In 2016, private equity giant General Atlantic passed an opportunity to invest in Byju's at a valuation of about $400 million, due to a revenue-valuation mismatch.

But in the subsequent years, Byju’s benefitted from a growing number of internet users and increasing comfort with online learning, and it started seeing a rapid growth trajectory. Consequently, Byju's revenue surged significantly, surpassing the Rs 1,300 crore mark during FY19.

Byju's had also raised significant funding, which helped fuel its expansion. Between 2016 and 2018, it raised close to $135 million, and its valuation soared from $380 million in 2016 to over $1 billion in 2018.

General Atlantic took note of this turnaround and finally entered Byju’s cap table in 2018. With a group of global venture capital investors, it invested in Byju's at a valuation exceeding $3 billion.

In the next four years, the PE firm enjoyed substantial returns as Byju's valuation surged past $22 billion. This success bolstered the PE firm's confidence in India's edtech landscape, prompting it to make another significant edtech investment in 2020–Unacademy.

So, all’s well that ends well? Not quite.

Both edtechs saw their core revenues plateauing post Covid as demand for online learning, especially for the K-12 (kindergarten to class 12) and test prep segments, dropped with schools, colleges and physical tuition centres reopening. This led to a decline in valuations of edtech companies as their revenue growth flattened.

For instance, Byju’s valuation has been cut down by BlackRock and Prosus to $8.4 and $5.1 billion respectively. SoftBank-backed upskilling unicorn Eruditus, was also marked down by a US-based AMC by 10 percent as of March 2023.

Further, Byju's grappled with additional challenges, including corporate governance issues, which have contributed to the company's current crisis. The company is also struggling with technical defaults on the two loans it raised in November 2021 and in May this year, while it is yet to close a long-pending fund infusion.

Having burnt its fingers, General Atlantic has now decided to distance itself from investing in Indian edtech firms. In fact, it has declined opportunities from at least two edtech companies since the beginning of the year. According to a source, the PE investor now employs a primary filter for potential investments: assessing whether a company is indeed an edtech firm.

General Atlantic and Byju's did not respond to queries sent by Moneycontrol.

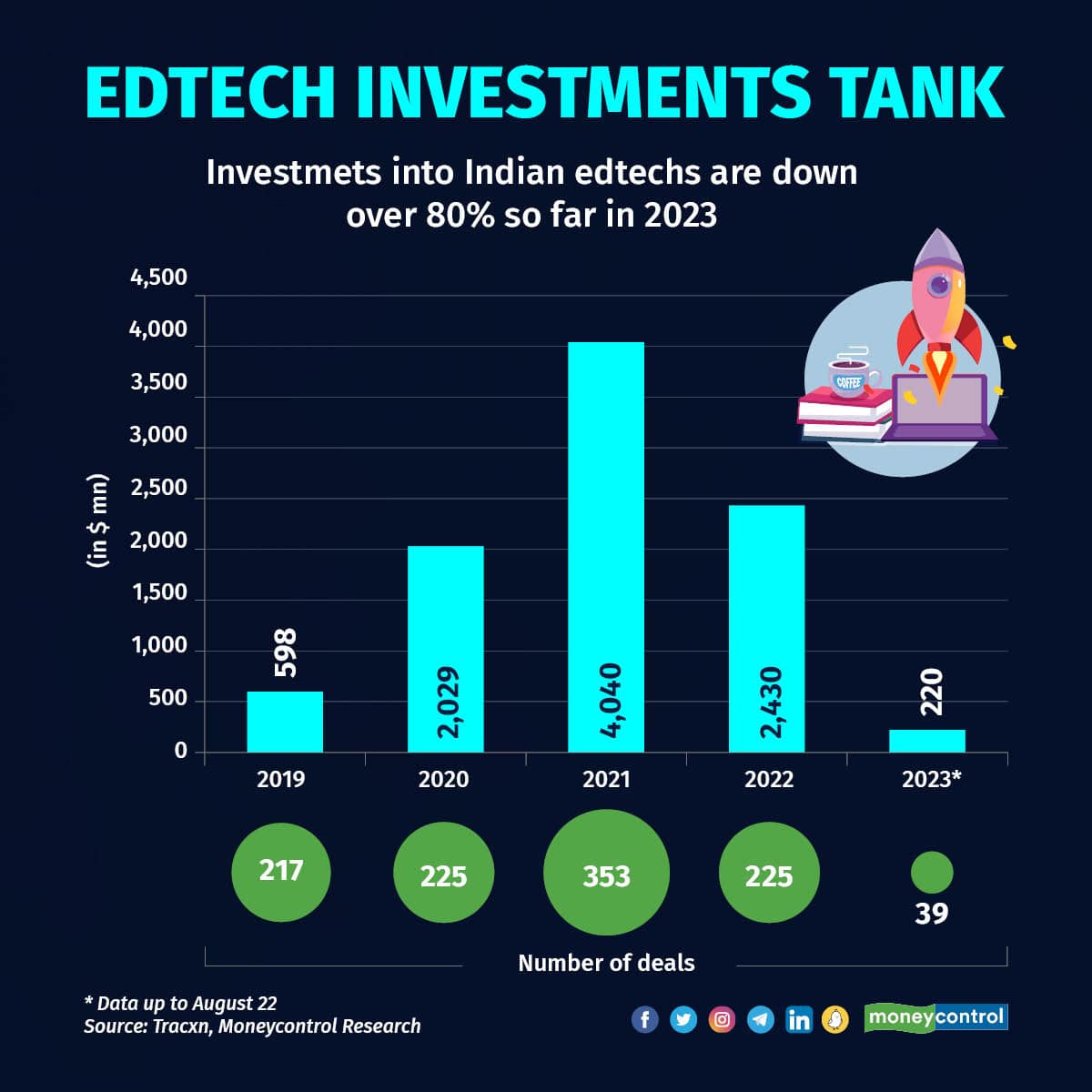

General Atlantic is not alone. The recent turmoil at Byju's has triggered unease among edtech investors across India. Thus, funding into the nation's edtech industry, which had been a standout performer during the pandemic, has dramatically plummeted to a fifth versus the previous year.

