During its heyday, in the peak of the pandemic till early 2022, online education platform Byju’s lured investors into edtech.

Venture capitalists who missed out on funding the giant wanted to invest in similar companies and those who held shares of such highly valued edtech firms wanted to double down to enjoy continued returns. Byju’s became the poster boy for Indian edtech.

Post-pandemic, the story took a bad turn. The third wave of the pandemic in 2021, unlike the previous two, waned faster, and so did the demand for online learning. Schools, colleges, and coaching centres reopened for offline classes.

Edtech companies now had to find a way to keep up with their projections as demand for their core business was dwindling.

Even though Byju’s acted fast and made a commitment of $200 million for opening tuition centres across the country, there was a lot to come its way that the company did not anticipate.

Amidst allegations of mis-selling, slowing demand, mass layoffs and mounting losses, Byju’s navigated a tough year in 2022, Moneycontrol reported towards the end of last year.

But if 2022 was a bad year for the company, 2023 was a nightmare.

How the tide turnedHere’s a quick breakdown on what went down with the once-feted edtech decacorn this year.

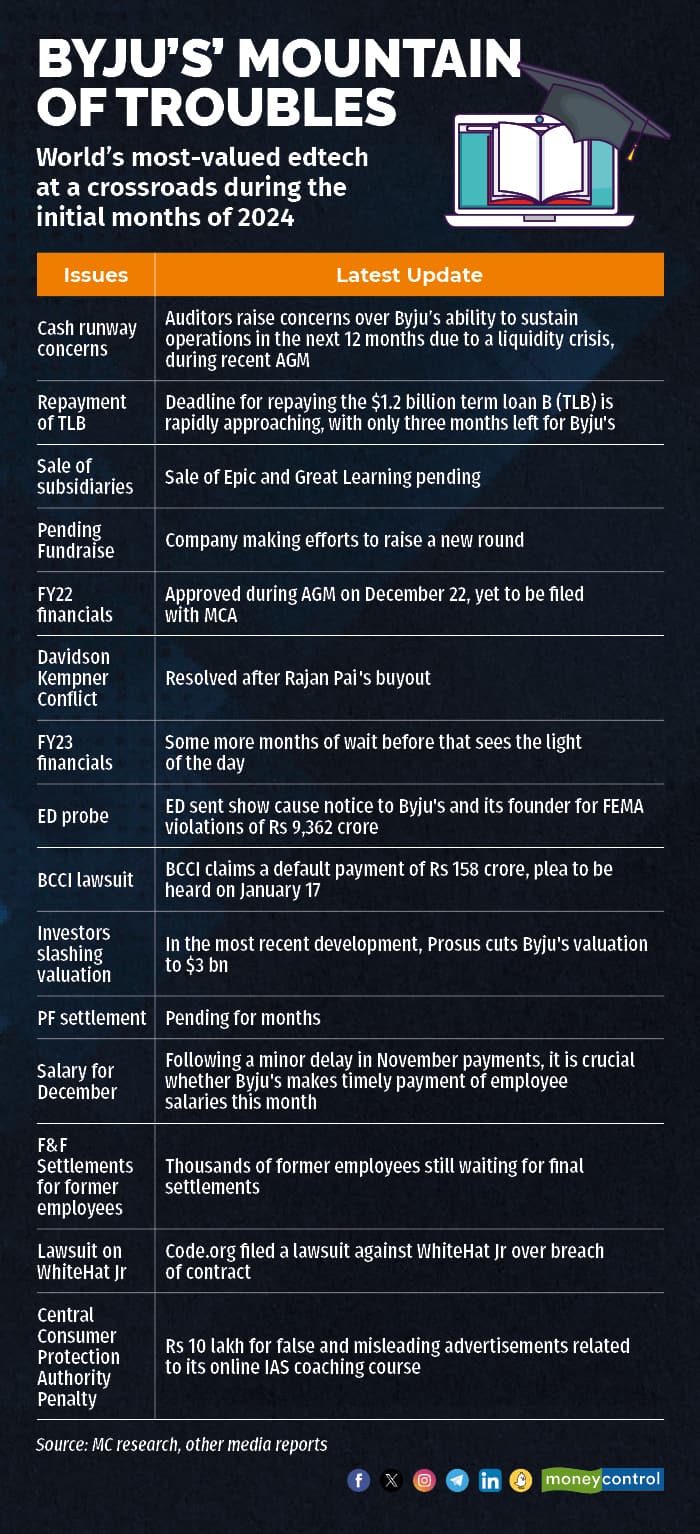

Byju's mountain of troubles

Byju's mountain of troublesWith great power comes great responsibility, so goes the saying. The challenges encountered by Byju’s have now rippled across the Indian edtech landscape, triggering scepticism among investors. The initial allure of Byju’s, which once attracted funding for the entire sector, has given way to a contrasting narrative, casting a shadow on the overall confidence in the industry.

In the current funding limbo, edtechs are now pulling out all the stops to woo investors —some flaunting their newfound love for Generative AI, others attempting a profitable makeover.

But the majority is bracing for the next year to bring some funding cheer. Meanwhile, investors believe that the sector is in a desperate need for a refresh, with a new cohort of startups entering the arena.

Second-order impact on Indian edtechIn August, Moneycontrol reported that the recent turmoil at Byju's has triggered unease among edtech investors across India. Thus, edtech entrepreneurs who became stars during the 2021 boom were bombarded with inquiries from investors on areas such as revenue recognition, adherence to compliances, and the implementation of governance protocols.

Some investors, like private equity firm General Atlantic, also decided to distance itself from investing in Indian edtech firms. In fact, it has declined opportunities from at least two edtech companies since the beginning of the year.

