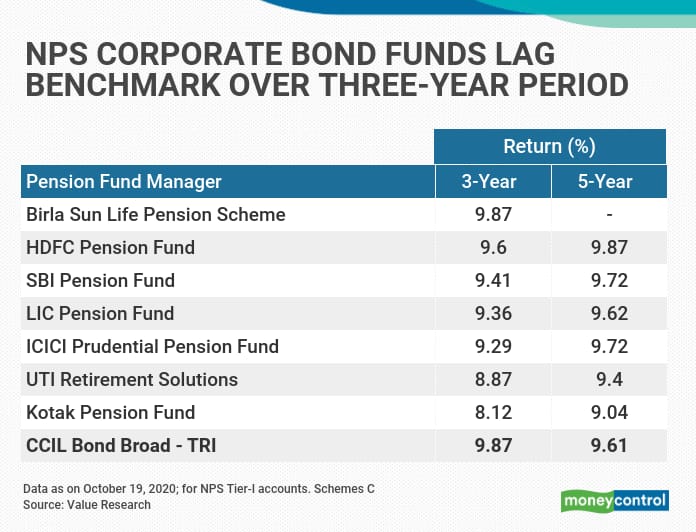

Most National Pension System (NPS) corporate bond funds underperformed the benchmark – CCIL Bond Broad TRI (total returns index) – over a period of three years.

However, all pension fund managers’ Scheme C funds have improved their performance over the last three weeks, according to data from Value Research. Birla Sun Life Pension Scheme was the top performer in this category with 9.87 per cent returns, at par with the benchmark, as per data as on October 19, 2020. Kotak Pension Fund found itself at the bottom of the list with 8.12 per cent.

The data pertains to regular, NPS Tier-I accounts that are maintained with the long-term goal of saving for retirement, with the subscribers’ age at vesting – or maturity – being 60 years. Withdrawals in between are generally not encouraged, except for specific reasons.

Doing better than mutual funds

Though the scheme C funds of NPS managers didn’t beat the benchmark, they have comfortably overtaken their mutual fund peers. Corporate bond mutual funds category delivered 7.51 per cent over three years. The five-year return of the category was 7.74 per cent.

Clearly NPS corporate bond funds outperformed MFs convincingly, by as much as two percentage points in some cases. The lower costs charged by NPS fund managers compared to mutual fund may be an added advantage.

Scheme C pension funds’ performance in the five-year category is relatively better vis-à-vis the benchmark. The pension funds yielded returns between 9.04 per cent and 9.87 per cent. Four out of six pension funds that have at least a five-year track record managed to beat the benchmark CCIL Bond Broad TRI, which recorded 9.61 per cent returns during the period. HDFC Pension Fund topped the list with 9.87 per cent returns, while SBI Pension Fund and ICICI Prudential Pension Fund jointly shared the second spot with 9.72 per cent returns. Kotak Pension Fund brought up the rear with 9.04 per cent.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.