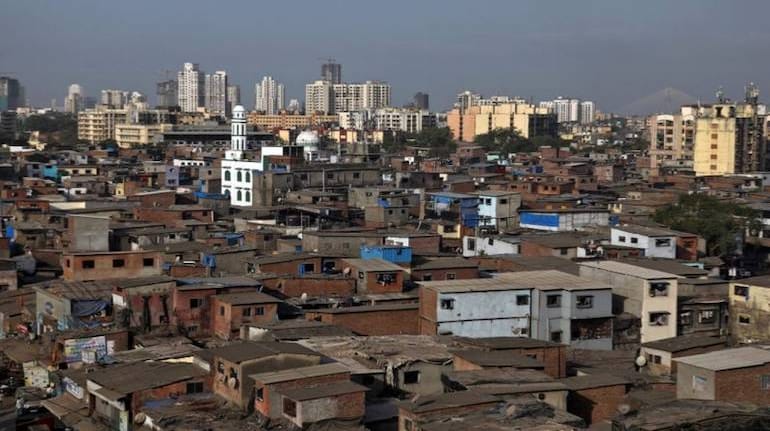

There is an uneasy silence among Mumbai builders. The sharks are up against a giant whale. The whale is the Adani Group. Ever since the giant conglomerate won the bid for the redevelopment of India’s largest slum Dharavi – it had become clear that the company would soon become a key player in the Mumbai real estate market. That did not cause much heartburn as everyone recognized the complex and mammoth task to redevelop a 600-acre slum was the work of only a select few.

With a peculiar notification last month by the Maharashtra Government, the heartburn began. The Government announced that the first 40 percent Transfer of Development Rights (TDR) was to be mandatorily purchased from the Dharavi Redevelopment Project (DRP). What is TDR? Simply put - it is a currency that allows you to construct more area in a plot of land.

How does one generate TDR? Suppose a developer is entitled to build 1,000 square feet based on plain-vanilla metrics like plot size and road width, but he can build only 600 square feet due to exotic barriers like coastal regulation norms or proximity to naval defense areas. Then the remaining 400 square feet can be sold as TDR in the open market for a price. Given the location of Dharavi, it seems plausible that Adani may become a major supplier of TDR in the Mumbai real estate market. Proximity to the airport will render restrictions in constructing tall buildings – allowing a strong generation of TDR from Adani.

ALSO READ: Dharavi redevelopment: Developers’ body seeks relaxations in buying TDRs from Adani Group project

The notification from the government is tight and comprehensive. It tells Mumbai builders 1) 40 percent of their TDR requirement has to compulsorily be purchased from the DRP 2) Not just 40 percent, the first 40 percent of TDR requirement has to be purchased from DRP 3) The pricing of the TDR is up to 90 percent of the Ready Reckoner price of the location where a builder is constructing his building. TDR from DRP will have a different value based on where you buy it.

Mumbai builders hate it. Now I hold no sympathy for them. Many of them have unleashed a savage attack on home buyers and decimated their hard-earned wealth accumulated over a lifetime. Yet – on principle, they are justified in their concerns here even if they are hesitant to speak about it publicly. The government has told Mumbai builders the amount of TDR to be purchased/when it has to be purchased/what price it has to be purchased. The notification has established the Adani Group as the captain and the rest of Mumbai builders as players in winning the Dharavi Redevelopment match.

I understand the rationale behind providing this powerful TDR card to Adani Group in a long-gestation project like Dharavi Redevelopment. An asset-liability mismatch is certain at periodic intervals. Housing stock can take months to sell but the sale of TDR provides smooth liquidity to override any temporary cash-flow issues. I admire the execution calibre of Adani and believe that he is certainly the best player at this point to execute a project of this scale and complexity. Besides Adani, only Lodha and Hiranandani in my view have even the bandwidth to contemplate undertaking such a challenging project.

Yet, this powerful TDR card may set the stage for higher costs in several Mumbai housing projects. Structured data doesn’t exist but it is believed that 1/3rd of housing projects in Mumbai use TDR for their FSI needs. In those projects – a quarter of the total constructed area is contributed from TDR. And recent historical pricing ranges from 30 percent – 60 percent of Ready Reckoner. (In Dharavi: Up to 90 percent of Ready Reckoner is proposed). It’s certain that projects who opt for TDR will see their costs rise in a consumer market that is resistant to price hikes. Smaller players pursuing redevelopment in inferior locations will be at a competitive disadvantage. Conversely, real estate projects of Adani may be at a competitive advantage in its other projects if adequate safeguards on intra-party transactions are not placed.

I suspect an alternative scenario will play out in the medium-term. Most Mumbai builders may lack execution prowess but their skill in inventing and discovering opportunities in the rule-book is legendary. They will find ways to simply bypass the need for sourcing TDR altogether, making the latest notification lose its power.

Here’s the solution and it is simple: Instead of effectively penalizing builders who purchase TDR from the DRP, incentivize builders to purchase TDR from DRP. That will grow the TDR pie although at a lower price - what will be lost in value will be compensated in volume. The Government has given a powerful Joker Card to Adani Group thinking it will provide financial cover for the Dharavi Redevelopment Project. It won’t. They should put the card back. The winning cards are in the deck. They just need to look closer.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.