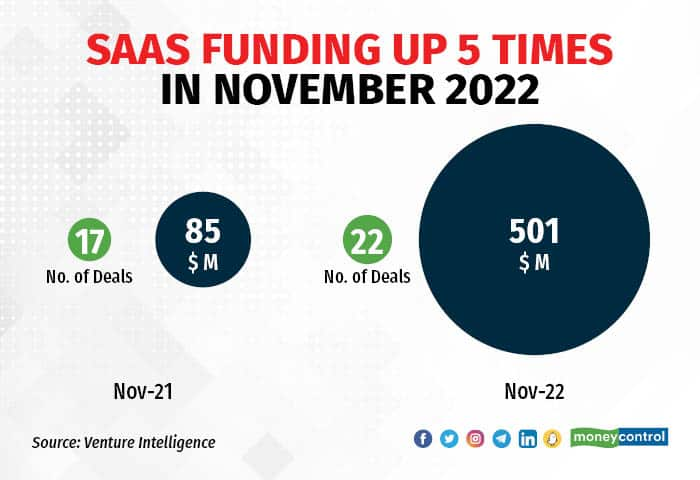

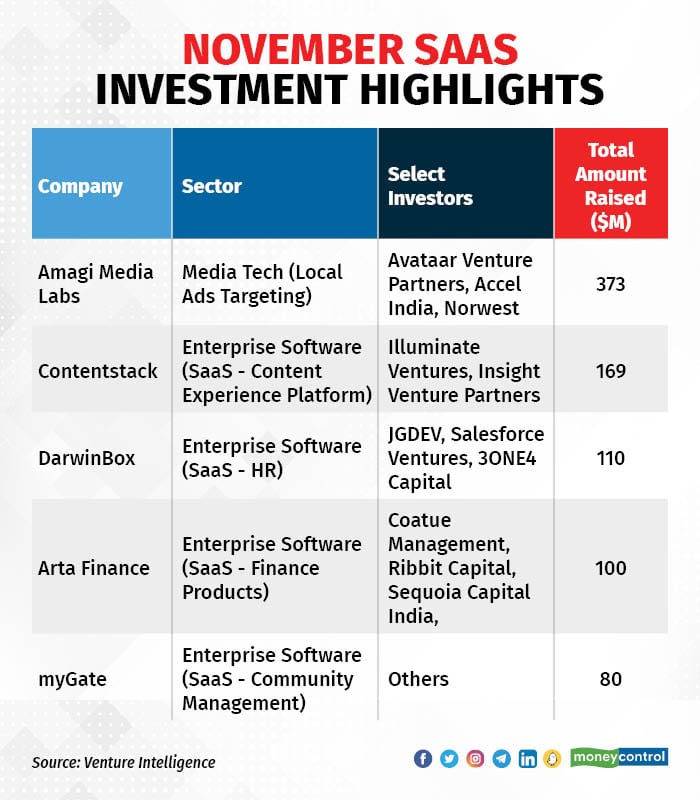

Despite the tight macroeconomic pressure and a funding crunch, Indian Software-as-a-Service (SaaS) startups have raised more than $500 million in November 2022 -- up nearly five times from the same month last year.

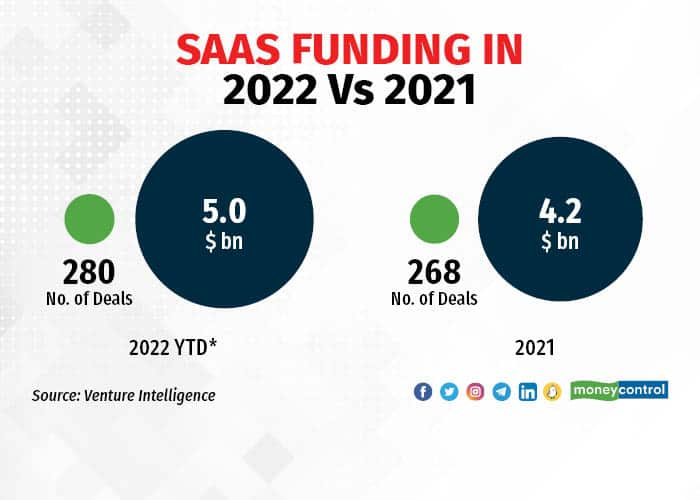

In November 2021, they raised around $85 million, and in the full year 2021, they raised $4.2 billion.

SaaS startups have raised $5 billion to date in funding since the beginning of 2022, according to data research and analysis firm Venture Intelligence.

“Overall, even at Together Fund, we are seeing more SaaS deals than before. This is despite the downturn in the economy, especially in the global market. The number of SaaS startups has also increased and investment activity is happening,” said Manav Garg, founding partner at Together Fund and cofounder of Eka Software Solutions.

Together Fund is a VC fund set up to support home-grown, innovative SaaS startups. It was founded by SaaS major Freshworks’ CEO Girish Mathrubootham in 2021.

