Two years ago, Teachmint was still best known for its mobile-first teaching software, built during the peak of the pandemic to help teachers conduct live classes from their phones.

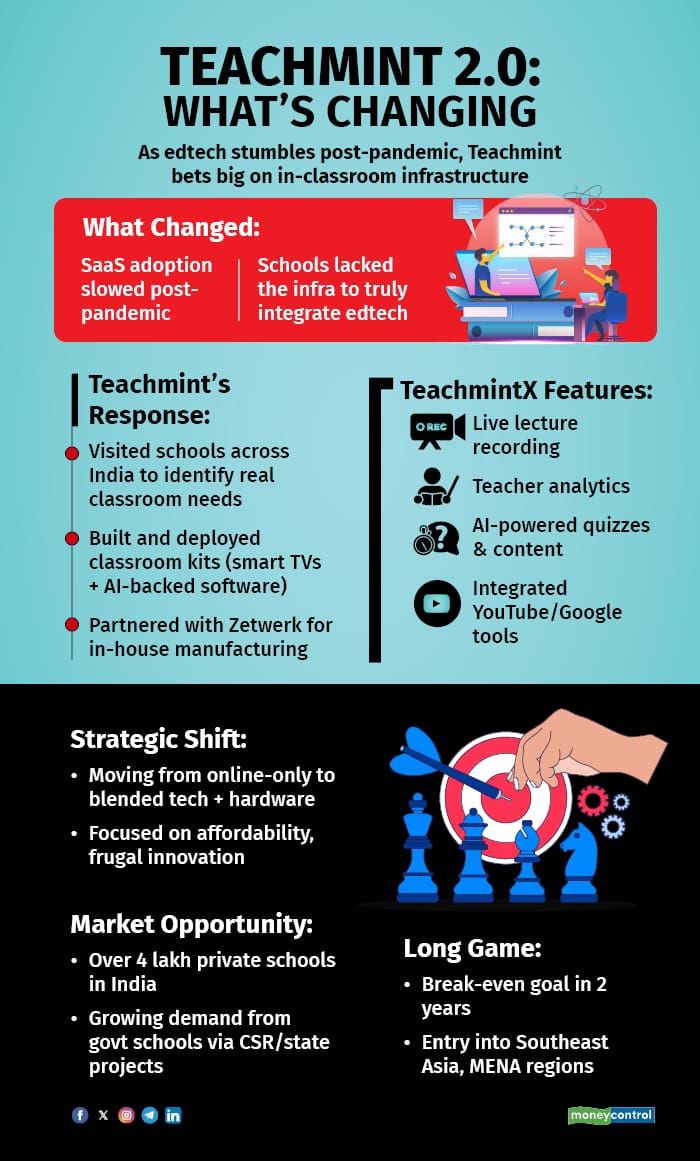

But when schools reopened and offline classes resumed, the momentum slowed. The demand for online teaching tools dropped, and Teachmint was forced to confront a hard truth: the business needed to evolve.

And fast.

Today, the company’s focus looks very different. Its teams are on the ground, visiting private schools, IITs, government schools, and even corporates across India. But they’re not selling software anymore. They’re setting up smart classroom TVs, turning bare-bones rooms into tech-enabled learning spaces.

Teachmint has made a decisive shift. What started as a SaaS platform for teachers is now a company leading with hardware, building its classroom kits in-house in partnership with contract manufacturers like Zetwerk.

This pivot, made last year, is now at the heart of its strategy. And it reflects a bigger change in how the startup sees itself, not just as a tool for online learning, but as a driver of real-world change inside the classroom.

“The biggest realization for us was that it's very important to be inside the classroom, and offer the infrastructure, because that’s where most of the teaching-learning impact is happening…That’s why we decided to make this move," said Mihir Gupta, co-founder of Teachmint.

