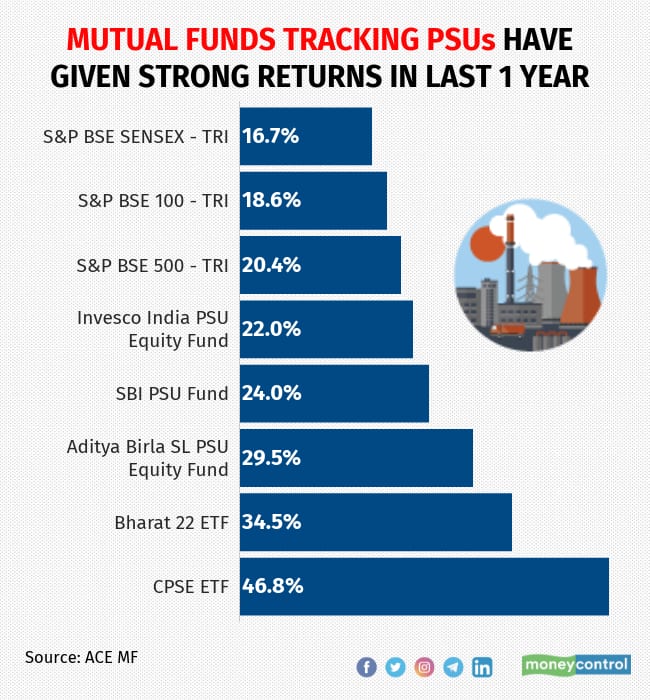

Mutual funds (MFs) that invest in stocks of government-owned public sector units (PSUs) have delivered strong performance in the last one year, beating major stock market indices.

These funds have given average returns of 31 percent, while market indices – S&P BSE Sensex, S&P BSE 100 and S&P BSE 500 – have given returns of 16-20 percent.

Experts say a combination of cheap valuations and signs of economic recovery has pushed up the prices of PSU stocks. In year-to-date, the S&P BSE PSU Index has given returns of seven percent, while S&P BSE Sensex, S&P BSE 100 and S&P BSE 500 have all given flat returns.

“The broad assumption is that over next three-five years we will see an economic recovery and when that happens, almost all sectors tend to see growth. When the growth is broad-based, market preference shifts towards stocks and sectors where the valuations are cheap,” says Arun Kumar, head of research, FundsIndia.com

In the past, PSU stocks have underperformed, which is why their valuations have remained on the lower side.

Between 2017 and 2020, the S&P BSE PSU Index has declined by about 50 percent.

Pankaj Pandey, head-research at ICICI Direct, points out that PSUs are largely in three sectors – commodities, banks and defence – and these sectors are seeing improvement.

“The PSU banks were among the most impacted due to the NPA issues. But, these issues now seem to be behind us. Commodity prices are elevated because of geo-political reasons, as well as the overall economic recovery. The outlook on defence sector has improved as government is looking at more indigenisation of defence manufacturing,” Pandey says.

Gas prices, as well as crude oil prices, have risen sharply on the back of Russia-Ukraine crisis. In year-to-date, the Brent crude oil prices is up 34 percent, at $104 per barrel.

Government’s decision to focus on strategic disinvestments, rather than divesting their holdings through offer-for-sale has also benefitted PSU stocks.

The possibility of OFS issue used to keep prices of PSU stocks under pressure. An OFS issue meant fresh supply of PSU shares in the open market as government looked to raise funds by selling these holdings.

Also, as these OFS came in at a discount to prevailing market prices, investors would buy and then sell shares immediately post-OFS for quick gains. This would also impact stock prices.

Large businessesWithin their respective sectors, PSUs usually have large market share and in some cases even a monopoly.

But at the same time, experts say when it comes to PSUs, there are usually concerns on how government’s policy actions would impact PSUs’ stock prices.

“Despite their strong market presence, PSUs trade at cheaper valuations. This is due to market perception around PSUs,” says Nirav Karkera, head of research at Fisdom.

However, he adds that these cheaper valuations offer stock- and sector-specific opportunities in PSUs from time to time, which is where the PSU funds can come in.

“PSU funds now have more sectors to choose from as new PSUs have got listed on the exchanges. There is an asset management company, as well as an insurance company listed now,” he says.

What should investors do?Largely PSUs operate in cyclical sectors, which can go through periods of strong earnings growth as well as contraction, depending upon the cycle the business is in.

So, timing of entry and exit becomes all the more important in PSU investments.

“It is not possible for investors to get the timing always right. It also requires deep understanding of different sectors, their business cycles and how government policies can impact these sectors,” says Rushabh Desai, founder of Rupee With Rushabh Investment Services.

“PSU funds can be part of tactical allocation for investors, but only if the investors understand the PSU space and the sectors very well,” he adds.

PSU funds are theme-based funds, which can go through periods of high volatility. Such funds can be avoided as core investments for long-term financial planning. Savvy investors can consider them for short-term tactical investments.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.