August 10, 2021 / 15:48 IST

Manish Hathiramani, proprietary index trader and technical analyst, Deen Dayal Investments:

The markets climbed well above the 16300 mark and seemed all poised to close above it too. However there was a sharp and nervous sell off mid day which brought the index close to 16200. We recovered well but did not close above the 16300 level. Once we are successful in doing so, we will witness a rally to 16600 as the next target for the Nifty.

August 10, 2021 / 15:43 IST

Ashis Biswas, Head of Technical Research at CapitalVia Global Research:

The market witnessed the continuation of trading within a small range and a reversal from the support level around the Nifty 50 Index level of 16200. The market is going to be crucial for the short-term scenario to sustain above the 16200. Sustaining above 16200, the market expects to gain momentum, leading to an upside projection till 16450-16500 level. The momentum indicators like RSI and MACD indicating a positive outlook to continue.

August 10, 2021 / 15:38 IST

Rupee Close:

Indian rupeeended 17 paiselower at 74.43, amid volatile tradesawin the domestic equity market.It opened 15 paise lower at 74.41 per dollar against previous close of 74.26 and traded in the range of 74.33-74.47.

August 10, 2021 / 15:36 IST

Market Close:

Benchmark indices ended marginally higher in the volatile session after hitting fresh record highs intraday.

At close, the Sensex was up 151.81 points or 0.28% at 54554.66, and the Nifty was up 21.80 points or 0.13% at 16280.10. About 679 shares have advanced, 2401 shares declined, and 98 shares are unchanged.

On the sectoral front, except IT, all other indices ended in the red with Nifty metal and PSU Bank indices shed over 2 percent each. BSE Smallcap index fell 2 percent, while midcap index was down nearly 1 percent.

Bharti Airtel, Tech Mahindra, HDFC, Kotak Mahindra Bank and M&M were among major gainers on the Nifty, while losers included Shree Cements, JSW Steel, Tata Steel, Power Grid Corp and IOC.

August 10, 2021 / 15:13 IST

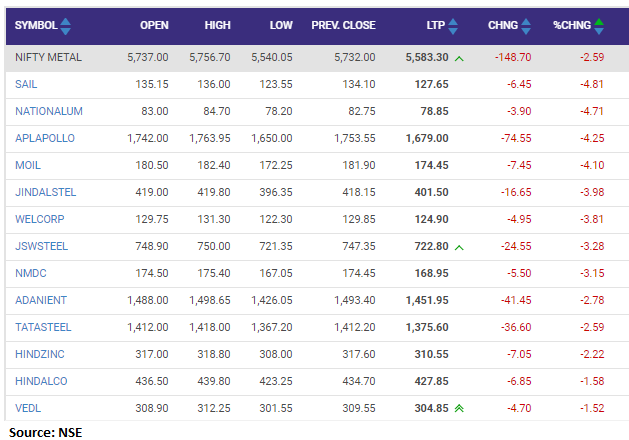

Nifty Metal index shed 2 percent dragged by the SAIL, NALCO, APL Apollo:

August 10, 2021 / 15:11 IST

Crude Updates:

Oil prices rose more than $1 on Tuesday, recouping some of the losses in the previous session, as rise of demand in Europe and the United States outweighed concerns over a rise of COVID cases in Asian countries.

August 10, 2021 / 15:09 IST

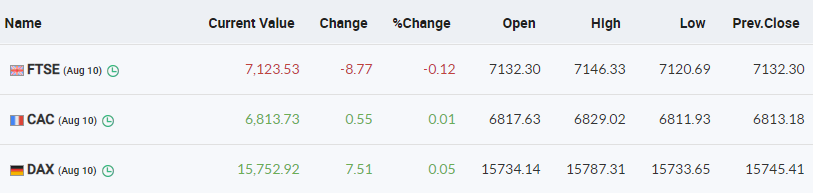

European Markets trade flat:

August 10, 2021 / 15:07 IST

Buzzing:

Sona BLW Precision Forgings share price touched a 52-week high of Rs 559.65, rising more than 16 percent on August 10 after the company reported a net profit of Rs 82.2 crore in the quarter ended June 2021.

The company’s revenue was at Rs 501 crore, growing 226 percent YoY. The net order book was at Rs 14,000 crore as of June 30, 2021.

August 10, 2021 / 15:03 IST

Market at 3 PM

Benchmark indices erased some of the intraday gains but trading marginally higher with Nifty below 16300.

The Sensex was up 182.36 points or 0.34% at 54585.21, and the Nifty was up 30.50 points or 0.19% at 16288.80. About 590 shares have advanced, 2416 shares declined, and 83 shares are unchanged.

August 10, 2021 / 14:51 IST

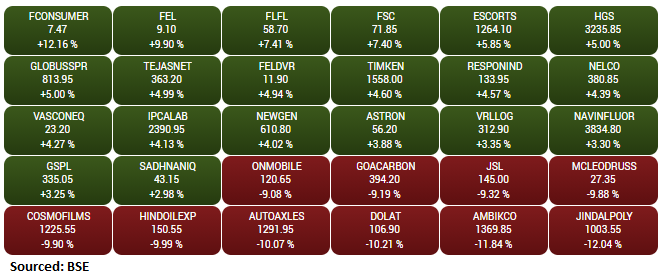

BSE Smallcap index fell over 2 percent with Jindal Poly Films, Ambika Cotton Mills, Dolat Investments, Automotive Axles down over 10 percent:

August 10, 2021 / 14:48 IST

Rupee Updates:

Indian rupee is trading lower at 74.41, amid volatiletradeseen in the domestic equity market.It opened 15 paise lower at 74.41 per dollar against previous close of 74.26.

August 10, 2021 / 14:42 IST

Capacite Infraprojects Q1 earnings:

Capacite Infraprojects has posted net profit at Rs 4.2 crore against loss of Rs 43.1 crore and revenue was at Rs 280 crore versus RS 23.7 crore, YoY.

Capacite Infraprojects was quoting at Rs 213.15, down Rs 15.35, or 6.72 percent on the BSE.

August 10, 2021 / 14:35 IST

Coal India Q1:

Net profit jumped 52.8 percent to Rs 3,174.1 crore in Q1FY22 against Rs 2,077.5 crore in the corresponding quarter last year.

Revenue climbed 36.8 percent YoY to Rs 25,282.1 crore against Rs 18,486.7 crore in Q1FY21.

EBITDA grew 58.7 percent to Rs 4,843.8 crore against Rs 3,051.6 crore YoY. EBITDA margin stood at 19.2 percent against 16.5 percent YoY.