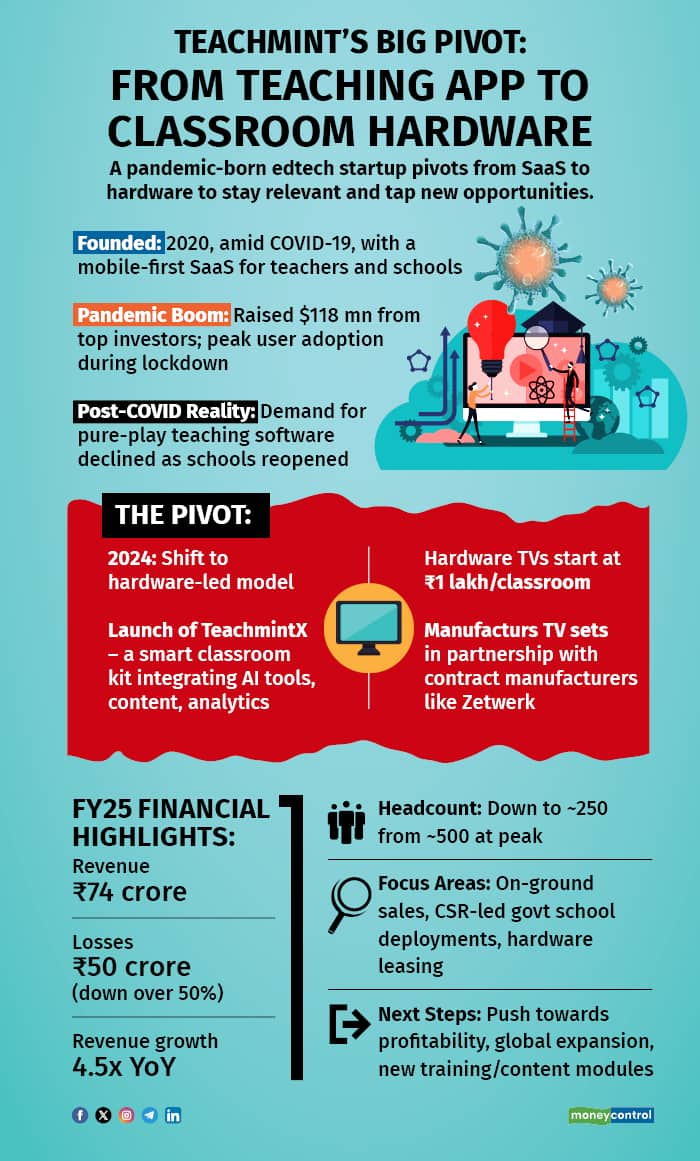

A Pandemic-Era Darling, Now Grounded in RealityFounded in 2020 by Mihir Gupta, Divyansh Bordia, and Payoj Jain, Teachmint emerged during the peak of India’s Covid-19 lockdowns, promising to empower school teachers and tuition tutors to go live with classes, manage attendance, assignments, and collect fees, all through a mobile-first SaaS platform.

The company raised nearly $118 million from marquee investors like Lightspeed, Better Capital, and Rocketship.vc, riding on the massive surge in demand for remote learning tools.

But like many other edtech players, Teachmint’s core offering began to lose steam once schools reopened and students returned to physical classrooms.

“Like many edtech startups, they had to confront the hard truth that engagement and monetisation in pure-play SaaS for schools wasn’t going to scale the way we all initially thought,” said an investor requesting anonymity.

While the startup continued to onboard teachers, engagement levels dropped, and monetisation remained a challenge.

“They had a strong tech stack, and the platform worked well, but adoption was fragmented and dependent on too many variables,” said another angel investor.

By late 2022, the writing was on the wall. The edtech boom was tapering off. Valuations were being reset. Investors were nudging portfolio companies to find profitability or die trying.

Byju’s, once the poster child of Indian edtech, was grappling with mounting losses and layoffs. Unacademy pivoted to offline test prep centres. Vedantu scaled back operations. Across the board, the exuberance of the pandemic years gave way to a harsh new reality: survive sustainably, or not at all.

For Teachmint, which had also acquired Teachmore to support individual educators, the need for reinvention was urgent.

TeachmintEnter the Hardware Pivot

TeachmintEnter the Hardware PivotIt was around this time that the founders began visiting schools, speaking directly to administrators. A consistent pain point emerged: while many schools had adopted online tools during COVID, they lacked the infrastructure and support to integrate technology meaningfully into classroom teaching.

