Ruchi Agrawal

Moneycontrol Research

- Talks about Brookfield asset management investing Rs 4,500 crore in Hotel Leela Ventures (HLV)

- Hotel stocks rally on the news

- Deal expected to turn around HLV- Positive for the Indian hotel sector

-------------------------------------------------

As per latest reports, Brookfield asset management is planning to buy a majority stake in the loss-making Hotel Leela ventures (HLV) in an estimated Rs 4,500 crore deal. The news lifted some hotel stocks on December 17 with EIH Associated Hotels and Taj GVK Hotels and Resorts gaining 20 percent and 7 percent, respectively.

The deal brings a breather to HLV that has been through a period of mounting debt and profitability erosion due to increasing interest costs. Though the exact contours and confirmation of the deal are still awaited, if it goes through, the capital infusion could be a turning point for the company and facilitate in bringing it back to profitability.

What it means for Hotel Leela Ventures

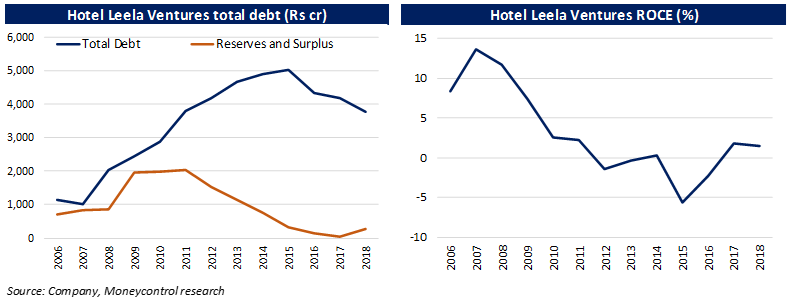

HLV has seen a sharp and continuous increase in its debt in the last decade. As of March 31, 2018, the Rs 1,027 crore market capitalisation company had accumulated a debt of Rs 3,781 crore on its books. The interest costs to service this debt ate away the company’s profits turning it into net losses and eroding returns in the past years. Inability to honour interest payments and defaults led the company into restructuring.

Infusion of Rs 4,500 crore through the proposed deal would help in taking care of the debt strengthening the balance sheet and improving returns. The deal is expected to involve the sale of four out of five properties owned by the company, land holdings and the Leela brand. With no outright exposure in hotel management, Brookfield might want HLV to continue managing the business after the sale of the properties.

There is also a possibility of a buyback of shares or an open offer after the deal to buy out minority investors that could lead to a further uptick in share prices.

What it means for Indian hotels sector

Entry of Brookfield is being considered a big positive for the Indian hotel and could potentially mark the beginning of many such deals.

The sector had suffered in the past on account of low occupancies and suppressed room rates due to rising supply. However, the overall demand-supply situation is improving with a slowdown in supply growth and a rapid uptick in demand, leading to an improvement in rates. With a concomitant increase in occupancy, the room rates are improving. Most major players in the industry are benefitting from this upcycle.

Amid changing dynamics, the domestic hotel sector is becoming increasingly attractive for foreign investment. With improving returns in the current sector upcycle, the deal could highlight the growing Indian hotel sector to global investor thereby attracting many other foreign players in coming times.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.