The world’s most-valued edtech company Think & Learn Pvt Ltd which runs education platform Byju’s has also become the world’s most expensive edtech company for investors after a decline in its FY21 (2020-21) revenue that led to a surge in its revenue multiple.

Byju’s’ FY21 revenue released last week showed that the company has a revenue multiple of over 40 for the year as it was valued at about $13 billion as of March 2021.

Revenue multiple is a financial metric used by investors to value startups, usually loss-making ones arrived upon by dividing the company’s valuation by revenue.

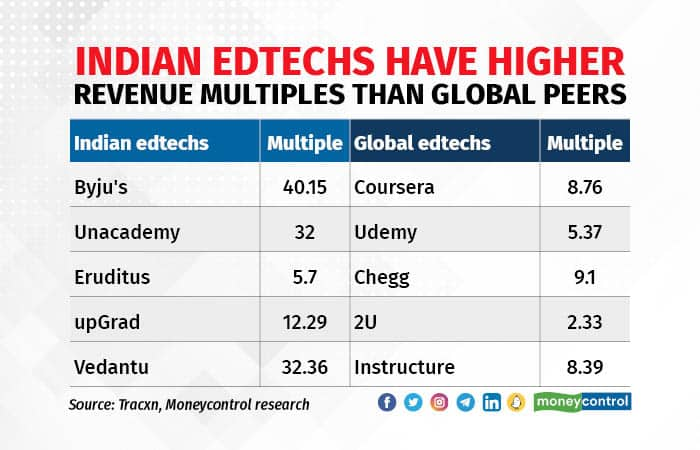

To put the number in perspective, Byju’s’ closest consumer-facing edtech rivals upGrad, PhysicsWallah, Eruditus, Unacademy and Vedantu have revenue multiples in the range of 6-33 for FY21.

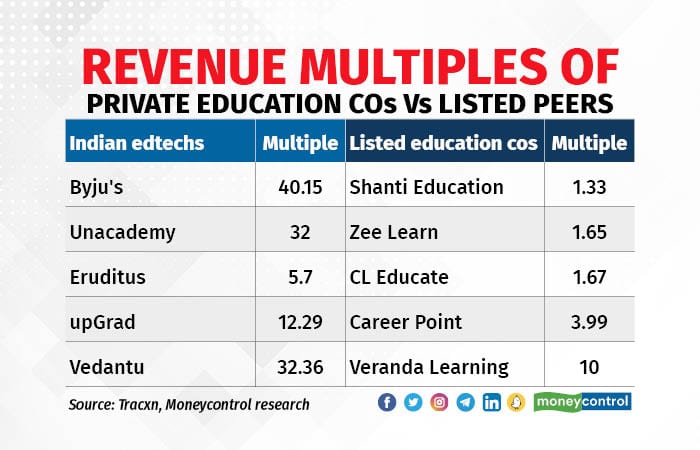

Some of the world’s largest edtech companies like 2U Inc, Udemy, Instructure, Coursera, and Chegg have revenue multiples between two and nine. Biggest listed Indian education companies by market capitalisation such as Shanti Education, Zee Learn, CL Educate, Career Point, and Veranda Learn have revenue multiples between one and 10. These companies, however, are far smaller than Byju’s in terms of valuation and revenue.

“As companies’ valuation goes higher, their revenue multiple tends to fall as their revenue growth slows. Byju’s is valued at over 7x of its next peer--Unacademy -- but its revenue is only about 5x of Unacademy,” said an industry expert requesting anonymity.

“Also revenue multiples of Unacademy, upGrad, etc will start falling from this year as their valuation grows and their revenue growth rate slows. No company at a $22 billion valuation will manage to raise money at 40x revenue. When you are as large as $22 billion, people start looking at profits and profit multiple not revenue,” the expert added.

To be sure, Byju’s’ revenue multiple has also been falling with its revenue and valuation growing. In FY20, the company had a revenue multiple of 25, which was down from its revenue multiple of 30 in FY19. If Byju’s is required to raise funds this year, the company will have to do so in a flat or a down round, industry insiders said, adding that the company would otherwise have to match its projections or show more revenue in following years.

“When growth is slowing or there is negative growth, sales multiple will reduce in absolute terms. That is a certainty. The question is will the company be able to raise money now when the sales multiple is contracting or the valuation is falling,” said Shyam Sekhar, founder and chief ideator, ithought Advisory.