In response, Teachmint launched its Integrated School Platform, building smart interactive digital boards and proprietary classroom management systems with software. The company now sells and installs these kits, starting from Rs 1,00,000 per classroom, making it an affordable alternative to traditional smartboards.

“Yes, hardware does require investment, but we’ve approached it very frugally. For any changes or new product lines, we operate within clearly defined budgets and timelines. That mindset has helped us significantly improve our bottom line while increasing the value proposition we deliver in a big way," Gupta said.

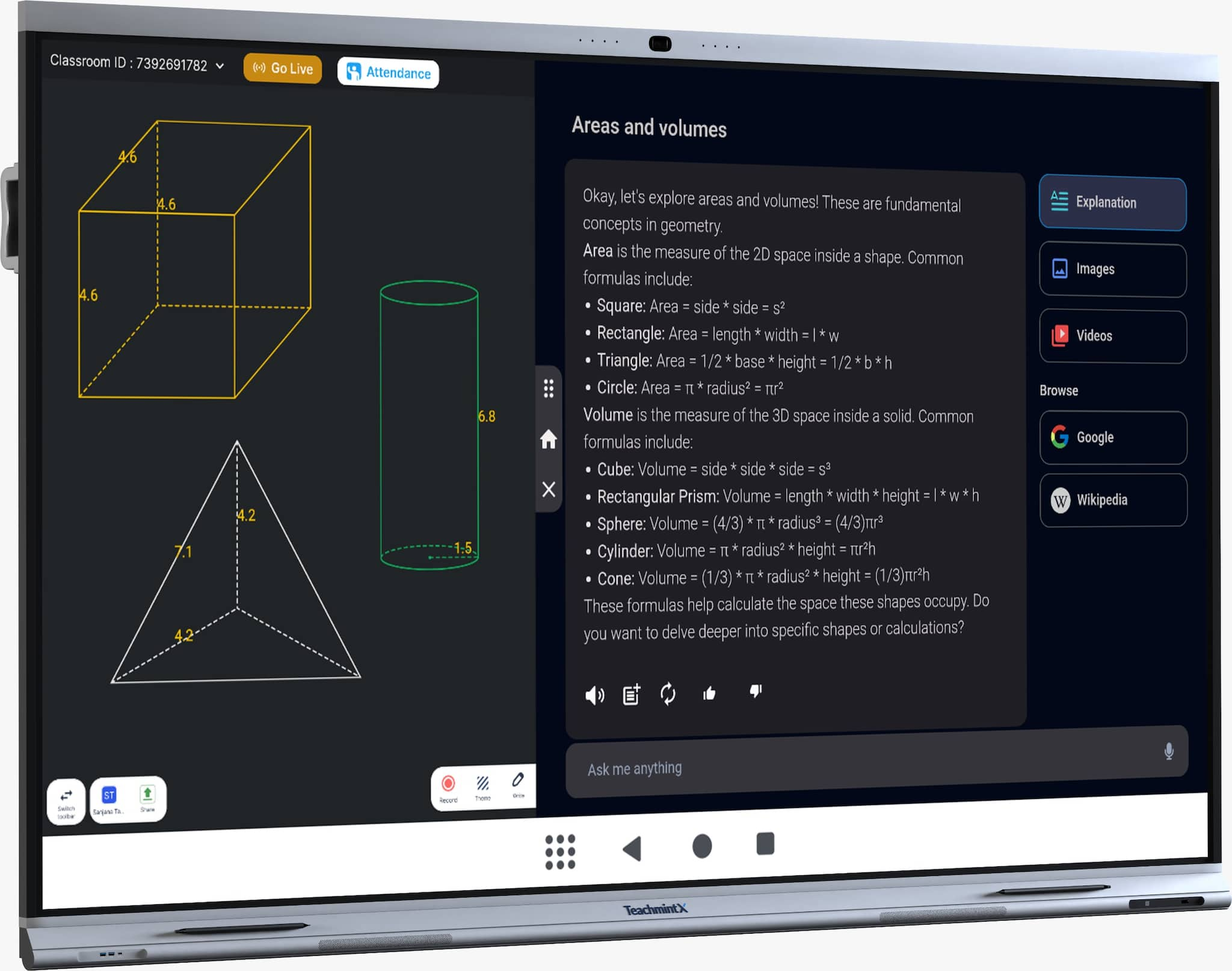

Unlike expensive AV setups, TeachmintX, the company’s flagship hardware device, integrates generative AI tools, assessments, content generation, teacher analytics, and even automated lecture recordings—right from inside the classroom.

“Tech was virtually absent inside most physical classrooms even post-COVID. That’s where Teachmint X came in," Gupta explained. "It integrates AI, content, and live quizzes in a way that doesn’t require teachers to change their natural style".

Operational changes: layoffs, efficiency drives and moreThe device, built in collaboration with contract manufacturers like Zetwerk and with Google for YouTube integration, marks a major shift in Teachmint’s DNA, from a pure software play to a vertically integrated, product-led company.

The company’s restructuring also involved right-sizing the team.

“Yes, our headcount is naturally lower than what it was during the pandemic, but it’s been stable for a while now. We’ve found the right org size that we can generate significant value from. At the same time, we continuously hire for roles that help us meet the evolving needs of the business," Gupta said.

The company has also trimmed its headcount to around 200 employees, down from nearly 500 during its pandemic-era peak, as it shifts focus to on-ground sales, manufacturing partnerships, and classroom deployments.

Much of the efficiency, he noted, has come from what he calls “operational hygiene.”

“In India, we realised the monetisation potential from standalone education software is vastly different compared to a tangible product that delivers value from day one. That shift has had a significant impact on revenue, margins, and cash flow over the last 12–18 months," he added.

FY25: Signs of a Turnaround Teachmint

TeachmintThe pivot is now beginning to reflect in Teachmint’s financials.

