing companies, such as Uber and Rapido, are in discussions with electric two-wheeler manufacturers in India to help the shift to EV fleet services or to form partnerships to offer vehicles at reduced costs to registered driver partners.

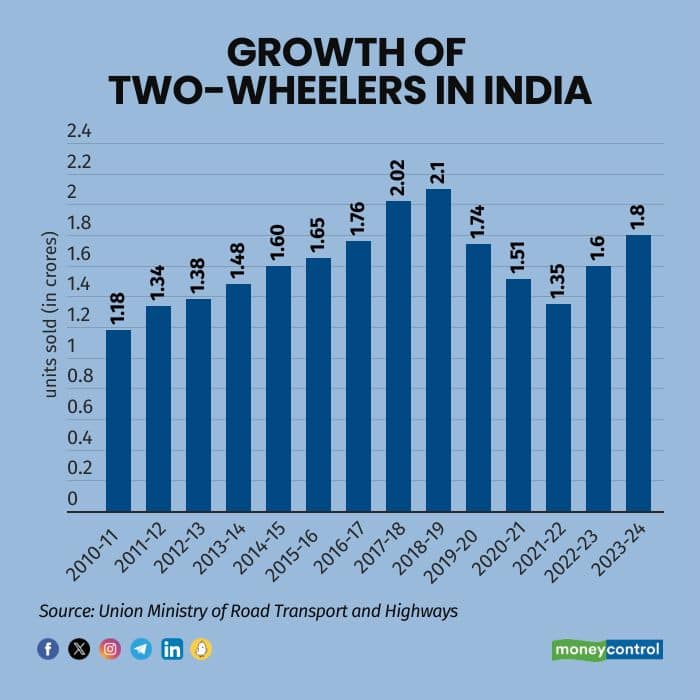

These companies are approaching firms like Zypp and Bounce to accelerate the process of electrifying their bike-taxi services. In fact, the overall growth of two-wheelers also signal a rise in consumption.

Also Read: Ride-hailing firms knock EV 2W manufacturers’ doors for bike-taxi electrification

