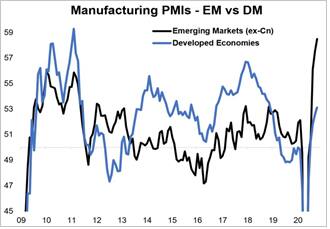

The emerging markets (EMs) have seen a vast improvement in their economic outlook in the past few months. Many Asian EMs have already seen a swing back to expansionary numbers, while the ones in Latin America (LATAM), Europe, Middle East and Africa (EMEA) are seeing a surge in recovery momentum, despite their ongoing battle with COVID-19. The Manufacturing PMI, a leading indicator of economic activity, has rebounded firmly since August for most EMs, and exceeded the developed markets significantly.

Chart 1: Rebound in economic activity in EMs (ex China) has surpassed DMs

Chart 1: Rebound in economic activity in EMs (ex China) has surpassed DMs

Source: Topdown Charts (topdowncharts.com), Refinitiv Datastream, Markit. Data as of October 2020.

Source: Topdown Charts (topdowncharts.com), Refinitiv Datastream, Markit. Data as of October 2020.

Looking forward to 2021, the combination of: i) cyclical recovery, ii) weakening USD, iii) commodity upcycle and iv) continuation of China’s strong recovery should uplift EM’s growth. A vaccine approval next year will be a huge catalyst. Of these, the US dollar weakness and commodity upcycle are likely to be long-term tailwinds, indicating a multi-year positive set-up for EM equities, which have strong inverse correlations with these factors.

Supported by robust double-digit earnings growth projected for the next two years, EM equities (gauged by MSCI EM index), in aggregate, are set to deliver a potential upside of 18 percent by end-2022, despite the elevated valuation. We look at the factors contributing to the tailwind, and present our revised estimates on the sectoral earnings in the global emerging markets.

Forces aligning to lift emerging markets

Due to EMs’ sensitivity to global demand (i.e., exports-focus, heavy commodity exposure), a cyclical recovery can significantly uplift growth in these markets. Based on previous crises, we see that EMs typically register a stellar growth rate of above 5 percent after an economic trough. The recent slew of vaccine news spell another positive for EMs. In our opinion, a vaccine approval (unless late in 2021) should amplify the cyclical recovery, setting the stage for a synchronised global demand rebound.

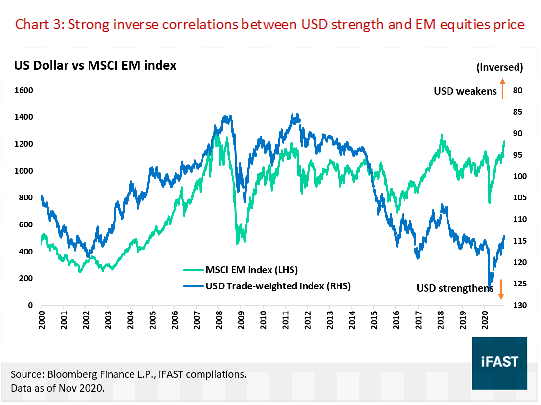

A weaker USD is broadly positive for EM growth as it i) eases stress from USD funding and ii) is supportive for commodities prices. Looking ahead, we see continued dollar weakness, especially against EM currencies. The wide interest rate differentials (especially between EM and the US) and possibly greater ‘money printing’ by the Federal Reserve (to finance more government spending under a Biden administration) are strong near-term headwinds for the greenback.

A structural US current account deficit, coupled with an expected EM economic growth outperformance (USD tends to decline if growth of rest-of-the world outpaces US’), also sets up the prospects for a longer-term dollar weakness vis-à-vis EM currencies. With a possible multi-year dollar down-cycle in the works, we expect stronger and longer-term support for EM equities, backed by strong inverse correlations between the dollar’s strength and EM equity prices across history.

