Neha DaveMoneycontrol Research

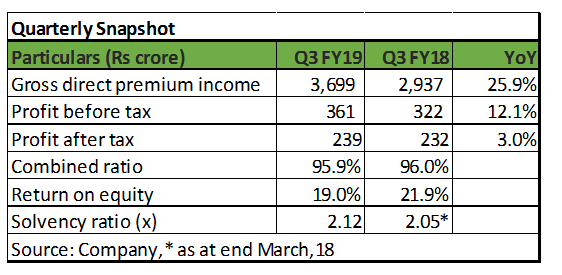

ICICI Lombard General Insurance reported strong growth of 25.9 percent year-on-year (YoY) in Q3FY19 Gross Direct Premium Income (GDPI) versus the industry growth rate of 13.6 percent. Consequently, it consolidated its position as the largest private non-life player and overall fourth largest player in the general insurance industry. Segment-wise details of premium growth business is awaited.

The insurer saw net profit rising by 3 percent YoY to Rs 239 crore in Q3. Growth in profit was muted due to upfront expenditure incurred on acquisition to achieve 25.9 percent growth in GDPI. The full benefit of earned premium will be realised over the policy period.

The combined ratio, a measure of insurance companies' profitability expressed as the total cost to total revenue, improved to 95.9 percent in Q3 from 101.1 percent in Q2. The insurer's combined ratio was higher in the last quarter on increased claims due to Kerala floods. The breakup of combined ratio into claims/loss ratio and expense ratio is awaited.

Capitalisation is adequate for ICICI Lombard as reflected in its solvency ratios at 212 percent, comfortably above the regulatory requirement of 150 percent.

Despite the inherent volatility in core risk-underwriting business, ICICI Lombard is well poised for earnings growth with an increase in insurance penetration, focus on profitable segments and improvement in operating efficiency.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.