06 January, 2025 | 12:32 IST

Applying for personal loans has become quite convenient these days with the advent of the digital platform and online lending apps. While it’s easy to apply for a personal loan, getting approval could be a tough task. And here one factor is your key to success— your credit score.

Your credit score plays a significant role in determining your eligibility for various financial products, including personal loans, and it can be affected by how you manage your loans. Ironically, availing a personal loan or applying for it could also temporarily impact your credit score.

Table of Contents

A credit score is a number that indicates your creditworthiness to potential lenders. It ranges between 300 and 900, with higher scores over the long-term representing better financial behaviour. A score above 750 is considered excellent and it can help you secure a personal loan at favourable interest rates.

For those considering a personal loan, the credit score plays an important role in determining eligibility and the interest rate offered. Lenders often run a credit score check before approving a loan, and they prefer applicants with a higher score because it indicates a lower risk of default.

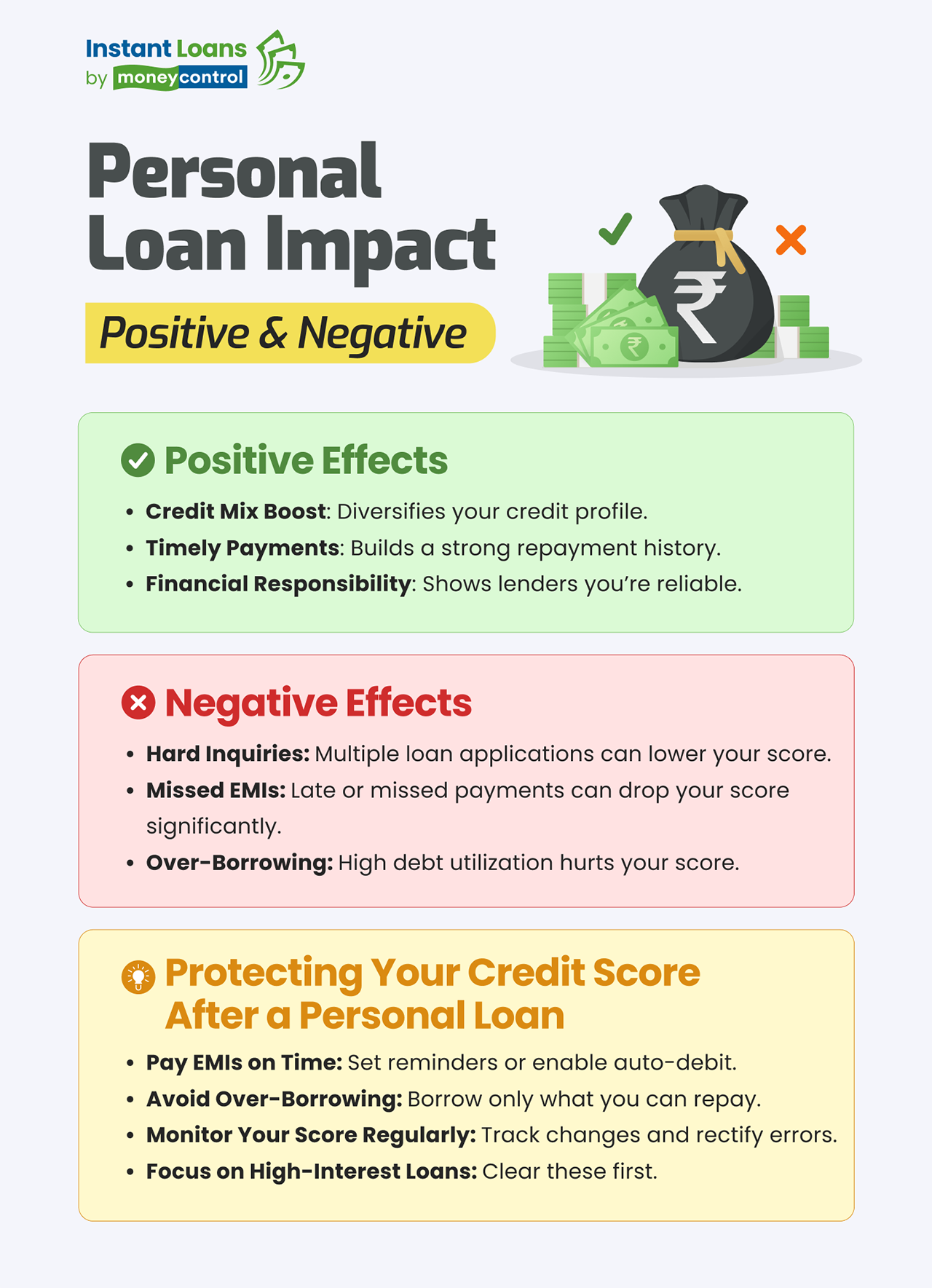

Your credit score can be impacted both positively and negatively when you take a personal loan. Here’s how:

Maintaining a healthy credit score after taking a personal loan is essential. Here are a few ways in which you can do it:

ALSO READ: What Affects Your Credit Score & How To Build a Healthy Credit Score

Defaulting on a personal loan will lead to a negative impact on your credit score, and the longer the default, the harder it becomes to restore a healthy credit score. The lender may also escalate the matter, leading to legal complications and debt recovery actions. Your credit history will show defaults, making it challenging to get approved for future loans or credit cards. Even if lenders do approve your applications, you will likely be offered loans at a much higher interest rate, reflecting the perceived risk.

Personal loans are unsecured, meaning they come with relatively higher interest rates compared to secured loans like home loans or auto loans. So, it is important to balance your personal loan with other financial commitments such as existing loans, credit card payments, and regular monthly expenses. Failing to manage these expenses can lead to high debt-to-income ratio, which will further reduce your credit score.

Moneycontrol offers flexibility by providing both personal and business loans depending on your employment status. What makes Moneycontrol stand out is its easy, three-step process to get a loan — enter your details, complete KYC and set up EMIs. Within minutes, you can have the funds transferred to your bank account.

In conclusion, a personal loan can either enhance or damage your credit score, depending on how responsibly you manage the loan. By making timely payments, avoiding over-borrowing and regularly checking your credit score, you can protect and improve your credit score.

Share it in your circle

Table of Contents

Explore Top Lenders for Instant Loan upto

Get Instant Loan up to ₹50 Lakhs with Zero Paperwork from Top Lenders

100% Digital

100% Digital Quick Disbursal

Quick Disbursal Low Interest Rates

Low Interest Rates