In a world of financial uncertainties, investors often grapple with a fundamental question: How to balance growth and stability? Hybrid funds, a versatile investment vehicle, have emerged as a powerful solution. By combining multiple asset classes like equity, debt, and commodities, these funds allow investors to achieve the dual goals of risk management and consistent returns. Here's why now is the time to make hybrid funds a cornerstone of your investment strategy.

Asset allocationImagine a tightrope walker balancing across a high wire. Success depends on the careful distribution of weight—too much on one side, and they’ll fall. Asset allocation works on the same principle: it distributes your investments across different asset classes like equity, debt, gold, or even international markets to strike the perfect balance between risk and return.

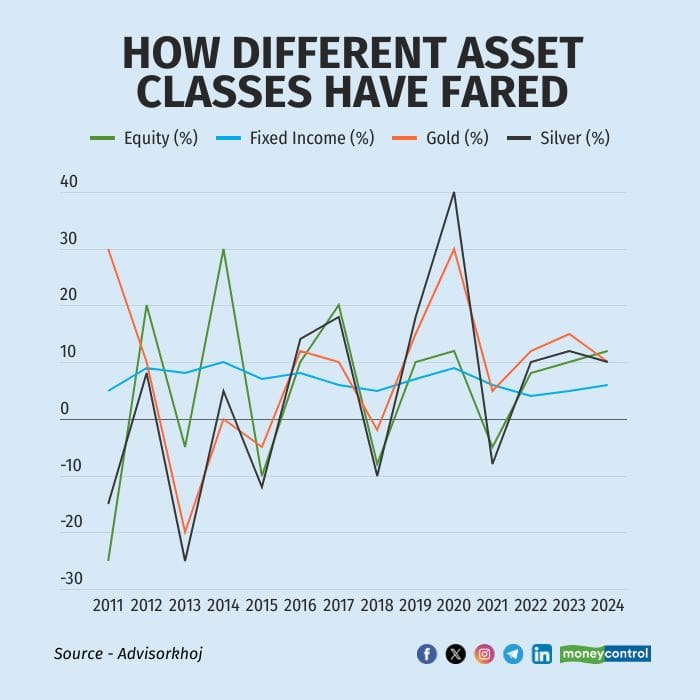

In financial markets, every asset class has its own cycles. Equity might outperform during economic booms, while commodities like gold tend to shine during downturns. By diversifying, you ensure that when one part of your portfolio underperforms, another compensates. The goal isn’t just to maximise returns but to make the journey smoother.

Why hybrid funds can be a perfect fitHybrid funds bring asset allocation to life within a single product. Unlike traditional mutual funds that focus on one asset class, hybrid funds blend different investments to cater to a variety of risk appetites and goals.

Also read | How the next-gen of affluent families are managing their wealth

But their appeal goes beyond convenience. Markets are unpredictable—2024’s rollercoaster journey highlighted how sudden economic shifts can affect investor confidence.

Hybrid funds act as shock absorbers, cushioning your portfolio against volatility while ensuring you don’t miss out on opportunities for growth.

Hybrid funds aren’t a one-size-fits-all solution; they come in various types, each tailored for specific investor needs. Let’s break them down:

1. Arbitrage funds: Low-risk parking lotsThese funds exploit price differences in the stock market’s cash and derivative segments. With their equity-heavy structure, they are a tax-efficient alternative to fixed deposits, suitable for short-term goals.

2. Conservative hybrid funds: Safety with a dash of growthWith up to 25 percent in equities and the rest in debt, these funds cater to risk-averse investors who still want exposure to equity. Over a long horizon, the equity portion can deliver meaningful growth while the debt portion provides stability.

3. Dynamic asset allocation funds: Intelligent adaptabilityThese funds dynamically adjust equity and debt exposure based on market conditions. For example, when markets are overvalued, they reduce equity exposure, and when valuations are attractive, they increase it. This strategy minimises downside risks, making them ideal for volatile times.

4. Multi-asset funds: All-weather championsBy investing in at least three asset classes (for example, equity, debt, and gold), these funds are built for investors who want consistent performance regardless of market conditions. Think of them as the financial equivalent of a Swiss Army knife—versatile and reliable.

5. Aggressive hybrid funds: For the risk takersWith up to 80 percent in equities, these funds are for investors with a higher risk tolerance who seek substantial long-term returns. The debt component tempers volatility, making them a smarter choice than pure equity funds for those who want some downside protection.

Current market context: Why now is the time for hybrid fundsThe Indian stock market has undergone significant corrections in 2024, presenting a unique opportunity for investors. Valuations are attractive, but uncertainties around corporate earnings and global economic headwinds persist. In such conditions, a balanced approach becomes critical.

