Health insurance is an important financial tool that helps in dealing with unwanted medical emergencies and beating the impact of health care inflation on your wallet. It is an insurance you must have in your portfolio. The earlier you buy a health cover, the better it is for you. This is because premiums tend to get more expensive with age.

Adhil Shetty, CEO, Bankbazaar, said when you are younger, having a health cover ensures that you do not have to dip into your savings and disrupt your financial goals in case of a medical emergency. “It is an individual decision to be taken after considering several factors such as your and family’s medical history, your lifestyle, the cost of healthcare in your city, the inflation, as well as the policy features you require. Most importantly, it must not be a ‘do it, shut it, forget it’ decision. You must review every time there is a change in any of these factors,” he added.

Here are some of the important health benefits includes under various health insurance plan are:

Out Patient Department (OPD) Service: It is the service which you get without being admitted to a hospital.

Availability of room in exigency: Despite having enough cash to deposit, emergency treatment is given to the patient. The service is provided through cashless card service given to you by the insurer.

Maternity benefit: Most health plans cover maternity benefit where hospitals provide care before and after your baby is born.

Prescribed drugs benefit: You can get the monetary benefit for the prescribed drugs advised by a doctor. The same can be claimed from the insurance provider.

Full rehabilitation: Proper treatment in the hospital is given to the patient until he/she restores his health back to normal life.

Path-Lab tests cover: To strengthen the healthcare delivery services towards the economically weaker sections, many health insurance companies cover the cost of general pathology tests.

Behavioural health treatments: Some plans come up with mental health and substance use disorder services which include counselling and psychotherapy and other behavioural health related treatment.

Apart from these benefit, you can also claim the premium amount paid availing the policy for getting tax benefit under section 80D and 80DD. However, despite knowing all the facts, still availing health insurance is neglected by many of us. In India, the under penetration of general insurance remains extremely low at 0.77% of which only 15-20% is health insurance.

Naval Goel, CEO and Founder of PolicyX.com said health insurance is still not underpenetrated as people procrastinate when it comes to their health. Some developed countries have made it compulsory to invest in health insurance that helps the population to have a secured future. “In India, a lot of people do not give much preference to health insurance due to lack of awareness, funds and reach. The government is taking many initiatives in solving the same issue and has come out with many helpful programs, however, we should focus on more ideas to create awareness among the needful section of the country."

Diseases which are getting common these days

Vaidyanathan Ramani, Head- Product and Innovation, Policybazaar.com said that lifestyle diseases such as heart attack, diabetes and hypertension are increasing at an alarming rate every year in India. One hospitalisation is enough to burn a hole in the pocket. Moreover, medical treatment cost will outpace inflation in the years to come. “It is quite crucial for any individual to buy an adequate health cover at an early age to have a safeguard against medical emergencies that may strike any time,” he said.

However, there is one key point to keep in mind. Increasing medical inflation means that medical expenses will rise over time. Therefore, those who are reluctant in buying health insurance plan should take proper advice from their financial planner and buy a relevant insurance plan for themselves. This way, you will notice that 10 years down the line, there may be a mismatch in the amount of cover you originally opted for and your current needs. So, start early, and keep increasing your cover periodically.

Data Analysis: Understanding health insurance mismatch between sum insured and claim cost

Let us understand through certain data analysis that how individuals are ignoring to have health insurance. Moreover, those who are availing it are not having sufficient coverage as they are lacking in reviewing their plans on a regular basis.

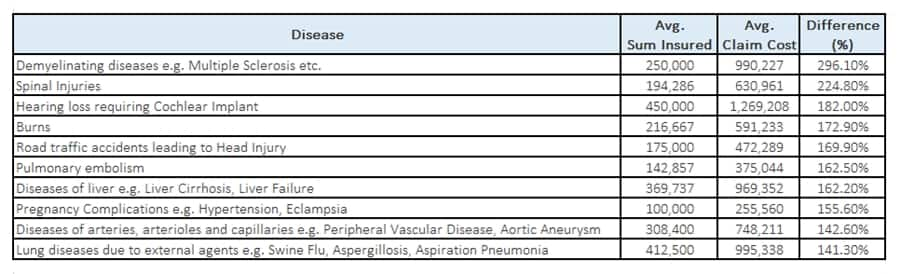

Bhaskar Nerurkar, Head-Health Administration Team, Bajaj Allianz General Insurance said that his team has analysed their internal claims data and noticed a huge gap between the sum insured and the actual cost of the claim incurred. The highest gap being in demyelinating diseases & spinal injuries, which is close to 296% and 225% respectively. Some of the common ailments such as injuries, burns, liver failure, hypertension, swine flu and pneumonia the difference in average sum insured and average claim cost lies in the range of 140% to 170%.

Here are the details on under insurance claims received during 2016-17

Hence, it’s vital for individuals to periodically enhance the sum insured of their health insurance plan which is an ideal way to counter medical inflation. “A combination of hospitalization plan, critical illness plan and a personal accident plan is adequate to provide 360-degree protection,” said Nerurkar.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.