20 March, 2025 | 15:08 IST

Personal loans are often a quick fix for financial emergencies, but choosing the right one could be a tedious task due to a plethora of options. The loan tenure, or the length of time you intend to repay the loan, is one of the most crucial factors to take into account. Whether you want to pay off your debt more quickly or have lower monthly payments, selecting the right tenure can make all the difference.

Also, the loan repayment tenure could be a deciding factor for your total outgo to clear the debt. For instance, if you choose a longer tenure your total interest payment will increase compared to a shorter term.

Let’s take a look at how the minimum and maximum terms for personal loans can impact your financial planning.

Table of Contents

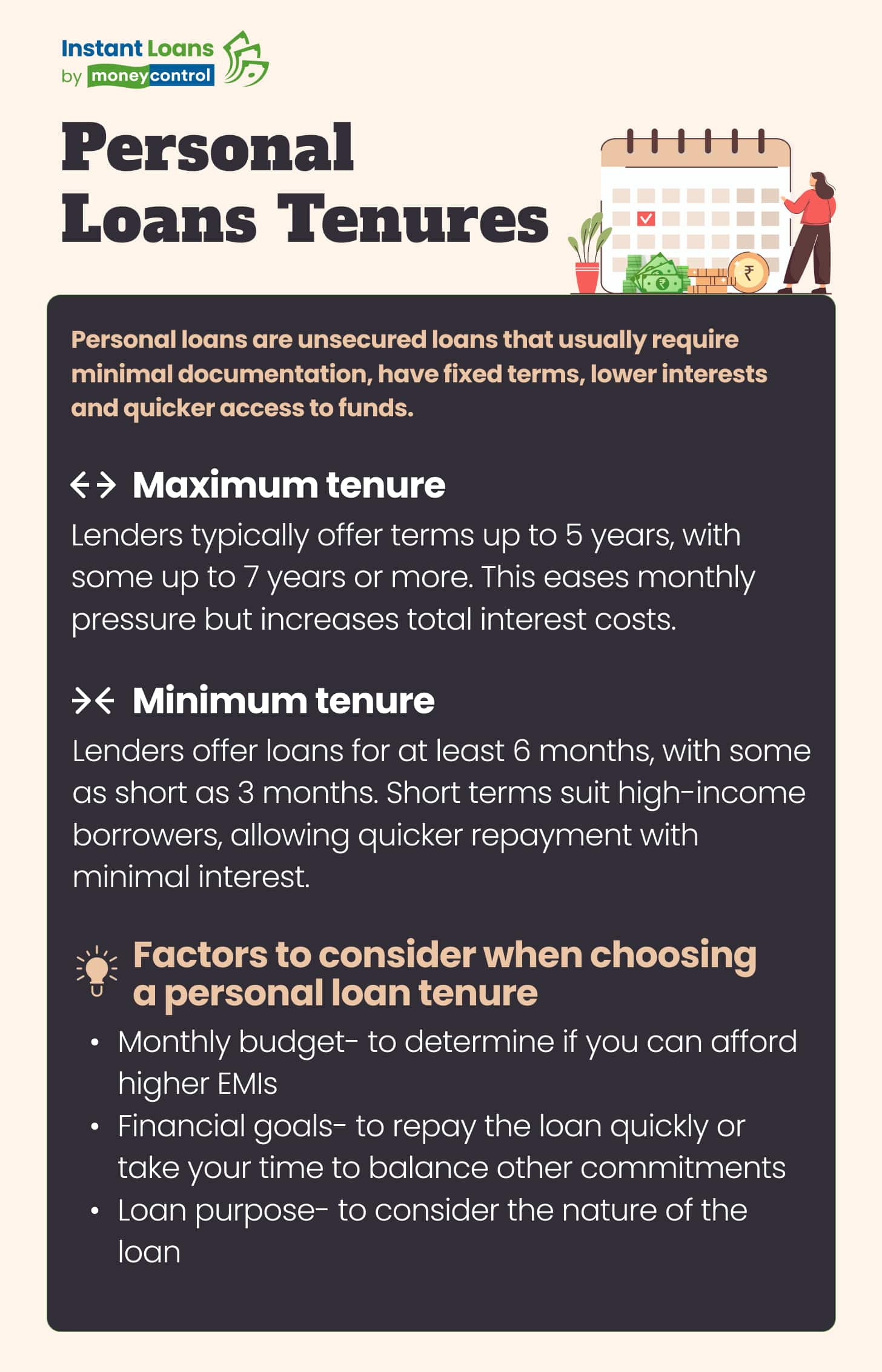

An unsecured loan taken out for personal use from a bank or non-banking financial institution (NBFC) is known as a personal loan. Instead of collateral, these loans are determined by factors including income and creditworthiness. Since they are usually fixed-rate loans, the interest rate doesn’t change during the course of the loan.

Moneycontrol provides access to instant loans up to Rs 15 lakhs in partnership with its lending partners. Based on the employment status, you can choose between a personal loan and business loan. It’s a 100% digital process, with interest rates starting at 12% per annum and there are no hidden charges.

When it comes to personal loans, the repayment period can make all the difference. While most lenders offer a typical term of up to 60 months (5 years), some may extend it to 7 years or more. Choosing a longer loan term can ease the pressure on your monthly budget. However, your total interest payment could be higher due to longer duration.

Most lenders provide loans with a minimum tenure of one year, or 12 months. But, this can vary depending on the lender and your financial profile. Some lenders might provide options as short as three months. Shorter loan terms are ideal for borrowers with higher monthly incomes, allowing for quicker repayment with minimal interest. Some lenders impose a lock-in period of 3 to 6 months, during which borrowers can't pre-pay or close the loan early.

When deciding on a personal loan tenure, it’s crucial to analyse your monthly budget, financial goals, and the purpose of the loan to ensure you make the right choice.

While exploring personal loans, it’s essential to balance the interest rate with the repayment period. While longer loan tenure might seem attractive due to lower monthly EMIs, it increases the total interest paid over time. Conversely, opting for a shorter tenure means higher EMIs, but it saves you on interest costs in the long run. Your choice should reflect your financial priorities — would you prefer lower monthly payments or paying less in total interest? Making this decision carefully is the key to effective financial planning.

Another key factor is the early repayment. If your financial situation improves, settling the loan ahead of schedule can save you on interest costs. However, some lenders impose a prepayment charge, so it’s essential to review these terms before finalising the loan. The flexibility to repay early without extra charges can play a major role in deciding the loan tenure that best fits your needs.

ALSO READ: Personal Loan Prepayment: Key points to consider before paying off your loan earlier

If reducing your monthly expenses is a priority due to other financial commitments, choosing a longer tenure can be beneficial. Balancing between a longer and shorter repayment period is key to managing your finances effectively. Consider factors like your monthly budget, financial objectives, and the purpose of the loan to determine the tenure that best suits your needs.

In conclusion, understanding the tenure of your personal loan is vital, as it affects your overall financial well-being. Make this decision carefully, considering your current financial situation, future goals, and immediate needs. Sound financial planning requires finding a balance between the overall interest cost throughout the loan tenure and an affordable EMI.

Through the Moneycontrol app and website you can access multiple personal loan offers for various tenures. You can apply for loans up to Rs 15 lakhs in a completely digital process. The interest rates start at only 12% per annum.

Share it in your circle

Table of Contents

Explore Top Lenders for Instant Loan upto

Get Instant Loan up to ₹50 Lakhs with Zero Paperwork from Top Lenders

100% Digital

100% Digital Quick Disbursal

Quick Disbursal Low Interest Rates

Low Interest Rates