Business-to-business (B2B) marketplaces in India are set to clock $125 billion in GMV (gross merchandise value), Avendus Capital said in a report, instilling confidence in the sector that has seen some of the country’s top revenue-grossing unicorns in FY22 (2021-22).

B2B marketplaces, as of calendar year 2022, had a GMV of about $20 billion, which grew almost 100 percent over 2019 on a CAGR (compounded annual growth rate) basis, according to the report. Now in the next five years, it is expected to grow at 45 percent CAGR, the report showed. Moreover, tech penetration in the B2B marketplaces is expected to deepen to 5 percent by 2027 from under 1 percent currently.

“India also has a lot more fragmented supply chain compared to the developed countries. Here small and medium enterprises either supplying to larger companies or larger companies supplying to small and medium enterprises, or intersect between small and medium enterprises so trade volumes are actually much bigger than what happens globally,” said Varun Gupta, Managing Director, Investment Banking, Avendus Capital.

Also read: Razorpay-owned Ezetap sees 88% growth in offline payments in FY23: Report

“Supply chain is extremely broken and the third-party B2B marketplaces are actually coming and disrupting or digitising those supply chains and bringing efficiencies,” Gupta, who is also one of the authors of the report, added.

The report further showed that only five companies had a GMV of more than $300 million as of 2020 and only 1 company had a GMV of over a billion dollars. The count has gone up to 14 and 5 respectively.

Marketplaces in manufacturing segments like industrial materials, fashion and apparel, construction and equipment and (MRO) maintenance, repair, operations and packaging are expected to grow at 51 percent CAGR in the next five years to clock GMV of $70 billion, according to the report. Retail distribution segments like pharma and medical supplies, food and FMCG (fast-moving consumer goods), auto and electronics, meanwhile, are seen growing 37 percent CAGR by 2027 to have a GMV of $55 billion, the report showed.

Also read: India's five edtech unicorns spend over Rs 2,250 cr on advertising; Rs 5,500 cr on employees in FY22

The underlying market opportunity for B2B manufacturing companies is over $2 trillion, while for retail distribution, it is more than $700 billion. Both the categories offer more than 50 percent export opportunities, the report showed.

“B2B marketplaces are also actively contributing towards increasing the country’s exports. Most large B2B marketplaces you see have started getting anywhere from 10 to 25 percent or even sometimes higher revenue from exports,” said Gupta.

The report attains significance as it comes at a time when tech-enabled B2B marketplace unicorns in India like OfBusiness, Infra.Market, Moglix and Udaan have recorded strong growth in revenue over the last two years, thanks to deeper penetration of digitisation due to Covid-19-induced restrictions. Udaan, in fact, emerged as India’s highest revenue-grossing unicorn in FY22, while OfBusiness was the most profitable unicorn during the period.

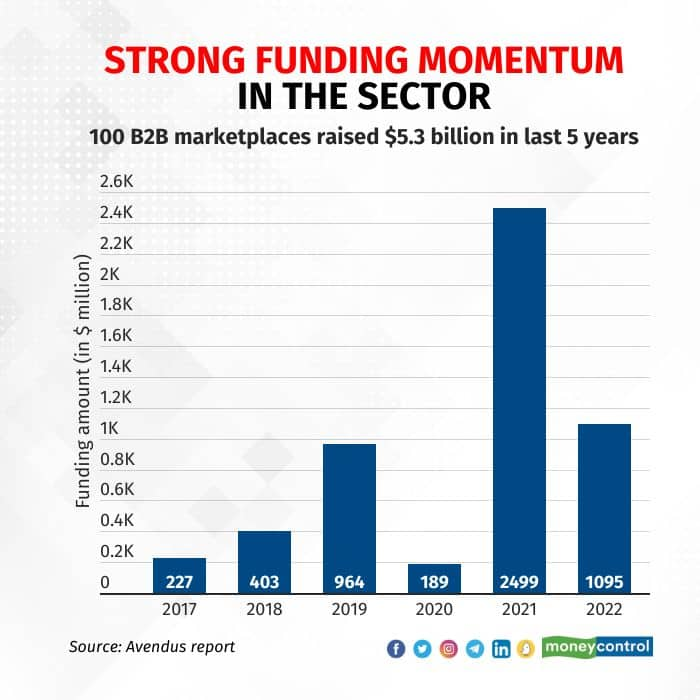

Naturally, this sector has also attracted investors’ attention. Between 2017 and 2022, B2B marketplaces have about $5.3 billion in funding, with 67 percent of it coming in just the last two years, the report showed. In India around 100 B2B marketplaces have gotten funded to date, according to the report.

“If we see investment trends, last year was the second-highest calendar year in terms of funding activity. 2021 was an aberration, given the dry powder available, companies did multiple rounds and got themselves well capitalised. Last year was obviously lower because companies had enough dry powder. But we think 2023 will be an interesting year when you will see an uptick in terms of overall capital coming into the space,” Gupta added.

The report further predicted that by 2027, India would have more than 20 unicorns in the B2B marketplaces segment, from 7 currently, with as many as 7 companies getting publicly listed during the period.

“We think what is very important for the sector, from here on, is also to see some kind of public market outcomes from these tech unicorns. So our expectation is, if markets were not what they are today, we would have expected in the next 12 months, one or two IPOs (initial public offering) from some of the larger guys,” said Ekta Parashar, Investment Banking, Avendus Capital, who was also one of the authors of the report.

“But what we think is there will be at least five to six IPOs in the next five years. And that also sort of gives way to exit liquidity, a new kind of capital for these other situations,” she added.

Interestingly, the report showed that while B2B marketplaces in India received over $5 billion in funding last year, the same number was five times of India, or $26 billion globally. This runs counter to the fact that the Indian economy’s size is single-digit percentage point of the global economy.

According to Parashar, this apparent mismatch is because of two broad reasons — firstly, legacy companies in major economies like US and China have been able to digitise their B2B trade better than India. And the second reason is that horizontal marketplaces like Amazon and Alibaba have been able to cater to the B2B e-commerce sector, while the funds they raised for doing so could not be distinguished from their B2C arms’ funding.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.