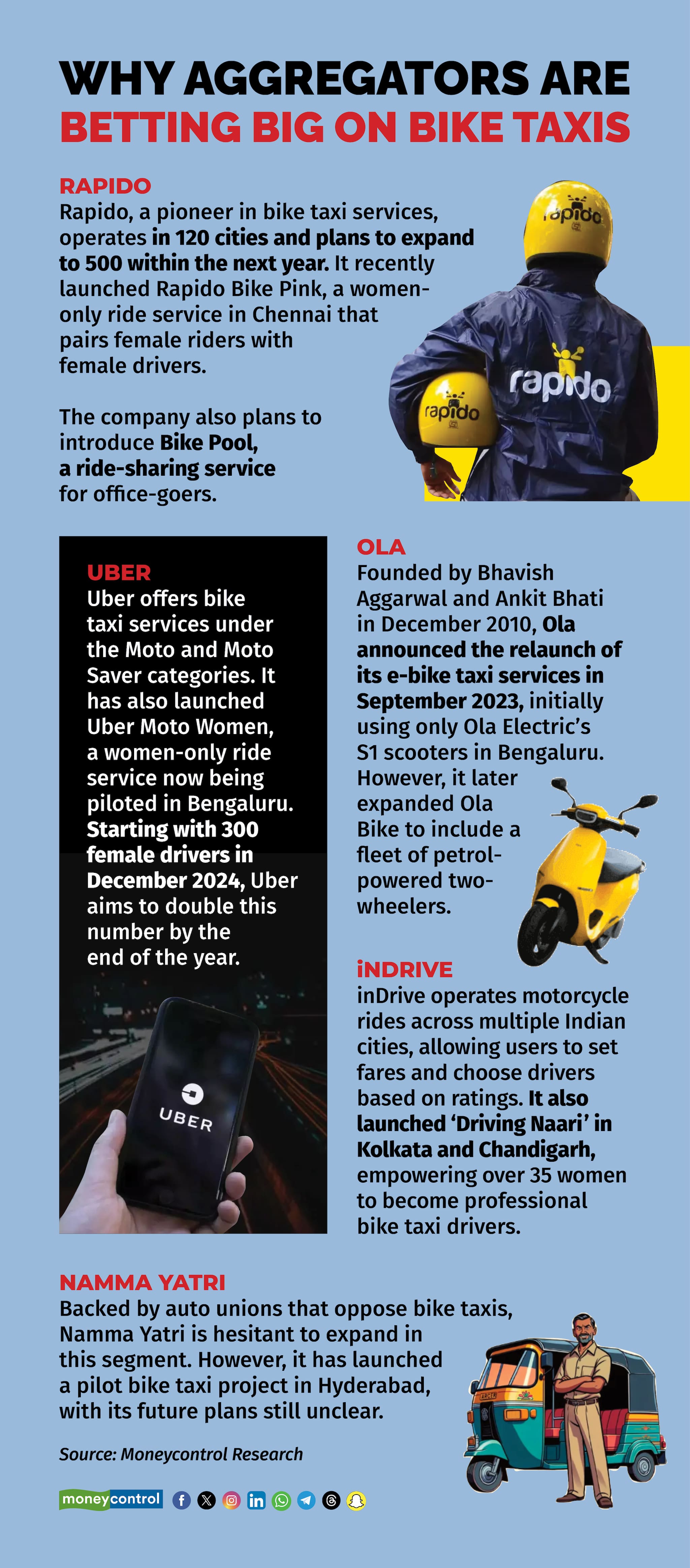

Rapido’s expansion plans: Aiming for 500 cities with newer models

Bengaluru-based Rapido, currently operating in 120 cities, has ambitious plans to expand to over 500 cities within a year. It is also experimenting with a bike taxi pool for office-goers travelling in the same direction.

"Our affordable fare of under Rs 10 per km has made bike taxis a transformative solution for urban mobility. With over 3 million new users joining us every month and 20 million relying on our services for first- and last-mile connectivity, Rapido is redefining how Indians commute,” said a company spokesperson.

Beyond bike taxis, Rapido has diversified its services, adding auto rickshaws, cabs, and parcel delivery.

The company is also focusing on fleet electrification and initiatives like 'Bike Pink' in Chennai, which provides electric bikes and training to financially disadvantaged women.

Also Read: Rapido to switch to all-electric bike-taxi fleet in Delhi by next year

Uber, Ola, and Namma Yatri’s strategies

Uber is expanding its bike taxi service, Moto, across 125 cities, with safety features like an emergency button, ‘Share my trip,’ and 24/7 safety support. The company also launched Moto Women in Bengaluru, aiming to double the number of female bike-taxi drivers from 300 in December 2024.

Similarly, Ola, which relaunched its bike-taxi service, with its electric S1 scooters in Bengaluru, later pivoted back to petrol-powered two-wheelers. Despite CEO Bhavish Aggarwal’s initial announcement that the service would remain electric, Ola Bikes now offers both fuel-based and electric options.

The latest entrant Namma Yatri, backed by auto unions, is in a unique dilemma. While it piloted bike taxis in Hyderabad, it has refrained from expanding in Karnataka, largely due to resistance from auto drivers. The platform has publicly denied plans to launch bike taxis in Bengaluru.

Several players are moving beyond the traditional bike-taxi model, introducing initiatives focused on inclusivity and safety, such as women driver development programmes and road safety training.

“We have launched the Driving Naari programme in Kolkata and Chandigarh, a purpose-driven initiative by inDrive, aimed at empowering women to break barriers and explore their potential behind the wheel. Under this programme, we support women in becoming professional drivers. It began as a pilot project in India and has now expanded to these cities. Currently, 35+ women are actively offering moto rides with inDrive,” said an inDrive spokesperson.

“In terms of road safety, we conduct annual 'SafeDrive with inDrive' campaigns, where we educate our drivers on passenger safety and comfort. As part of this initiative, drivers also receive specialised road safety training from traffic police officials,” he said.

A $5 billion market opportunity

The revenue potential of India’s bike-taxi industry is estimated at $5 billion, according to the Ola Mobility Institute. Allied Market Research projects the sector to grow from $50.5 million in 2021 to $1.48 billion by 2030, at a CAGR of 48.5 percent.

Urban mobility expert Ravi Gadepalli explains the sector’s rapid rise.

"Two-wheeler taxis are growing due to their affordability and efficiency. While public transport follows fixed routes and schedules, bike taxis offer flexibility. They are cheaper than three-wheelers and taxis, helping commuters save both time and money. In traffic-clogged cities like Bengaluru, two-wheelers can weave through congestion and reach destinations faster," he said.

While bike taxis are growing at a healthy phase, concerns around safety—particularly for women—continue to be a challenge. Reports of vehicle seizures, attacks on bike taxi drivers by auto unions, and incidents involving unruly riders also cast a shadow on the sector’s growth.

Globally, bike taxis have flourished, particularly in Southeast Asia, where Indonesia’s Gojek employs over 2 million riders, as well as in markets like Brazil, Colombia, and Nigeria. In India, as urban traffic congestion worsens, bike taxis are poised to remain a crucial part of the mobility ecosystem despite regulatory hurdles and industry pushback.

However, several industry experts emphasise that for long-term sustainability, companies must also prioritise an electrification roadmap, aligning with the broader push towards cleaner and more sustainable urban transport.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.