Also read | Trump's ban on birthright citizenship: EB-5 Visa demand from Indians may see a sharp uptick

The Reserve Bank of India’s revised GDP growth outlook of 6.6 percent for FY 2025 signals cautious optimism. Add to this a macroeconomic landscape of moderating inflation, narrowing fiscal deficits, and strong corporate fundamentals, and you have a recipe for long-term growth—but only if you can navigate short-term turbulence.

Hybrid funds, with their diversified portfolios, provide exactly that—stability in rough waters and potential for growth when the storm passes.

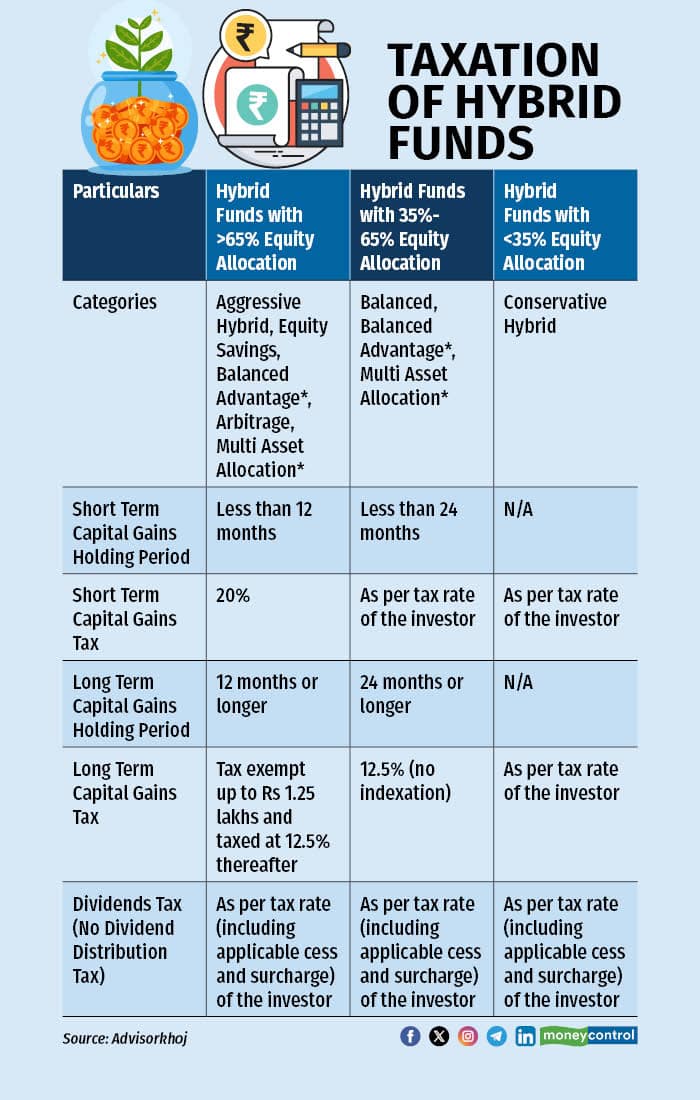

The tax advantage of hybrid fundsThe Union Budget of 2024 introduced several changes to the capital gains taxation framework. The following table provides a general overview of how hybrid funds are taxed. It’s important to note that tax implications may vary across different schemes within the same category, so this information should be used as a guideline only.

Understanding the tax implications of your investments can make a significant difference to your net returns. Always consult a financial advisor for clarity.

Why hybrid funds stand out1. Simplicity for beginnersFor those new to investing, hybrid funds eliminate the complexity of managing multiple asset classes separately. They provide a ready-made solution tailored to varying risk profiles.

2. A balanced strategy for all market conditionsExperienced investors often struggle with timing markets. Hybrid funds take that burden away by adjusting allocations dynamically or through pre-set strategies.

3. Risk management and growthBy diversifying across asset classes, hybrid funds reduce the impact of market downturns while still allowing you to benefit from the growth of equities.

Making the most of hybrid funds● Start small: If you’re new, begin with conservative or dynamic hybrid funds.

● Know your goals: Align the type of hybrid fund with your financial objectives and risk appetite.

● Stay consistent: Hybrid funds are most effective when held for the long term, allowing their diversified strategy to play out across market cycles.

Final thoughtHybrid funds aren’t just another investment option—they’re a smart way to navigate today’s tricky financial world. They help you find the right balance in your portfolio, manage risks, and still aim for growth, no matter how the market moves.

Also read | How a 'trust' structure can facilitate smooth inter-generational transfer of wealth

Whether you prefer playing it safe or chasing bigger returns, there’s a hybrid fund that fits your style. As markets keep changing, think of hybrid funds as your steady guide—keeping your investments grounded while helping you grow your wealth over time.

The writer is co-founder and Executive Director of Prime Wealth Finserv Pvt Ltd.Disclaimer: The views expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.