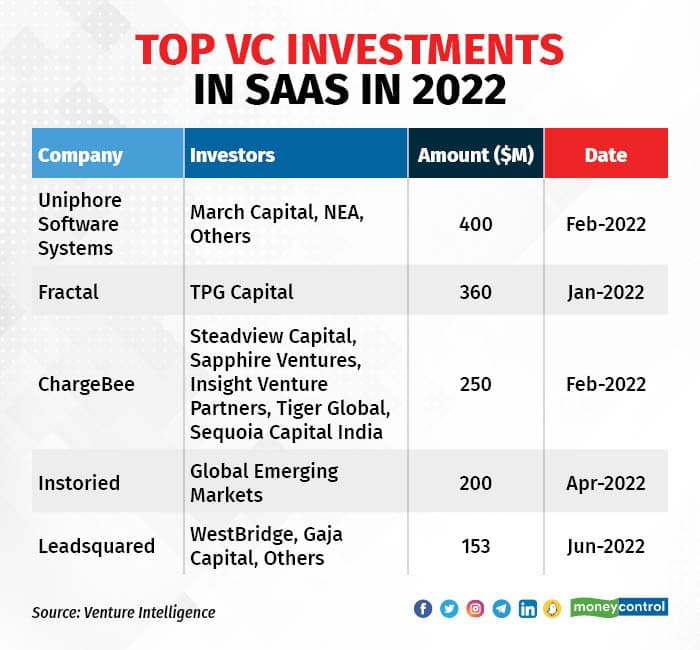

Top investments include $400 million raised by Uniphore Software Systems during February 2022, and $360 million raised by SaaS firm Fractal from TPG Capital in January 2022. While large rounds did not take place in November, a number of startups raised smaller rounds.

Valuations correct since last year

“Though there is going to be some impact, overall, the sector is very optimistic, with solid unit economics. It is highly unlikely there will be a major impact,” Garg said.

Companies that raised funds at a large valuation will find it difficult to raise funds for the next two rounds, said investors.

“Companies that have raised at peak valuations, let's say, like 30X or 40X, may find it difficult to get the same valuation...even for investors they are answerable to their LPs (limited partners). Maybe in the long term, it doesn't matter but in the short run, some LPs may find it difficult,” said Prasanna Krishnamoorthy of Upekkha, a value SaaS Accelerator.

No larger impact due from global macroeconomic pressures

While there is no significant impact on SaaS startups in India, investors keep a caution on high-value enterprise SaaS firms.

“Things might slow down, maybe not so much in the Indian market but in Europe and the US…new client addition is slowing down but retention is still very good,” added Upekkha’s Krishnamoorthy.

“SaaS companies serving Indian customers are facing zero to no impact. The impact is mostly in the US…for the US or Europe, the reality is that many companies are prioritising cost, and that is to fundamentally make SaaS more strong,” said Bessemer Ventures’ partner Anant Vidur Puri in a recent media interaction.

The SaaS ecosystem in India, and, globally, is starting to feel the heat of slowing demand growth, ahead of a likely global recession and is beginning to implement cost-cutting measures, including layoffs.

Chargebee, an Indian SaaS company, said last week it was laying off more than 100 employees.

“This difficult decision was driven by external market forces as well as the need to address the operational debt we have accumulated in the last few years,” Chargebee’s cofounder Krish Subramanian wrote in a LinkedIn post.

Globally, companies like Salesforce and Zendesk have also announced cost-cutting and layoffs due to the recession-like environment.

The Russia-Ukraine war and its impact on supply chains, runaway inflation, and the US Federal Reserve’s aggressive interest rate hikes are causing fears of a recession in the US. Experts are concerned that this may lead to lower spending on software, a dampener for SaaS companies.

However, for some companies, recession has taken no impact or is even helping them grow.

Ashwini Asokan of AI-based SaaS company Mad Street Den said recession is helping startups, in a way.

“We are investing millions of dollars and building local teams across the globe, especially in the US and in the Middle East. Recession is having an impact, AI is on top of the mind of many investors and they continue to be bullish,” she added.

Companies like Zoho and Kovai, a Coimbatore-based SaaS firm, are keeping a caution on new hires. They have, however, ruled out layoffs.

Customer acquisition costs likely to go up

Customer Acquisition Cost, or CAC, measures how much an organisation spends to acquire new customers. CAC is basically an important business metric. It is the total cost of sales and marketing efforts, as well as property or equipment, needed to convince a customer to buy a product or service.

With macroeconomic pressures setting in, many companies are lowering their software spending. This is impacting the CAC of many SaaS companies.

“The larger issue is CAC. The overall narrative is that the money was available cheap. Now, however, with interest rates going up and money not available cheap, people are moving towards profitability. Therefore, CAC will be largely looked up and moved with caution,” Garg said.

A company like Freshworks may have an impact. However, even if the CAC goes up, if it is a startup with revenues of, let’s say, $3 million or $4 million, there will be no major impact at all. There is no need to worry for those companies, Garg added.

“We hear that new sales, though closing, are slowing down for companies across the board. Let’s say, if it used to take two months, it takes 5-6 months now, and that increases your cost of acquisition,” Krishnamoorthy said.

Investors betting big on SaaS for 2023

In fact, Bessemer Ventures, which recently invested close to $60 million in fintech SaaS firm Lentra, said that the company is betting big on SaaS and has plans to invest more in the category for 2023.

“SaaS startups show a very prominent trend. We see SaaS firms have a long-term vision, and many companies have strong unit economics too. We are betting on fintech SaaS and Data SaaS firms,” said Vishal Gupta, partner, Bessemer Ventures.

Blume Ventures, which recently announced the final close of its fourth fund at more than $250 million (around ₹2,000 crore), exceeding its target corpus of $200 million, said that it is also betting big on enterprise saas and data.

From edtech, fintech, health, commerce and consumer internet companies, Blume is betting big on robotics and AI to SaaS and enterprise software. Blume has invested in SaaS firms like Zipy and Sourcewhiz.

“We want to find the best opportunity. There is no hurry. We need to find the best companies…There are many promising ones in the SaaS space,” Gupta added.

VC firm Avataar has started new funds that will focus on the SaaS sector. Avataar Venture Partners said a new fund with a target corpus of $350 million will invest in 12-15 growth-stage startups that operate on B2B and SaaS models.

Chiratae Ventures marked the first close of its maiden growth fund at $100 million on November 8 and said in a report that cloud security, cloud-native enablers, hyper-intelligent automation, Web3, and verticalised solutions would be the key areas of interest for investors.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.