SpiceJet Ltd, the Gurugram-based company that operates the eponymous low-cost carrier, will declare its Q4FY23, full-year FY23 and Q1FY24 results on August 11. The airline had deferred its results for Q4 and FY23 owing to the ill health of one of the members of the audit committee. The company has been facing heavy going in the recent past yet continues to operate against all odds.

Battling multiple cases, IDERA (Irrevocable Deregistration and Export Request Authorisation) notices and appeals after appeal by the Marans from whom Ajay Singh bought SpiceJet, the airline has been trying everything to swim against the tide.

This includes giving equity to aircraft lessors, which has been done with one lessor; settlement with a few other lessors; hiving off cargo arm SpiceXpress as a separate entity; infusing equity by the promoters; and relying on government schemes for loans to operationalise additional aircraft.

Also Read: Kalanithi Maran seeks attachment of 50 percent of SpiceJet's daily revenue

What do the numbers say?

In June this year, new entrant Akasa Air pipped SpiceJet to occupy the fifth spot by market share within a year of starting operations. In a market heavily dominated by IndiGo, and with no other player having a market share in double digits, this was no mean feat. The fact that a newbie airline with 19 aircraft could leapfrog an established player such as SpiceJet was a testament to the current state of affairs at the latter airline.

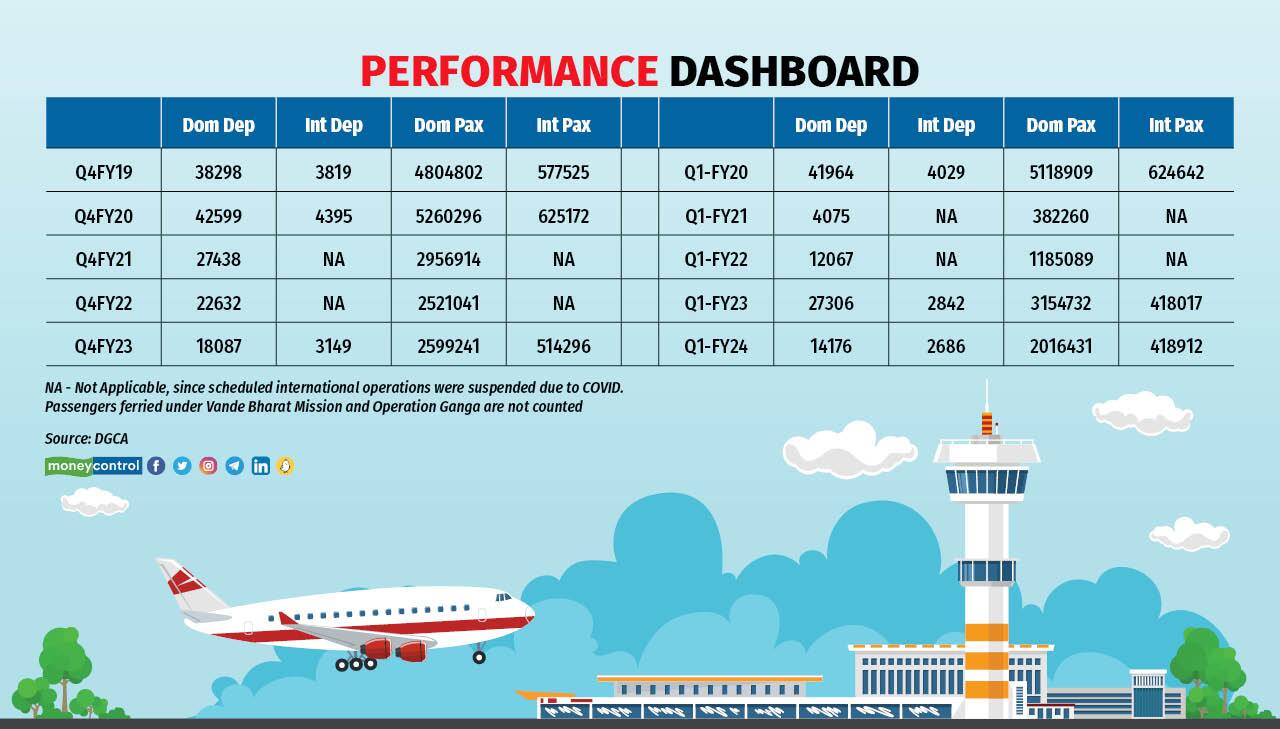

The tussle with lessors and lack of funds to get its own aircraft airborne have led to a drop in departures and, consequently, passenger numbers for SpiceJet. Sample this: even as the industry grew in departures and passenger numbers, recording its best-ever April to June quarter, SpiceJet saw a drop in both metrics sequentially.

SpiceJet had 22 percent fewer domestic departures in Q1FY24 versus its immediate preceding quarter, resulting in a similar drop in passenger numbers. On the international side, there was a 15 percent drop in departures over the same period but a 19 percent drop in passengers carried.

The airline operated more departures in Q4FY22 than it did in Q4FY23. But the FY22 quarter was when the industry as a whole was hit hard in by successive waves of COVID infections. The situation becomes dismal when compared to pre-COVID times. SpiceJet’s domestic departures have shrunk 67 percent in the April-June quarter of 2023 compared to the same quarter in 2019 (pre-COVID), while passenger numbers dropped 41 percent. On the international front, a third of its flights and passengers are not part of SpiceJet family anymore. SpiceJet's international departures dropped to 2,686 in Q1-FY24 as compared to 4,029 pre-COVID (Q1-FY20).

Impact on finances

SpiceJet lost Rs 1,516 crore in the first three quarters of the previous financial year and earned a profit in just one. While IndiGo turned the leaf in Q4, would SpiceJet do the same? We are now over four months out from the last day of Q4 and the results may not matter much, yet it will show how deeply the airline is mired. In any case, the result will not move the airline to black.

For the 11 quarters since the start of COVID, the airline amassed cumulative losses of Rs 4,220 crore. It is now in a vicious cycle. It needs more planes to earn more revenue and thus hope for more profits, but to have more planes it needs more money, more leases, and more stable partnerships, all of which the airline is sorely lacking.

Revenue in Q3FY23 stood at Rs 2,314 crore while it was Rs 2,454 crore in Q1FY23. Beating these numbers with fewer flights and passengers carried is a challenge, but with a decrease in fuel prices, the airline could post a profit. The balance sheet will show reduced liabilities due to one lessor agreeing to opt for equity and the proceeds from the slump sale of SpiceXpress.

Not in position to benefit from Go First’s suspension

The airline had been a major beneficiary of the suspension of Jet Airways. Not only did it take on additional B737 aircraft in quick succession, it also spread its wings with new flights and bid for more routes under UDAN, the government’s regional connectivity scheme, betting on the steady growth of the aviation industry in India. However, the black swan event of the pandemic broke its back.

In fact, the airline did not opt for wet-lease operations this summer, unlike during last winter, to increase the number of flights and thus revenue, though largely believed to be at a lower margin since wet or damp leases are expensive propositions but help with a short-term increase in capacity.

The results on Friday will let us know if the airline has generated cash in the true sense, with no further compensation likely from Boeing for the grounding of the 737 MAX aircraft. Moreover, IndiGo and Air India are expanding rapidly, and pilots are in high demand again. Facing multiple cases in various courts, the future of the airline could well be decided by the courts and pilots, or the lack of them. How long can SpiceJet sustain the onslaught of salary hikes and capacity induction? Will there be a way out when under pressure from all sides? The answer may not be found in these results but there will certainly be an indication.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.