Are advance tax rules different for senior citizens? Today's Ask Wallet Wise question explains how they vary for those with income from business or profession and those without.

Moneycontrol’s Ask Wallet-wise initiative offers expert advice on matters related to personal finance and money-related queries. You can email your queries to askwalletwise@nw18.com and we will try and get a top financial expert to address your queries.

I need your advice on the payment of advance tax to be paid for LTCG of Rs 95 lakh following the sale of equity shares of Rs 130 lakh recently. I am a senior citizen, do I need to pay the advance tax?

Expert advice: In the case of a resident senior citizen (aged 60 years or above) who does not have any income chargeable under the head “Profits and Gains of Business or Profession”, the provisions of advance tax do not apply as per the proviso to section 207(2) of the Income-tax Act, 1961. However, where such senior citizen earns capital gains, the exemption from advance tax liability continues to apply, provided there is no business income.

Accordingly, if the individual is a senior citizen without any business income, and the only taxable income is Long-Term Capital Gain (LTCG) of Rs 95 lakh on sale of equity shares, there is no liability to pay advance tax during the financial year. In such a case, the entire tax liability, including surcharge and cess, may be discharged at the time of filing the return of income.

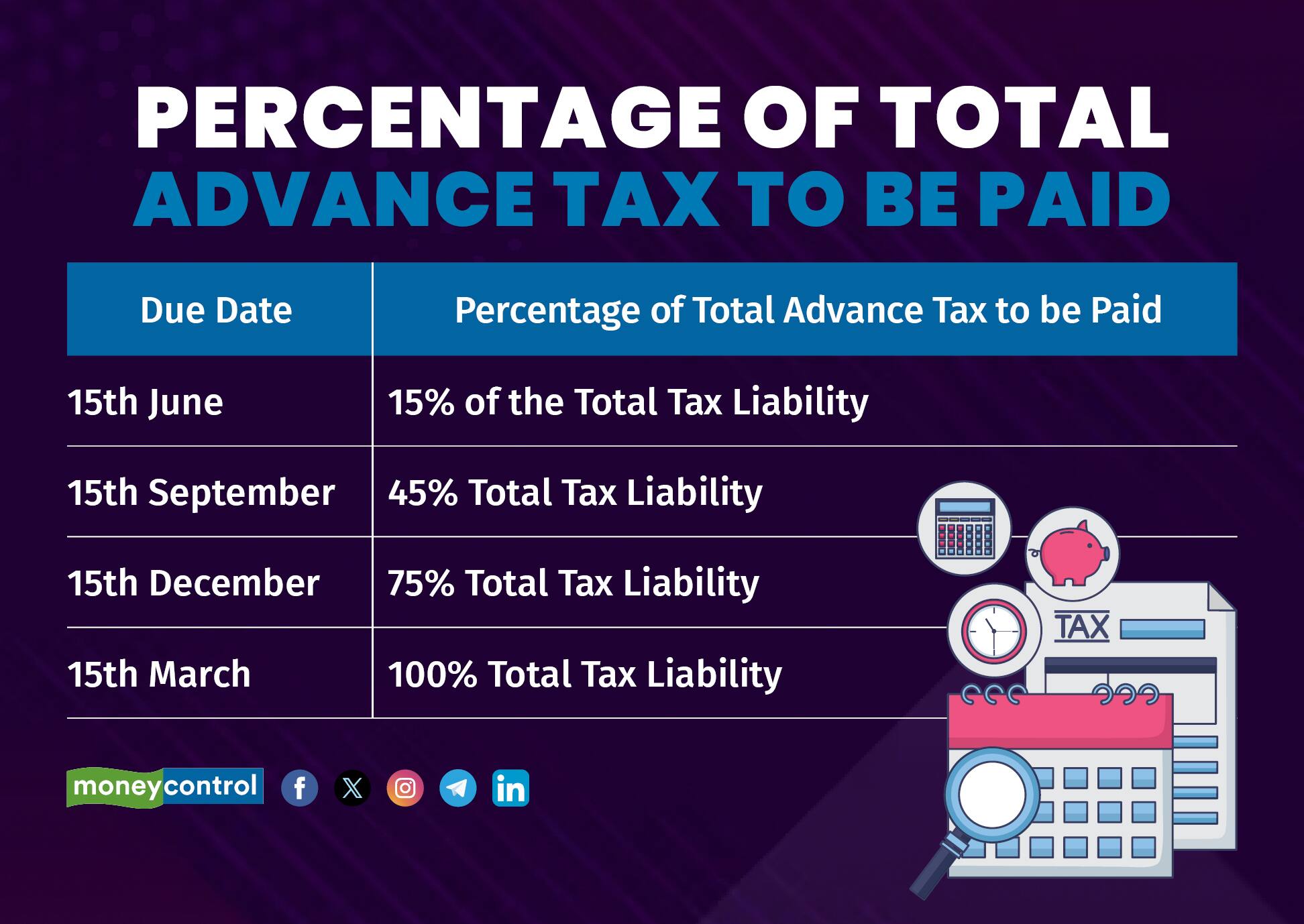

However, if the senior citizen is a non-resident or has business income or opts to pay advance tax voluntarily to avoid interest under sections 234B and 234C, the due dates for advance tax payment are as follows:

Advance tax rules for senior citizens

Advance tax rules for senior citizens

Thus, If the senior citizen has no business income, there is no obligation to pay advance tax on the LTCG of Rs 95 lakhs. Tax can be paid in full before filing the return under self-assessment without attracting interest under sections 234B or 234C. If there is any income from business or profession, advance tax will become applicable, and it is advisable to pay the tax in the remaining instalments or by 31st March to avoid interest consequences.

Disclaimer: The views expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Ask Wallet-Wise

Ask Wallet-Wise

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.