This also came on the back of widening losses in FY22 as unicorns spent aggressively on advertising and promotions and handsomely on employees, according to our analysis in April this year.

As a result, funding into the nation's edtech industry, which had been a standout performer during the pandemic, dramatically plummeted to $712 million in 2023, down from $5.33 billion in 2021, according to data by Tracxn. In fact, it has also fallen massively from $2.9 billion last year.

In the current year, the number of funding rounds in edtech companies has fallen to 69 from 364 in 2021 and 242 in 2022.

Edtechs push the brakes on growthOn the back of a drying-up funding pipeline, the trend of aggressive expenditure on advertising and promotions, and employee benefits saw an apparent reversal this year.

As hyper-spending strategies for growth were discarded and a noticeable slowdown in demand became evident to investors, several models, heavily reliant on online delivery, continued to suffer in 2023.

With the year coming to an end, the confidence in a solely online education model eroded for numerous entrepreneurs.

To be sure, while last year saw a considerable shift, in 2023, many ventured into offline education within test preps, and startups within the higher education and upskilling sector opening fully residential programmes for longer durations, they effectively took on top legacy tech institutes in India.

However, not every startup survived the swift trend back to offline.

Lightspeed-backed edtech startup FrontRow shut its operations weeks after Moneycontrol reported it is considering a potential sale or even a shutdown in the worst-case scenario. Similarly, in Moneycontrol’s latest edtech report, the founder of Exampur, Vardaan Gandhi, said that to escape a near-death for his company, founders held off paying salaries to employees, mortgaged personal belongings and scaled down massively.

Moneycontrol had earlier reported how Noon Academy laid off staff across roles in India after discontinuing classes and holding back teachers’ salaries for over eight months. The list goes on.

Layoffs and recoveryMeanwhile, others put their heads down and focused on course correction. Many edtech unicorns and smaller startups have continued mass layoffs to reduce employee costs, a major cost centre.

Edtech startups have made up over half of the total layoffs that occurred in the startup ecosystem this year, with unicorns like Byju’s and Unacademy becoming top contributors.

Similarly, companies also rationalised their advertising and marketing spends, with revenue growth slowing and external funding drying up.

For instance, the founder of an edtech soonicorn (startup soon to be valued over a billion dollars) told Moneycontrol, requesting anonymity, that the company went from a high cash burn of 60 percent on marketing and advertising of total expenses to 5 percent, after the pandemic.

