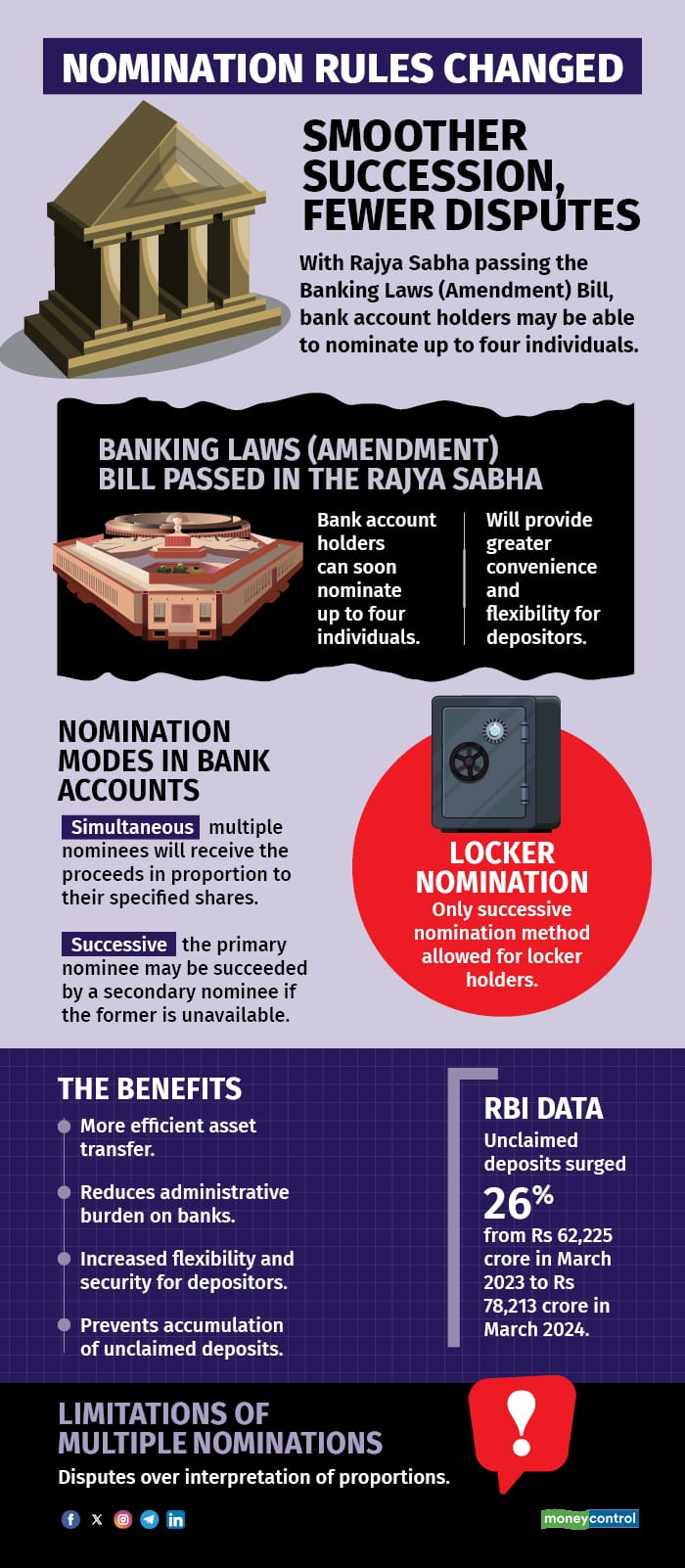

With the Rajya Sabha on March 26 passing the Banking Laws (Amendment) Bill, bank account holders will soon be allowed to appoint up to four nominees.

Finance Minister Nirmala Sitharaman has said account holders will soon have the flexibility to choose between two types of nominations — “successive" and "simultaneous". However, for those renting bank lockers, only successive nominations will be permitted, ensuring a clear line of succession for accessing the locker, preventing potential disputes.

New nomination rulesAllowing multiple nominees offers depositors greater flexibility, security, and a streamlined asset transfer process, said Kunal Sharma, partner at Singhania & Co.

Following the demise of the account holder, a nominee acts as a custodian, facilitating a seamless transfer of funds. However, it's essential to note that a nominee is not the ultimate beneficiary but rather a person authorised to receive the account's custody from the bank. The nominee is then responsible for distributing the assets to the rightful heirs according to applicable succession laws, according to Amey Pathak, Partner at Cyril Amarchand Mangaldas.

The amendment can ease the administrative load on banks while providing account holders with added peace of mind. “Allowing multiple nominees for bank accounts can help prevent a significant problem — the accumulation of unclaimed deposits,” said Pathak.

There was a 26 percent surge in unclaimed deposits from Rs 62,225 crore in March 2023 to Rs 78,213 crore in March 2024, the Reserve Bank of India's (RBI) annual report has revealed.

By permitting multiple nominees, account holders can ensure that their funds are distributed according to their wishes, reducing the likelihood of deposits going unclaimed.

“It will also strengthen governance in the banking sector and enhance customer convenience with respect to nomination and protection,” said Neelam Singh, an advocate at the Allahabad High Court.

The amendment introduces two methods of multiple nominations — simultaneous and successive. By clearly identifying nominees and following these methods, account holders can reduce the risk of disputes among nominees, ensuring a smoother transfer of assets.

Simultaneous nomination allows account holders to appoint multiple nominees to share the account proceeds in the event of their death. According to Pathak, the distribution will be made on a proportionate basis, with each nominee receiving a specified percentage of the account's value.

For instance, if Mr P had Rs 10 lakh in his savings account and nominated his wife, son, and daughter as simultaneous nominees with a 40:30:30 split, the bank would distribute the funds accordingly upon his passing. His wife would receive Rs 4 lakh, while his son and daughter would each get Rs 3 lakh, after which the account would be closed.

Also read | RBI repo rate cut: Home loan rates dip, but new borrowers may miss full benefit

Successive nominationSuccessive nominations ensure that the primary nominee can be succeeded by a secondary nominee if they are unavailable, creating a clear, priority-based succession pathway. This change ensures that asset distribution continues smoothly even if the initial nominee is unable or unwilling to claim the assets. “This method also covers the exigency where a nominee dies before receiving the money,” Pathak said.

For instance, consider successive nominees A, B, and C. The bank will first attempt to pay the proceeds to A. If A is unavailable or unable to receive the funds, the bank will then pay B. If B is also unable to receive the proceeds, the funds will ultimately go to C.

By minimising the need for judicial interventions like probate, the amendment streamlines the succession process, Sharma said. This enables nominees to access funds more quickly, providing essential financial continuity for dependents or business operations, especially during urgent financial needs.

It must be noted that in the case of articles kept in bank lockers, only the successive nomination method can be followed.

Also read | Health insurance claim denied? Approach insurance ombudsman for redressal

Multiple nominees? Ensure clarity to avoid disputesAccording to Pathak, having multiple nominees may lead to disputes over proportion allocation, despite the amendment calling for explicit proportion specification. To avoid such conflicts, it's essential for account holders to maintain clear and detailed documentation regarding their nominees and proportion allocations.

“To minimise potential risks, depositors should verify that their nominations align with their will and other estate planning documents, ensuring an appropriate distribution of assets," Sharma said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.