Note: EM countries included in the MSCI EM index include EM countries include: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Pakistan, Peru, Philippines, Poland, Qatar, Russia, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates.

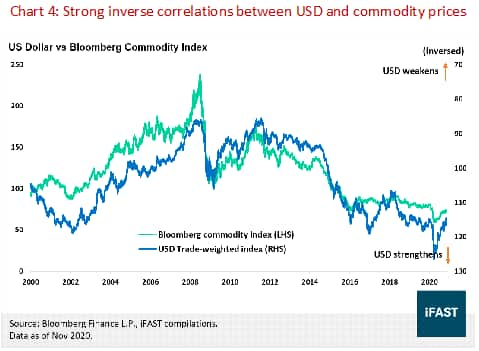

Prolonged years of underinvestment by commodity producers (CAPEX for most commodity sector broadly declined since 2012 despite a brief upturn in 2017) has resulted in delayed supply response. This is evident from a drawdown on commodity inventories (for many sectors) over recent quarters, even as global demand was revitalized.

In our opinion, this is an uncommon occurrence this early in the economic cycle and may lead to a possible supply shortage, considering the potential output cuts planned in 2021 by producers. On the demand side, we expect support to come from strong Asia demand as well as the broader global cyclical recovery.

All things considered, years of weak CAPEX and a burgeoning global cyclical recovery are set pieces for a possible supply-demand mismatch. Coupled with the positive backdrop of a weakening dollar, commodity prices could see further upside in the coming years, acting as tailwinds for EM equities, which historically tend to be uplifted by rising commodity prices.

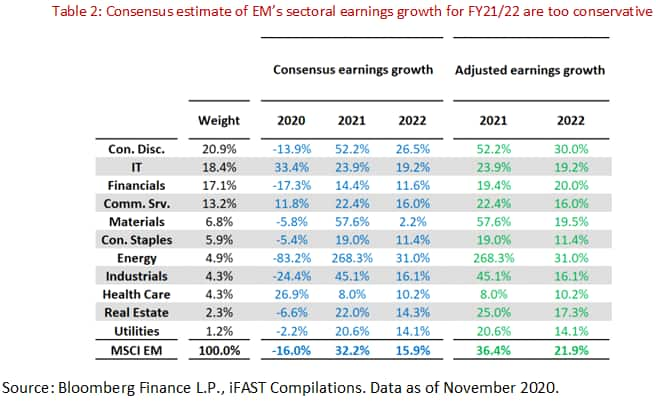

Cyclical sectors to beat conservative earnings estimates

While our EM earnings growth projection for FY20 is closely in line with consensus expectation of 16 percent, our projection for FY21/22’s growth rates differ. Especially at a sectoral level, we believe that the current consensus’ FY21/22 earnings expectation for cyclical sectors (such as Consumer Discretionary, Financials, Real Estate) are too conservative, especially after accounting for historical revisions and comparing against growth rates during previous crises.

We believe the conservative earnings estimates warrant an adjustment, backed by our constructive macro outlook for EM, and we project EM earnings to grow robustly by 36.4 percent (FY21) and 21.9 percent (FY22) from a bottom-up estimate.

Conclusion

Given the conservative estimates by consensus, it is likely that 2021 may see upwards revision in EM earnings estimates. This should provide the impetus for greater price return as markets should react positively to these revisions. While this surge in good news has led to some froth in EM equities’ valuation, elevating the risk of de-rating in the near term, we believe many will view a de-rating as a dip-buying opportunity, given the mounting risk-on appetite for EM equities.

The true cautionary note for this outlook is the pandemic, since a severe resurgence in cases, be they within EMs or DMs, will spell bad news for a cyclical recovery and a delay in vaccine approval in this scenario could magnify the impact. Nevertheless, given the uncertainty in COVID-19 cases, it is hard to ascertain the likelihood of the above scenario and thus, does not derail our outlook for EMs significantly.

(The writers are Senior Analysts at iFast Research, Singapore)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.