Over 73 percent of startups that raised capital between Rs 50 lakh to Rs 2 crore in India have received angel tax notice(s) from the Income Tax Department till date. This is as per findings of a survey conducted by LocalCircles and the Indian Private Equity & Venture Capital Association (IVCA).

Around 30 percent of startups have received three or more such notices, as per the survey, which included over 2,500 startups and entrepreneurs.

Only 27 percent startups did not receive any angel tax notice for raising money.

Angel tax has been the biggest bone of contention for startups as they are subject to it whenever they raise money from friends, family, and venture capitalists.

A startup becomes liable to pay angel tax when it receives an equity infusion in excess of its 'fair valuation'. Tax authorities treat the premium paid by investors as income, taxable at about 31 percent.

Watch: 3 Point Analysis | What is angel tax?

The issue came to light after various startup entrepreneurs reported receiving tax notices on angel investment raised 3-4 years back. They were being asked to provide an explanation for the funding raised and their valuations.

Media reports suggest that in some cases the sum that the startups must cough up as tax and late payment fee even exceeded the original funding amount.

Read: Govt likely to come up with fresh notification on angel tax in a week

The survey indicates that most Indian startups, who are raising money, have a high likelihood of receiving an angel tax notice under Section 56(2)(viib) or under Section 68 or both.

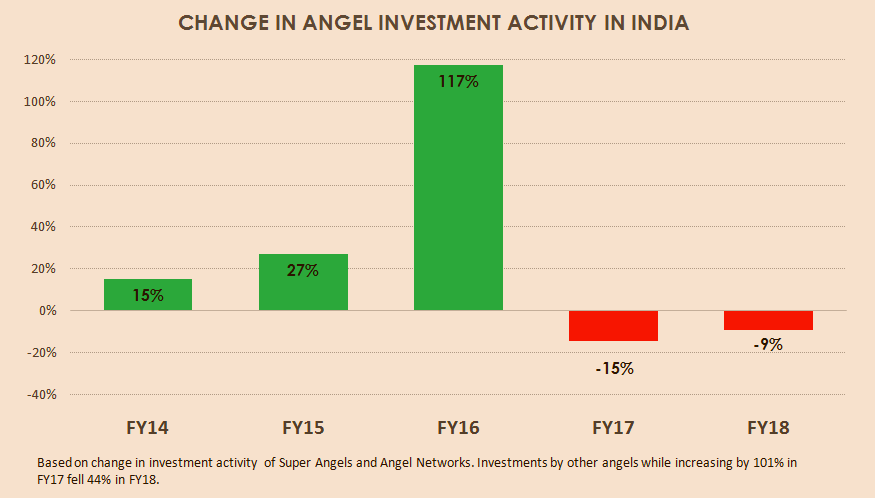

It also highlighted a worrying trend that angel investors are very cautious in making investments due to various hurdles, especially angel tax.

Sources: LocalCircles.

Sources: LocalCircles.

Funding has seen a downward trend even though the startup movement is on the rise and the number of angel investors have increased.

Startups were hopeful that the Budget will get them some respite from the issue or at least a commitment from the government on resolving the issue, but it stayed unaddressed in the Finance Minister's Budget speech.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.