Fireside Ventures, a venture capital (VC) firm focused on investing in direct-to-customer (D2C) brands, has marked the final close of largest-ever its $225 million fund, joining a growing list of India-dedicated private equity and venture capital (PE/VC) firms to raise sizable capital amid a funding winter.

The Fireside Fund III will invest only in new companies and plans to back 25-30 startups over the next three years, Dipanjan Basu, Partner and CFO (Chief Financial Officer), Fireside Ventures, said in a press conference on October 12.

Fireside Ventures, which has backed D2C unicorns like Mamaearth and Licious and initial public offering-bound boAt, managed to close the third fund in six months, Kanwal Singh, Managing Partner, Fireside Ventures, told media.

Across its three funds, the VC managed assets worth $395 million or Rs 3,000 crore. Singh also claimed that the revenue of its portfolio companies from its first fund was up 21 times since the investment, while the total revenue of its second-fund portfolio companies was up four to five times.

Since 2017, Fireside Ventures claims to have backed 31 startups and said it was the first institutional investor in about 75 percent of its 31 portfolio companies.

Fireside Ventures launched its first fund in 2017, with a size of $50 million. The VC said it invested in 18 brands with its first fund. In 2019, it launched its second fund of $118 million and invested in 13 brands.

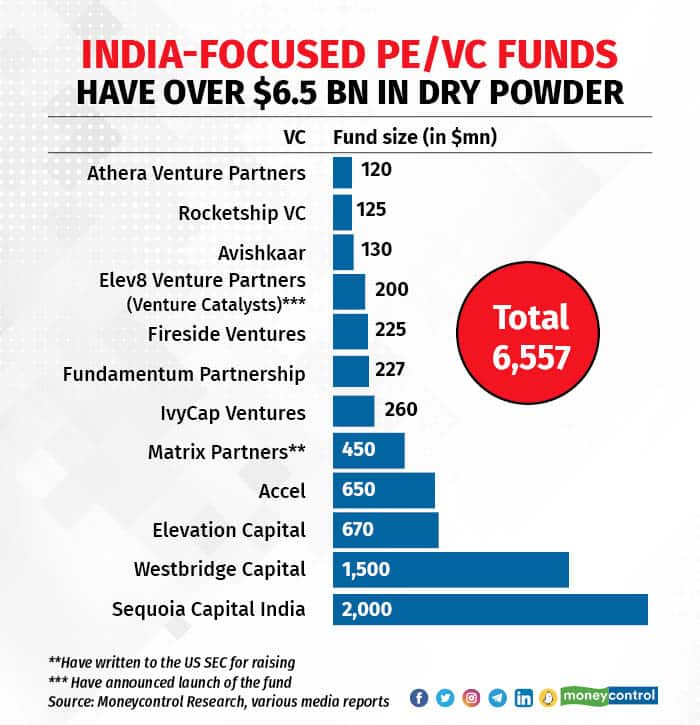

Fireside Ventures is the latest VC firm to raise a large India-dedicated fund, joining the likes of some of the world’s biggest including, Sequoia Capital, Accel, Elevation Capital and Matrix Partners.

According to data compiled by Moneycontrol, 12 India-dedicated PE/VC firms have raised over $6.5 billion from limited partners in 2022.

Moneycontrol reported recently how investors expect the so-called funding winter to last for another 12-18 months, even as PE/VC firms have over $9 billion of dry powder.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.