Edtech entrepreneurs are also inundated with inquiries from investors on areas such as revenue recognition, adherence to compliances, and the implementation of governance protocols.

Apprehensive investors

While the turmoil at Byju’s, currently the world’s most-valued edtech startup, has left its investors dissatisfied, it has also put a spotlight on the depth of India’s edtech market.

Prosus and Peak XV Partners, among its biggest investors, recently said that the executive leadership at Byju's regularly disregarded advice and recommendations relating to strategic, operational, legal, and corporate governance matters, forcing them to step down from the board.

While Prosus has marked down Byju’s fair value internally to $5.1 billion, Peak XV told its Limited Partners (LPs) that it will be “significantly marking down” the edtech.

But secondly, and more importantly, there have been concerns over Byju’s valuation, after it reported a minor dip in its consolidated revenue in FY21 (2020-21). FY21 was the first year of the pandemic, which heavily benefitted all edtech companies

“Byju’s is a big learning not just for the entrepreneurs but also for the investors. When you are on a growth path, you also raise a lot of debt. Debt should be very carefully taken and it is a lesson for the founders and VCs like us to allow debt up to a limit,” said Dr Apoorva Ranjan Sharma, Co-founder and President of Venture Catalysts, an investor in four edtech start-ups including Tiger Global-backed unicorn Vedantu.

“It has definitely impacted the edtech sentiment in the country today. But you must understand the edtech market is huge today in India. So, it is a massive opportunity. Companies that have good topline and bottomline growth, that is, hockey stick like revenue growth and promise on the bottomline, will be able to raise funds,” Sharma added.

Drop in edtech investments

With investors apprehensive about India’s edtech sector, funding to it has dropped more than 80 percent over 2022, according to data compiled by Moneycontrol through Tracxn. In the first eight months of 2023, edtech start-ups raised just about $400 million compared to $2.4 billion in 2022 and over $4 billion in 2021. To be sure, the 2023 investment figures are also lower than the pre-pandemic 2019.

“It is a tricky period. While India’s education sector offers this huge opportunity, it is sensitive given the country’s demographics,” said a late-stage investor, who sits on an edtech soonicorn’s (soon-to-be-unicorn) board, requesting anonymity.

“It is a tricky period. While India’s education sector offers this huge opportunity, it is sensitive given the country’s demographics,” said a late-stage investor, who sits on an edtech soonicorn’s (soon-to-be-unicorn) board, requesting anonymity.

“Just having a potential multibillion-dollar market won’t be enough, you will have to crack it in some way. Byju’s, for years, sold this opportunity to investors and particularly during covid years, it went a little overboard. But it isn’t anywhere close to its valuation. So the real question is, how large is India’s edtech market actually,” the investor added.

In a recent interview, Manan Khurma, the Founder and CEO of Cuemath, said that investors are now likely to approach the Indian edtech landscape with heightened scepticism due to the repercussions of Byju's challenges across the online education sector in India.

“Whenever something like this happens, it impacts the whole industry. With this whole struggle happening over at Byju’s, it obviously puts a question on the overall investor link. Investors will absolutely be more sceptical about investing in edtech,” Khurma said in an interview with Moneycontrol.

Ashwin Damera, the co-founder and CEO of Eruditus, echoed Khurma's sentiment. “When a market leader is in blues, the entire sector gets painted in the same shade,” said Ashwin Damera of Eruditus in an interview with Moneycontrol in July.

“I have personally heard investors saying 'look this person made an investment, but they won’t be making any India investments or they won’t be making any edtech investments for some time now',” Damera had said.

Moreover, early-stage edtech companies may have more to worry about than others. According to Sumeet Mehta, Co-founder and CEO of school edtech unicorn LEAD, early-stage start-ups might face problems while raising new rounds.

“When you are a small company at an early stage, you don't get to meet the LPs, you just get to meet the fund. For a new entrant, the issue of unfamiliarity could be significant,” he said.

Upskilling sees an uptick

To be sure, while caution has crept into edtech investments, certain niche sectors like upskilling have continued attracting investors. According to data on Tracxn, in the first eight months of 2023, investments into higher edtech are down just 13 percent compared to the whole of last year. Upskilling segments are also witnessing strong growth for artificial intelligence (AI)-powered courses.

Earlier this month, upskilling startup Disprz raised $30 million in its series C funding round led by Lumos Capital Group and 360 ONE Asset (IIFL). Eruditus, another higher education and upskilling platform is aiming to raise $150 million in a mix of primary and secondary rounds, and has got investor interest, Moneycontrol reported previously. upGrad, too, raised an internal round of Rs 300 crore through a rights issue in March.

Meanwhile, companies like PhysicsWallah and Unacademy are betting big on upskilling and higher education. PhysicsWallah recently launched a residential undergraduate programme for engineering in Bengaluru. The company, which turned unicorn last year, is also looking to raise at least $250 million, Moneycontrol reported.

As higher edtech and upskilling firms continue garnering investor attention, it remains to be seen if the tide for other companies will turn soon as Byju's rebuilds itself with a series of measures including appointing a new Human Resources head, onboarding industry veterans like Mohandas Pai and Rajnish Kumar as its Board advisors. The edtech is also engaging in active discussions with its lenders to resolve issues. Byju’s revival will be crucial for green shoots to emerge in India’s edtech sector.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.