“Year 2023 has cemented the realisation that education is a business that takes time to build. Ultimately, the parent is paying for outcomes. And if you don't deliver on that promise, you will suffer,” said Manan Khurma, founder and chief executive officer of Cuemath.

Khurma believes that edtech players missed on delivering on that promise amidst the hyper growth during COVID years. “With us at least, the goal is very clear that we want to build a business that is all about outcomes and retention, and that grows on the basis of reference,” he added.

Investors agree that entrepreneurs should continue to stay away from hyper expenditure on advertising and marketing for growth and brainstorm unique customer acquisition strategies for better outcomes next year.

“There will be a differentiated customer acquisition method. The question is what will be the company's strategy to acquire customers? What is their edge? A good product is table stakes. Distribution is critical. Starting a B2C business today and relying on digital marketing to acquire users will be a very challenging strategy,” said Mujtaba Wani, principal investor at GSV Ventures.

In 2023, as edtech companies prioritised cost-cutting initiatives, the adoption of generative artificial intelligence emerged as a valuable asset for many in the industry.

At the start of the year, edtech companies extensively experimented with OpenAI's ChatGPT and GPT technology. Startups found applications on GenAI in grading and customer support to the development of inventive assessment methods and content creation.

Soon, companies realised GenAI’s possibilities in much more than customer- facing products. They found that it is useful in backend operations to save costs as well.

What’s in store for 2024?Some believe that Generative AI has immense possibilities within edtech and a lot of it lies undiscovered in India in the coming years.

“The GenAI revolution has sparked a wave of new edtech startups in the US and the rest of the world. In India, we are seeing existing startups work to integrate AI into their offerings. However, we have only seen a handful of new startups in India that were sparked by and built on this new tech,” said GSV’s Wani.

For 2024, however, Ashwin Damera, founder and CEO of Eruditus, has a unique prediction as he believes next year will bring back focus on growth.

“A lot of hard work has gone in terms of trimming expenses, dropping some of the non-performing courses, sales techniques, and geography. In 2024, companies will again start looking at growth. The focus will be on how to achieve growth in double digits again,” said Eruditus’ Damera.

He said that, while in 2023, discussions revolved around EBITDA, 2024 will include both profitability and growth. Damera added that this upcoming growth will be less extravagant, compared to the startup frenzy of 2021 and will lean towards a more sustainable trajectory.

Similarly, for 2024, Wani added that higher education will continue to be an area of great opportunity and innovation in India.

“Master's Union is building a very interesting next-gen platform. Companies like PhysicsWallah, Scaler, Newton and others are launching hybrid degree offerings. U-Next, UpGrad, Sunstone and others are partnering with universities or startups like Coursera and Wolff University. There is a lot of interesting product development in this area,” added Wani.

Will a new crop emerge?While some remain optimistic about existing startups navigating challenges through cost-cutting measures and profitable forays, others anticipate the emergence of entirely new players building their companies, giving edtech a new lease of life.

“Overall, edtech has gone through a bit of a flux, and you already see what is happening, with some of the major players going through situations of their own. In the coming year or two, you will see a new crop of players who will end up doing pretty well emerging,” said Cuemath’s Khurma.

The ecosystem is hence sounding hopeful of better investment prospects in 2024.

“We can expect series A and B deals to the tune of $20 million, deals between $100-150 million might still be few and far between and it will be really for the best-in-class companies,” Damera added.

Some early-stage investors are also optimistic about new companies in the sector as they believe there is a lot left to do in Indian edtech.

“Education is an unfinished business. VCs have practically not done anything, made no difference. Till now, most startups are giving education to people who can afford it. In such a business, there is no need for a VC to come in and back such startups. The kind of students and learners who actually need it, for them, most existing businesses have not done anything. With what we have done till now, fundamentally, nothing has changed. There has been no impact as such,” Anand Lunia, general partner, India Quotient told Moneycontrol.

In 2024, Lunia signals intentions to invest in emerging players within the edtech industry at a time when his venture capital firm India Quotient plans the launch of a new fund.

The unfolding question is whether this sentiment will gain traction among fellow early-stage investors. If so, the timeline for its impact on improved funding across stages within the Indian edtech remains to be seen.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.