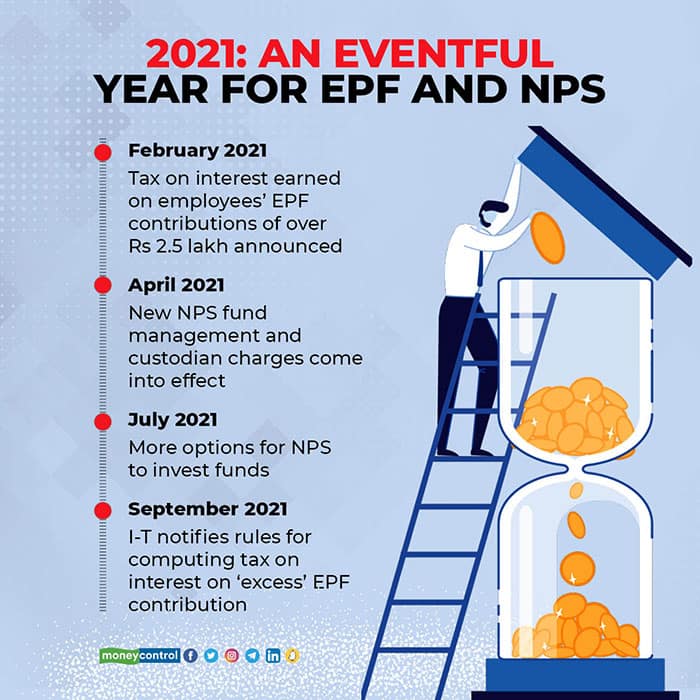

The year 2021 was expected to bring major changes in the National Pension System (NPS), with higher fund management charges and new pension scheme managers. However, it was the employees’ provident fund (EPF) that attracted maximum attention in the calendar year.

EPF no longer fully exempt from taxIn February, Finance Minister Nirmala Sitharaman decided to tax the interest earned on employees’ PF contribution of over Rs 2.5 lakh per annum. This move sent financial planners and tax consultants into a tizzy. EPF, until this financial year, was exempt from tax at contribution, accumulation and maturity stages.

EPF contribution is allowed as deduction under section 80C within the overall limit of Rs 1.5 lakh. Now, the interest earned – 8.5 percent per annum currently – on contributions in excess of Rs 2.5 lakh will be added to your income and taxed as per the slab rate applicable. I-T officials said that the move would affect less than 1 percent of taxpayers in India. For government employees, this threshold is higher, at Rs 5 lakh.

Also read: Explained: All about how you EPF contributions above Rs 2.5 lakh will be taxed

The rule also affects employees who voluntarily contribute amounts in excess of the statutory requirement (12 percent of basic salary and dearness allowance) to their provident fund. Now, high-earners – whose basic annual salary is over Rs 21 lakh – have little choice in this matter. But those who contribute to VPF should look to move this excess amount to retirement schemes such as the NPS, feel some tax advisors. “Many of our clients have shifted to NPS – tax benefits and returns are higher than that of EPF at present,” says Vaibhav Sankla, Principal, Billion BaseCamp Family Office.

However, others such as financial planner Suresh Sadagopan, Founder, Ladder7 Financial Advisories, believe that given the element of assurance that comes with the EPF, it is still a good option for some, despite the tax pinch. “It cannot be strictly compared with NPS. The biggest advantage is assured return. Conservative investors can continue with their investments in VPF. Besides, NPS subscribers have to mandatorily convert 40 percent of their corpus into annuities and the pension they receive later is taxable,” he says.

Higher charges, new investment guidelines for NPSThe year 2021 started with the impending revision in investment management charges. NPS fund managers can now charge a maximum of 0.09 percent as investment management fee, up from the measly one basis point earlier. Pension Funds Regulatory and Development Authority of India chairman Supratim Bandyopadhyay told Moneycontrol that the revision was necessary to ensure that the model was sustainable for pension fund managers. “These are pragmatic changes. It still remains a low-cost retirement-focussed product compared mutual funds or life insurance-cum-investment products,” says Sadagopan. Axis Mutual Fund’s pension arm will be the eighth PFM once it receives the Reserve Bank of India (RBI) approval.

In addition, the PFRDA also liberalised investment guidelines for pension fund managers, expanding the universe of stocks they could invest in.

For one, they can subscribe to initial public offerings (IPO). They can now invest in the top 200 stocks in terms of market capitalisation. Until June, they were allowed to invest in stocks that are a part of the F&O basket, with a market capitalisation of at least Rs 5,000 crore – that is the top 100 large-cap stocks. “Now, pension fund managers have access to a much larger universe, be it in equity or corporate debt. The expanded basket (from top 100 to top 200) is where the long-term growth will come from,” says Sumit Shukla, CEO, HDFC Pension Fund.

And, he is of the opinion that the momentum will continue in 2022, too, with large PSUs moving their superannuation funds to NPS. “This is an evolving opportunity. Also, traction for NPS tier-I and tier-II accounts has gone up and subscribers are looking beyond tax benefits. NPS AUM could swell to close to Rs 10 lakh crore next year,” he says, dismissing suggestions that the current volatility in the stock market could be a spoke in the wheel for the NPS bandwagon. “We are long-term investors and look at horizons of 10-12 years. We see these corrections as opportunity to invest more,” says Shukla.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.