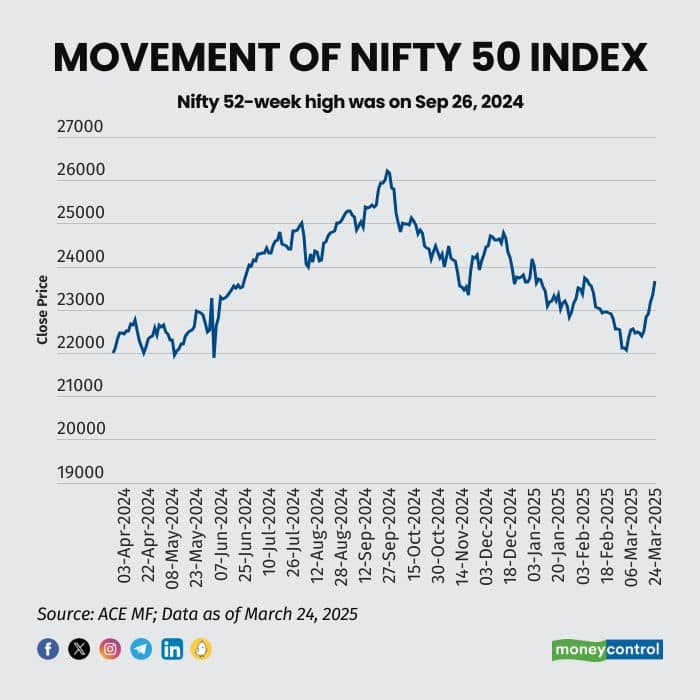

Benchmark equity indices – BSE Sensex and Nifty50 – have staged a smart comeback in March, after having witnessed a prolonged bout of selling in calendar year 2025 so far.

On March 24, the BSE Sensex soared by over 1,000 points - 1.40 percent -- to close at a six-week high of 77,984. Indices have been in the green for six consecutive sessions now, sparking the debate around whether the rise is transient or sustainable.

Bulls have been in charge in the month of March 2025Global factors spur market rally

Bulls have been in charge in the month of March 2025Global factors spur market rally“Equity markets are rallying as global macro uncertainty from CY24 fades, driven by elections in over 50 percent of the top 20 economies. The cycle is set to culminate with Trump’s remarks on India Inc. in early April. While earnings uncertainty persists, the resumption of macro decision-making should pave the way for economic momentum, ultimately supporting corporate earnings growth in 2HFY26,” says Trideep Bhattacharya, President and CIO-Equities, Edelweiss MF.

US president Donald Trump’s tariff threats since his election have led to uncertainty in the US markets, pulling down their performance. “The conjecture being drawn is that institutional investors will consider reducing their allocation to US markets and that allocation will flow to other markets, including India. Some of the FII buying witnessed over the last few days can be attributed to this,” says Ashish Khetan, Founder, Serenity Wealth, a SEBI-registered investment advisor, adding that the recent upsurge could also be a pullback rally after a sharp correction witnessed since September 2024. In a reversal of the trend since the beginning of 2025, foreign institutional investors (FII) have turned net buyers in the last three sessions, bought shares worth Rs 15,777.73 crore and sold shares worth Rs 12,721.97 crore.

Is the rebound sustainable?It’s too early to say, feel investment advisors. “Whether the current rally sustains or not will depend a lot on Q4 results as the Indian markets are still at higher valuations even though some of the excess valuation has come off. And these valuations will sustain if corporate earnings show growth. If they falter, there will be a question mark over the current market recovery’s sustainability,” says Khetan.

Investors ought to keep a close eye on corporate earnings for the January-March 2025 quarter in the coming days, besides global factors – particularly reciprocal tariffs that are set to be enforced from April 1, 2025 – instead of taking investment calls purely on the basis of the recent short-term upsurge. “I still believe we are not out of the woods. I think there is an expectation that the coming quarters could be much better in terms of corporate results and FPI funds have flowed in too over the last ten days. We are up 5-6 percent from the bottom, but that does not mean you should invest all the lump-sum that you may have in one go,” cautions Harshad Chetanwala, Co-founder, MyWealthGrowth.

He recommends a staggered approach in the current scenario – investing through the systematic transfer plan (STP) or systematic investment plan (SIP) route. “You can look at investing 20-25 percent of the investments you have earmarked for equities as lump-sum, but the rest should be in the form or STP or SIP,” he says.

Also read: Stock market crash: Have Rs 10 lakh to invest today? Here's how to make a well-rounded portfolio

Cliched and monotonous though it might sound, you must not lose sight of your own goal-oriented financial plan and asset allocation while keeping track of market movements. Your asset allocation, rather than market fluctuations, should dictate your investment strategy.

Retail investors should stick to their financial plans instead of tweaking their strategy because of markets going up or down in the short term. “If as part of regular portfolio review, their equity allocation has overshot their strategic allocation, then they can sell. Likewise, they can buy equity if equity allocation has fallen below the strategic allocation. Some of the more evolved family offices follow this approach, which interestingly gave them a sell signal in August/September and a buy signal in February,” adds Khetan.

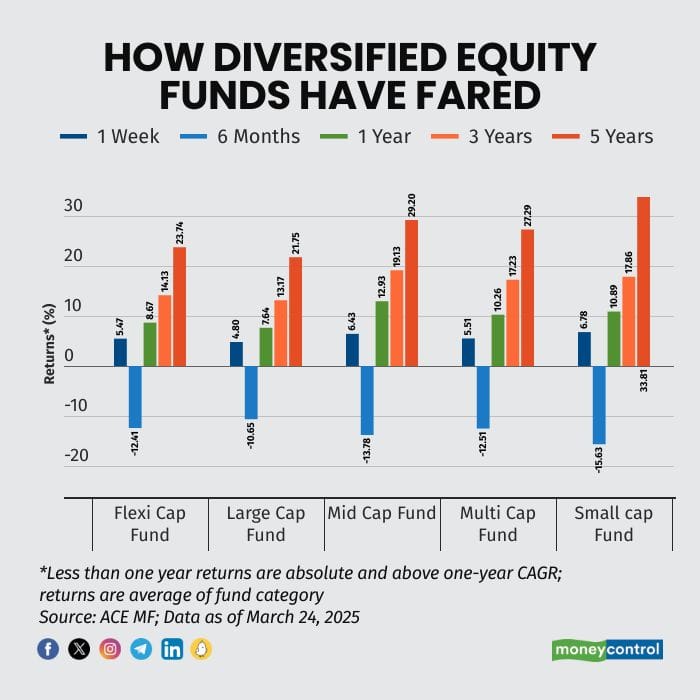

If you must invest in equities, continue to be wary of small and midcaps that have fallen more sharply compared to flexicap and largecap funds (see graphic). Chetanwala believes that the large-cap space now looks attractive. “You can look at large-cap oriented funds for now, including large-and-midcap schemes and flexicap funds. We would still recommend going slow on mid and smallcap schemes. We are still not comfortable with these two segments. Finally, your investment should be driven by your asset allocation and long-term goals,” he says.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.