“As a traditional investor, I am not able to make sense of this (Byju’s) valuation. I do not have any visibility of when this company will become profitable. As an investor, if I don’t have a sense of when it will turn profitable, then I would not have a sense of how much incremental capital it would need to become profitable. Without these two things, valuation is always in a zone of vulnerability,” Sekhar added.

The comments come at a time when Byju Raveendran, co-founder and CEO of Byju’s, has said that he has started reaching out to investors in the last few weeks. In a recent interview with Moneycontrol, Raveendran also said that he can raise $300 million in a week, when he was asked about updates on money coming from Sumeru Ventures and Oxshott Ventures. The company had earlier said that it was yet to get about $250 million of the over $1 billion it had announced raising last year from the two venture capital firms.

In another interview with Mint last week, Raveendran said that the company is planning for two rounds of funding, one will be a flat round at $22 billion valuation, and the other a converter round, which will convert at IPO (initial public offering) at a 20 percent discount. Converter rounds are typically offered to investors at a discount just before the IPO and they are given an option to convert it into equity when the company goes public.

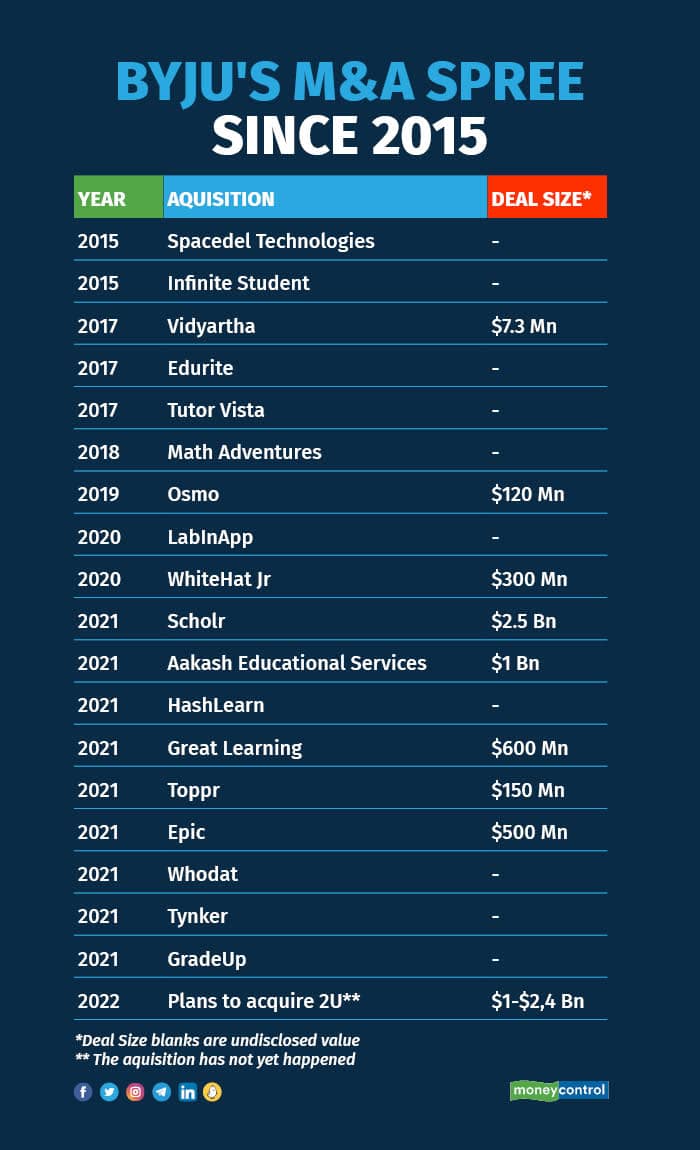

Over the years, Byju’s has been very aggressive on raising funds. The company has raised over $5 billion in a mix of equity and debt to date. Byju’s has also always commanded high valuations. The company, which became a unicorn only in 2018, saw its valuation zoom to over $22 billion in less than four years.

Byju’s has also expanded fast by acquiring a number of companies. According to data available on Tracxn, the company has either invested or fully acquired as many as 22 firms to date and has spent over $3 billion on acquisitions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.