Recently, an asset management company (AMC) reduced the expense ratio—the proportion of fund assets to the outgo on administrative and other costs—of its index fund based on the Nifty500 by almost 60 percent. This got many fans of passive investing a bit excited and once again brought the topic of choice of indexing back into discussion.

Given the number of choices that passive funds have started offering these days, it has definitely become a little confusing for many to choose one.

In this article, we will try to see which is a better choice between the Nifty50, Nifty100 and Nity500 for indexing.

How do Nifty indexes differ?

The Nifty50 is made up of the top 50 stocks by market capitalisation listed on the National Stock Exchange (NSE), while the Nifty100 contains the top 100 stocks by market cap. Logically, a combination of the Nifty50 and Next50 would seem like the optimal equation to arrive at the Nifty100, but that is not so. Do read the explainer at Nifty50 + Next50 is Not Same As Nifty100 and you will realise why investing in the Nifty100 alone is very different from investing in the Nifty50 and the Nifty Next50 separately.

The Nifty500 comprises the top 500 stocks by market cap. That is, it has stocks from the Nifty100 + Nifty Midcap150 + Nifty Smallcap 250.

Overlaps Between Nifty50 / Nifty100 / Nifty500

Once you look under the hood of all these indices, things get interesting. Here are a few observations from the latest data:

But does this mean it’s really true diversification?

I have my doubts. Why? Because the top 50 of the 500 stocks in the index have close to 60-61 percent weight. Also, large-cap stocks form about 73 percent of the index by weight.

So, all said and done, the Nifty500 like many other indices is a top-heavy, large-cap-oriented index. And even the factsheet about the index available on the NSE website states that the Nifty500 has a very high correlation of 0.95 (over the last one year) and a huge 0.99 (over the last five years) with the Nifty50 (as of the end of April 2024).

So, both the Nifty50 and Nifty500 tend to provide quite similar returns.

In fact, given the data about the large-cap heaviness of the index, it seems more like a case of overdiversification when it comes to the Nifty500. When you have 500 companies, with the bottom 450 stocks having just 27 percent weightage, there may be hundreds of companies that will not contribute significantly to returns even if they do very well.

Nifty500 fans will not like me for this, but I am not very sure if there is any meaningful value-add that one gets here (compared to the Nifty50) by adding an additional 450 stocks to the stocks already available in the Nifty50. Of course, there is a case to say that the Nifty500 is better than the Nifty50 when it comes to diversification and risk management.

Returns of Nifty50 vs Nifty500

I have also noticed that many people nowadays claim that the Nifty500 has delivered better returns over the last few years and, hence, it has an upper hand. Can’t say that is wrong but some context will be useful.

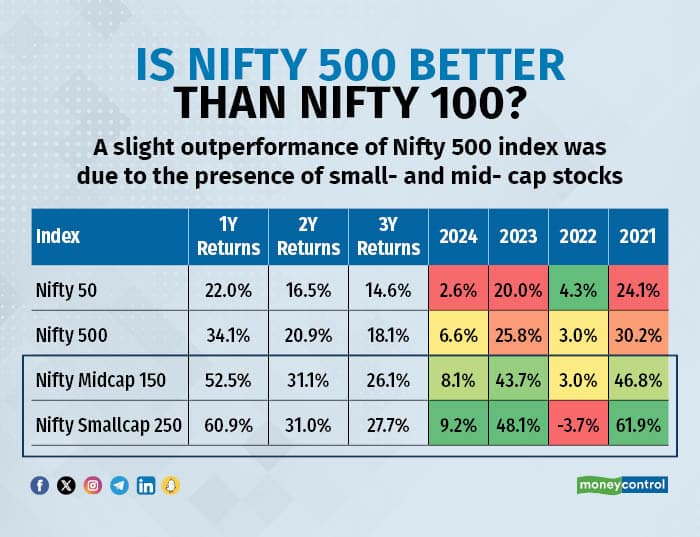

Have a look at the returns comparison of these two indices over the last 1/2/3 years:

As is clear, the Nifty500 has been doing quite well over the last three years. But why is that so? The last few years have been phenomenal for mid-caps and small-caps (take a look at the table below). And since the Nifty500 has some allocation (about 27 percent currently) to mid- and small-caps, this has played its part in pushing up the returns of the index ahead of the Nifty50.

So in bull runs that often see mid- and small-caps taking a lead over their large-cap peers, the Nifty500 (with its small but non-negligible allocation to mid-/small-caps) tends to do well. And this is exactly what has happened over the last few years as the Nifty500 has done better than the Nifty50.

But in times of larger declines and crashes, the Nifty50 will fall much less due to no allocation to non-large-caps. And if large-caps do better than others, the Nifty500 will tend to lag pure large-cap indices like the Nifty50/100 in such periods. So don’t expect the Nifty500 to consistently beat the Nifty50.

Also read | Best mutual funds: 86% of actively-managed schemes outperformed benchmarks in MC30’s 2023 run

Conclusion

For large-cap exposure, a passive strategy is the way to go. And in that, the Nifty50 is a sufficiently good option. One can also consider adding the Nifty Next50 separately to the mix. And if you were to ask me, you can comfortably skip the Nifty500 as well due to the reasons we discussed earlier. Or for rather lacking any strong reasons in favour of the Nifty500.

With the Nifty50 + Nifty Next 50 taking care of large-cap allocation, one can go for active funds for mid- and small-cap allocation. I believe that while going purely passive isn’t wrong, having a proper mix of active and passive funds helps build a more robust and risk-return-optimised market cap-diversified mutual fund portfolio.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.