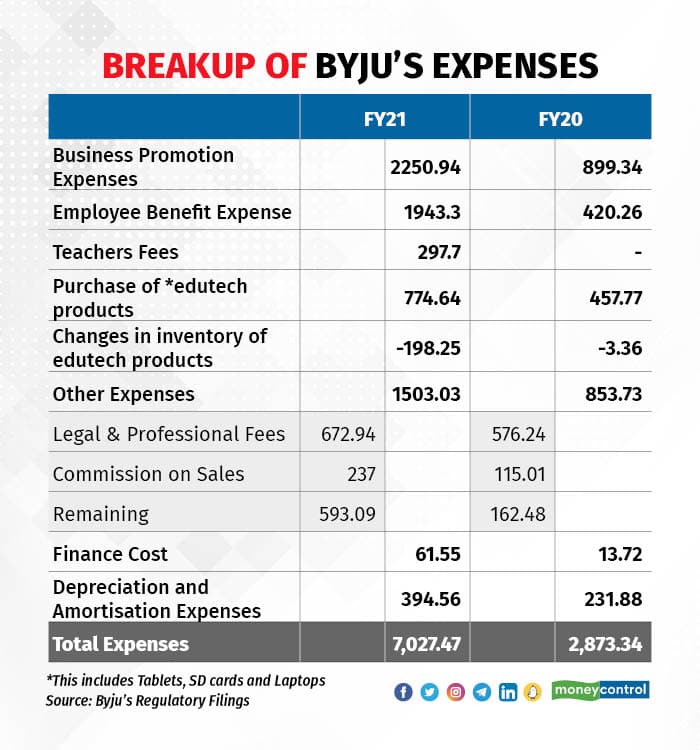

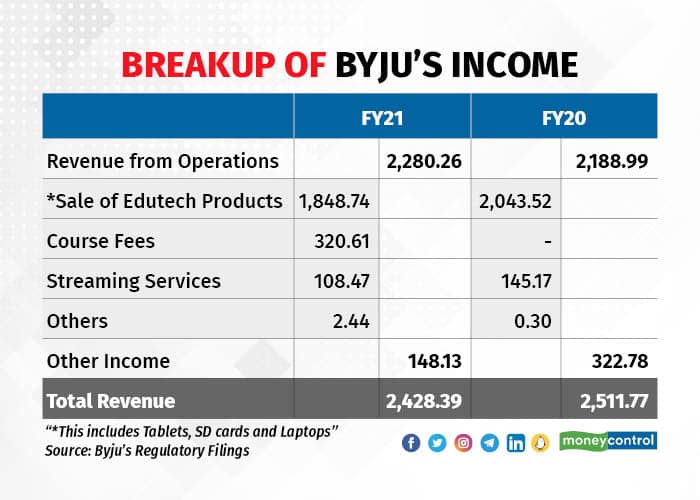

Byju’s declining revenue and mounting losses for fiscal year 2021 has not only made it the most expensive edtech firm in the world but has also put the spotlight on the valuations of its peers.

Byju’s commands a revenue multiple of over 40, and its peers are at the receiving end of increasing scrutiny and re-evaluation from investors.

Consumer-facing edtech unicorns such as the SoftBank-backed Unacademy, Tiger Global-backed Vedantu among others, had raised multi-million dollar funds in 2021 at sky-high valuations, cashing in on the pandemic-induced boost for online education.

But with the pandemic receding and schools and colleges reopening, these edtech companies have seen demand for their services moderating, thus raising concerns about their growth potential, industry insiders told Moneycontrol.

“I totally understand the argument that it (Byju’s results) was an FY21 number, which happened a year and a half back and not a recent one. But projections are always done on a base, and many edtech companies had raised money projecting X times/Y times growth on this base of FY21 and FY22, for coming years,” said an edtech investor, who has invested in three edtech unicorns, requesting anonymity.

“I guess while everyone was expecting slower growth, post the pandemic, no one expected sales to shrink. And with sales dropping on year, how are these companies going to justify their forward multiple? Investors are certainly going to raise questions on growth projections, going forward, and fundraising is going to get difficult for edtechs,” the investor added.

Byju’s did not respond to queries sent by Moneycontrol.

Corroborating this view, Mujtaba Wani, Partner at GSV Ventures, which has backed edtech unicorns like PhysicsWallah, Eruditus and LEAD, said that growth-stage companies should not value themselves at more than 10 times their forward revenue multiple. He said that even 10X forward revenue multiple is expensive for investors.

Struggle to raise funds

For instance, Unacademy has been looking to raise a round for the last six months at least. The startup has been in talks with a New York-based hedge fund to raise over $100 million round but the conversations haven’t fructified to date, according to sources in the know.

“Unacademy’s forward multiple will be much higher, even higher than Byju’s, if it tries to raise funds at any valuation over $3.5 billion (which is the company’s current valuation),” said one of the sources quoted above.

“It will have to have to project revenue of more than $150 million at least to raise money at a higher valuation and this is at a time when the sector is either shrinking or moderating. So I don’t feel they will raise a round in this environment unless they are really starving for cash, which I don’t feel is the case. And then, they have taken cost-cutting initiatives recently that will help them to survive much longer,” the source added.

Questions sent to Unacademy remained unanswered.

Conserving cash

The source was referring to the company's move to cut the monthly burn to Rs 50-60 crore from Rs 200 crore previously, as reported by Moneycontrol last month, after taking initiatives like pay cuts for founders and management, stopping complimentary food for employees, and hundreds of layoffs.

Even Vedantu has cut its monthly burn down to Rs 15-18 crore in the first quarter of FY23 from Rs 65-70 crore in the same period of FY22, according to a source. The company is now focusing more on profitability over growth and thus has also undertaken mass layoffs, the source said.

Vedantu has laid off over 700 employees since the start of this year, Moneycontrol had reported. Vedantu did not comment for the story.

“In a market like this, when the company cannot control the external environment (falling demand) much, it’s best for it to control what is in its hands,” said the source quoted above.

“So Vedantu is rather looking to cut its burn and prepare a runway as it waits for demand to bounce back and I think that’s a very logical way of doing things,” the source added.

Innovation could take a hit

The fight for survival for edtech companies in India may also hit innovation, going forward, industry observers said, as startups scale down investments in tech with funding to the edtech sector drying up and demand falling.

Online education companies or consumer-facing companies initially solved the problem of accessibility for millions of students across the country. Most of these companies started with a basic motive of making learning content available for students on demand.

Later, edtech companies like Byju’s and Vedantu made inroads into the integration of technology with learning content by leveraging AI/ML (artificial intelligence and machine learning) capabilities.

As the pandemic gripped the nation and classes moved online, these companies further upped their investments in technology in a bid to improve student retention but were not able to successfully do it, said the first edtech investor quoted above.

“In my opinion, there is a new challenge for the edtech sector now. Before the pandemic, these companies were solving the problem of accessibility and online learning was always seen as supplementary,” the investor said.

“But the scenario has changed post the pandemic, as students and parents in particular have realised the disadvantages of online learning. So it’s difficult for edtech companies to attract students by just solving for accessibility” he further said.

“For them to actually attract kids, they need path-breaking changes in technology, something that students and parents would want to invest in and so they need to heavily invest in tech. But looking at the current situation, edtech companies are struggling to survive and so heavy investments in technology look difficult,” the investor added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.