A big disadvantage in a bank fixed deposit (FD) is that subsequent interest rate hikes do not benefit existing FD investors.

Yes Bank’s latest FD offering hopes to correct this anomaly. The Yes Bank Floating Rate Fixed Deposit (FRFD) will modify interest rates in line with where they are headed.

With the Reserve Bank of India (RBI) having started to hike the repo rate this financial year to control accelerating inflation, Yes Bank’s FD is poised to pass on the benefit to its FD holders.

But is it as simple and rewarding as it looks? Let’s take a closer look.

FD linked to repo rateThis is a floating rate FD whose interest rate is linked to the prevailing repo rate. In the last two months, the RBI has hiked the REPO rate twice by a cumulative 90 basis points. One basis point is one-hundredth of a percentage point.

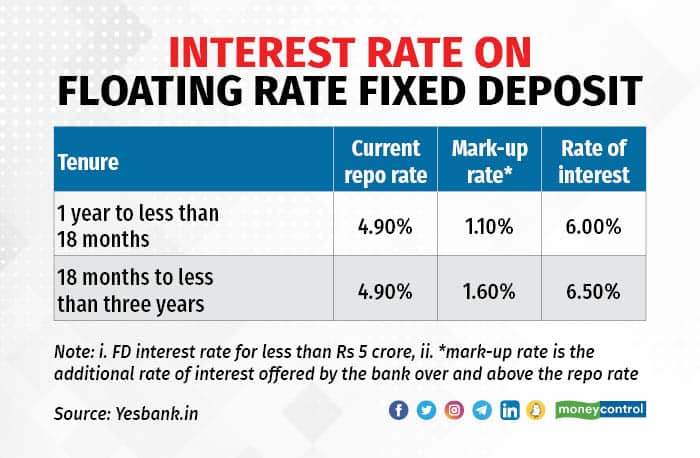

Over and above the existing repo rate, the FD will add a mark-up and that is the interest rate it will offer you. At present, the 3-year FD rate is 6.5 percent after the mark-up.

The interest rate is higher compared to Axis Bank’s 5.70 percent and State Bank of India (SBI)’s 5.35 percent on a 3-year FD. But, Yes Bank’s floating rate FD interest rate is lower the 6.90 percent being offered by AU Small Finance Bank on a 3-year FD.

A floating rate allows investors to earn dynamic returns on their FDs.

This floating rate FD can be availed for a tenure of 1 year to less than 3 years. This is usually the length of a single interest rate cycle during which either interest rates go up or down.

The minimum investment is Rs 10,000. The rate of interest of a floating-rate FD consists of two components, namely benchmark rate (i.e. repo rate) and the mark-up. The final rate is derived by adding the repo rate and the applicable mark-up. Once invested, the mark-up remains constant for the entire tenure of the FD, only variable part is the repo rate, which gets reset on the first day of the subsequent month if RBI effects any change in the rate. Refer to the table for existing interest rates on this FD.

Senior citizens get an additional 0.50 percent interest for an investment of less than Rs 2 crore and up to 0.45 percent for an investment of Rs 2 crore to less than Rs 5 crore. Only resident individuals and non-individuals can invest in this FD. Investors have only a quarterly interest compounding option in this scheme and payout happens only on maturity, along with principal amount.

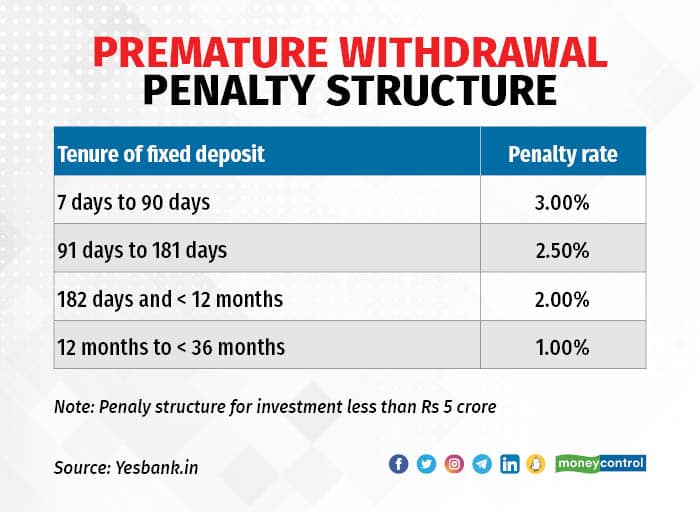

The FD allows an overdraft facility up to 90 percent of the principal value. A premature withdrawal facility is available with an applicable penalty from 1 percent to 3 percent (refer to table).

The floating-rate FD is beneficial to investors, especially given that we are in a rising interest-rate situation.

“Investors opting to invest in floating rate FDs at this stage will benefit from the rising interest-rate environment,” says Amol Joshi, founder of Plan Rupee Investment Services.

“One of the primary advantage of floating rate FD is that the revision on the interest rate will happen automatically and will not require any manual intervention by the bank or the customers,” added Prashant Kumar, MD and CEO, YES Bank.

There is no fixed upper-limit and lower limit on the rate of interest in this FD scheme; it moves completely in tandem with repo rate. The interest rate transmission is faster and smooth, as interest rates will be reset every month in floating-rate FDs. This floating rate feature is a new phenomenon in fixed deposits.

“Today it’s an exception, but tomorrow I believe it will become the norm as other banks may introduce similar FD schemes,” says Harshvardhan Roongta, Principal Financial Planner, Roongta Securities.

What doesn’t workOne of the major drawback is any decrease in the repo rate shall result in a decrease in the effective interest rate of the floating-rate FD.

There is no regular interest income for investors as a payout happens only on maturity along with the principal amount.

“The penalty charges for premature withdrawal are as high as 3 percent. So, investors are unlikely to get any returns if withdrawn prematurely. It will be a loss-making proposition,” says Joshi.

Typically, other bank FDs have lower premature penalty rates. For instance, Axis Bank and AU Small Finance Bank charge 1 percent as a penalty for premature withdrawal. Axis Bank levies no penalty on the first partial withdrawal of upto 25 percent of the principal amount invested in an FD.

Should you invest?Yes Bank’s floating-rate FD may be a bit complicated for the average FD investor to decipher if interest rates remain volatile throughout its tenure. Typically, the traditional FD investor seeks fixed returns from his investments. She does not track repo rates. Her basic aim is to know the fixed rate of returns for investing the principal amount during the tenure.

“Most of the FD investors do not understand factors leading to an increase or decrease in repo-rate movements. Such investors shouldn’t opt for a floating-rate FD scheme,” says Roongta.

But the product is innovative and aims to address a downside in a typical fixed deposit.

Joshi advises investors preferring to invest in FDs to hold 40 percent of their saving in floating-rate FDs and the remaining 60 percent in traditional fixed-rate FDs.

“Avoid investing a higher portion in floating-rate FDs because the product is new and investors need to understand how it behaves in a real investment scenario,” he adds.

Make note of the high penalty charged for a premature withdrawal.

“In case there is a probability of premature withdrawal, then prefer traditional fixed-rate FDs since floating rate FDs have higher penalty charges,” says Joshi.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.