“This is the year we did devices dedicatedly. Our losses decreased by more than half. Revenue, in fact, increased more than 4x year-on-year.”

Gupta said that the company has clocked a revenue from operations of around Rs 74 crores in FY25, with losses at Rs 50 crores.

As per RoC filings, Teachmint’s operating revenue rose to Rs 17.1 crore in FY24, more than doubling from Rs 8.1 crore in FY23. Meanwhile, net losses narrowed by 37% to ₹110.1 crore, from ₹180.7 crore the previous year.

Teachmint is not alone in sensing opportunity in this space. LEAD School, Next Education, and others are also betting on hardware-software bundles to serve India’s over 4 lakh private schools, many of which are keen to upgrade from chalkboards to smart classrooms.

But the transition isn’t easy. Hardware businesses are capital-intensive, supply-chain dependent, and slower to scale than SaaS. While Teachmint still has a decent cash buffer from past fundraises, the next 18-24 months will test that runway.

“We have built a pan-India distribution network for reaching across the education ecosystem. You’d be surprised — we’re seeing a lot of adoption in government schools too, either through direct state orders or through CSR-driven partnerships where we are the technology providers," according to Gupta

What’s Next?For now, the founders believe their full-stack strategy, bottom-up distribution, and real-time classroom insights give them an edge.

Gupta said that the firm is not in a hurry to raise funds and the focus is on profitability.

“We’re still focused on improving our profitability profile and expect to bring losses down further. Over the next two years, we’re targeting break-even and moving towards profitability."

The company also has international plans.

“We’re present internationally, and it’s part of our long-term thesis. We’ve seen similar digitisation dynamics in Southeast Asia, the Middle East, Central Asia, and parts of Africa. Our product — being AI-driven and curriculum-agnostic — fits in well across these markets. However, Indian market is the biggest focus, he added.

The company is also experimenting with new offerings like teacher training modules, content tie-ups, and even hardware leasing models to reduce upfront costs for budget-conscious schools.

“We’re no longer just a SaaS tech company. We have transformed into a full-stack AI infrastructure partner in education. And we’re playing the long game," Gupta said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.