The fund options offered by the National Pension Scheme (NPS) under the Tier – I account of the ‘all citizen model’ have a proven track record for more than 15 years.

Scheme–G and Scheme–C, the debt funds that invest mainly in government securities and corporate bonds respectively have delivered higher returns since inception and outperformed not only their benchmarks but also their mutual fund counterparts.

NPS is a defined contribution pension scheme, which was first introduced for Central and State Government employees on January 1, 2004. Thereafter, it was extended to all Indian citizens from May 1, 2009. It allows investors to accumulate a corpus during their working life for their retirement.

Comprehensive investment solutions

Under the Tier – I account of the ‘all citizen model’, the NPS provides four asset classes --Scheme–E for equity, Scheme–C for corporate bonds, Scheme–G for government securities and Scheme–A for alternative investments. Investors are required to invest in these schemes in the prescribed proportion as suggested by the pension fund regulator.

Also see: How ‘bucket strategy’ can ensure regular income after retirement, while protecting nest egg

Scheme-C and Scheme-G, two debt-oriented asset classes have delivered comparatively better returns while taking less risk. This has made them attractive choices for investors with a low risk profile.

Both the asset classes have generated better returns over the long run - say 5, 7, 10 and 15 years and beat their benchmarks and mutual funds counter parts comfortably.

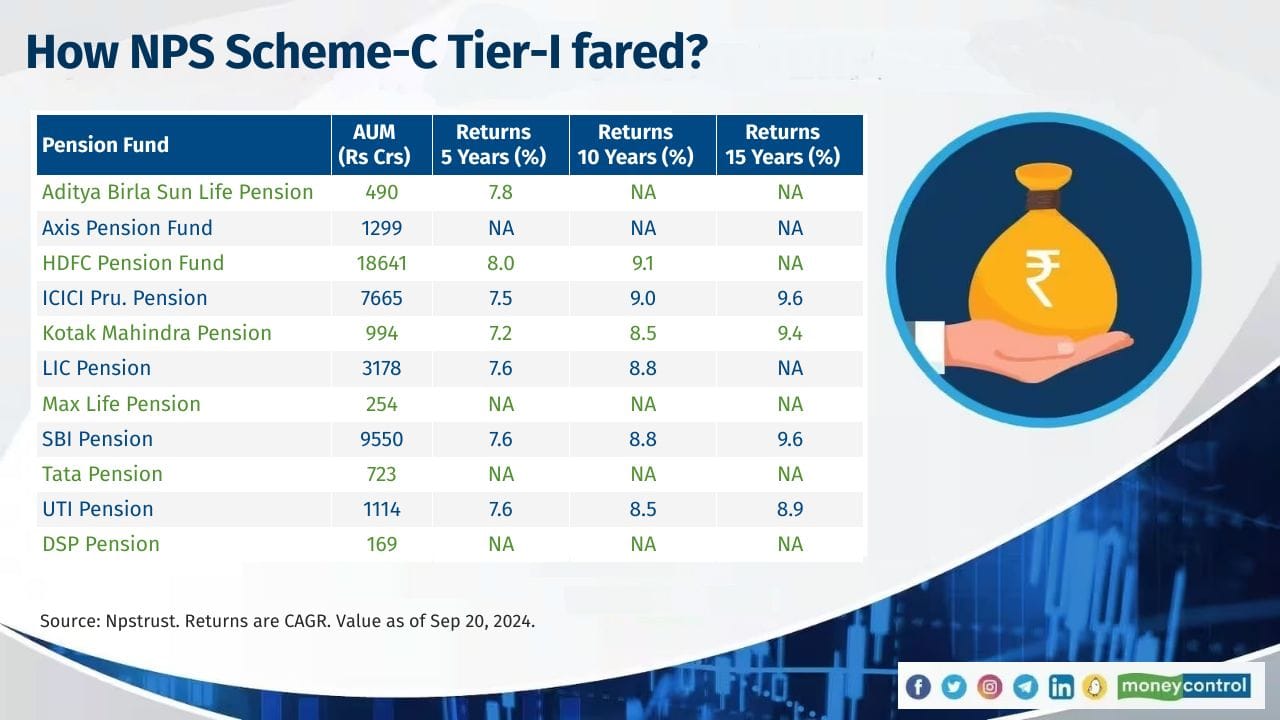

Currently, 11 pension managers manage the corpus of the NPS. Of these, four pension funds have a track record of more than 15 years.

See here: How to choose the right annuity plan in NPS?

For instance, over the last 15 years, Scheme-C managed by four pension managers have delivered an average return (compounded annually) of 9.4 percent, which is greater than the 7.4 percent average return of corporate bond funds managed by mutual funds.

Similarly, the average return of Scheme-G is 8.8 percent for the past 15 years, higher than the average return of gilt funds managed by mutual funds, which is 7.5 percent.

Corporate debt schemes (Scheme–C)

All the four corporate debt schemes managed by these pension funds outperformed the category average of corporate bond funds managed by the mutual funds for the 15-year timeframe. SBI pension and ICICI Prudential pension topped the chart. These funds invest primarily in the top rated debentures issued by public and private sector enterprises. Allocation to bonds rated below AA- is almost nil. Many of these funds are aggressive on taking duration calls while a few of them are less aggressive. For instance, the portfolio Modified Duration of SBI pension as of August 2024 was 5.2 years (4.6 years same period last year) while the UTI pension was 6.9 years (4.3 years last year).

See here: No new sovereign gold bonds? Check out the most liquid ones on the NSE

Government bond schemes (Scheme–G)

Government bond schemes (Scheme–G) offered by pension managers delivered better returns and comfortably outperformed the gilt category of the mutual funds. SBI pension and Kotak pension were the top performers. These schemes mainly invest in government securities and state development loans. As per the latest data, the portfolios of a few of them are aggressive on taking duration calls.

For instance, the portfolio Modified Duration of these schemes managed by SBI pension as of August 2024 was 9.9 years (7.6 years last year) and UTI pension was 9.1 years (7.3 years last year).

Also see: Should retirees invest in tax-free bonds in secondary markets?

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.