The markets hit an all-time high early in the previous week. Should we continue to remain invested in equity or consider booking some profits? This is a question which often pops up in this phase of the market.

The nature of the market is to make new highs and it will continue to do so, buoyed by earnings growth of the underlying companies. So, the question is not about new highs, but how fast it is climbing and is it running ahead of fundamentals or not. Further, we remain strong proponents of asset allocation and not putting all investments in any one asset class.

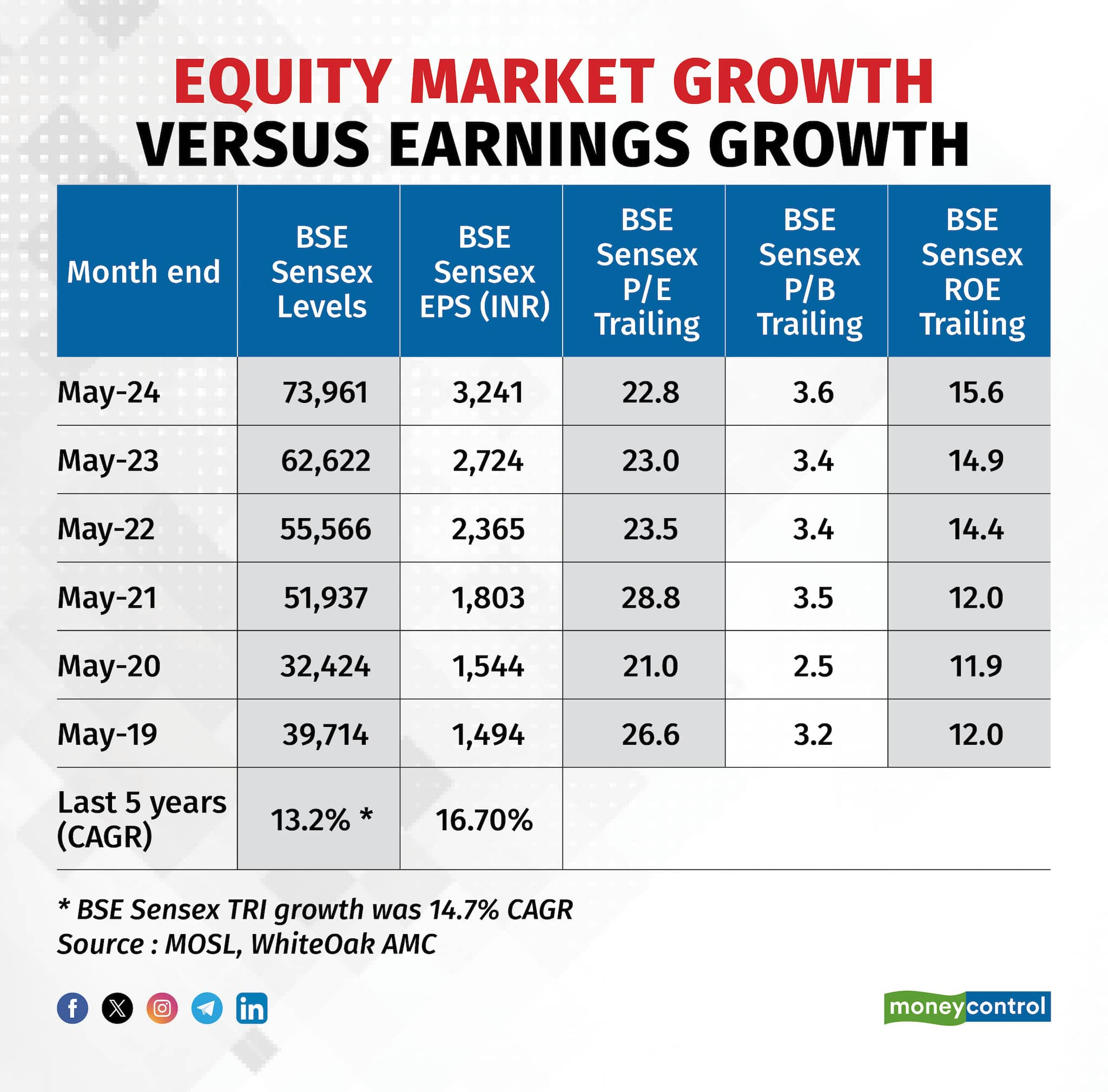

If we track the growth of the equity market over the last five years, some of the data draws our attention.

In short, the earnings of the underlying companies in the BSE Sensex (which are representative of the market) have been growing faster than their stock prices. We would add that past performance may not be sustained in future and is not a guarantee of future returns. Having said that, there seems to be no indication that the market has run ahead of itself.

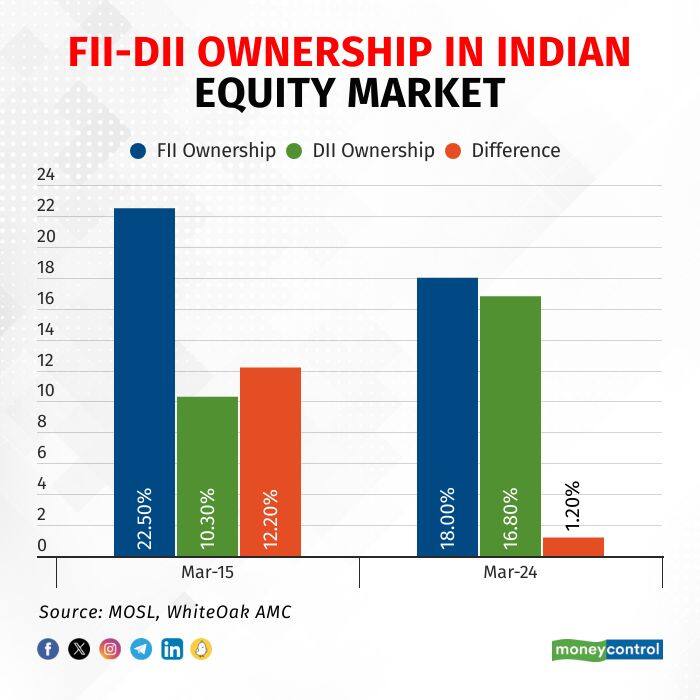

Let's take an additional data point on FII /DII ownership in the Indian equity market.

This indicates that the gap in ownership has significantly narrowed, leading to far less dependency on any one source of funds taking a divergent call. Therefore, the market has been very resilient despite FII flows being significantly net negative in the last few quarters (barring some short-term reversals). A big source of DII inflows has been a steady SIP book, which has now grown to Rs 20,000+ crore a month (on a gross basis), and is expected to sustain. If we look at May data alone, we saw Rs 42,000 crore of FII selling vs Rs 56,000 crore of DII buying.

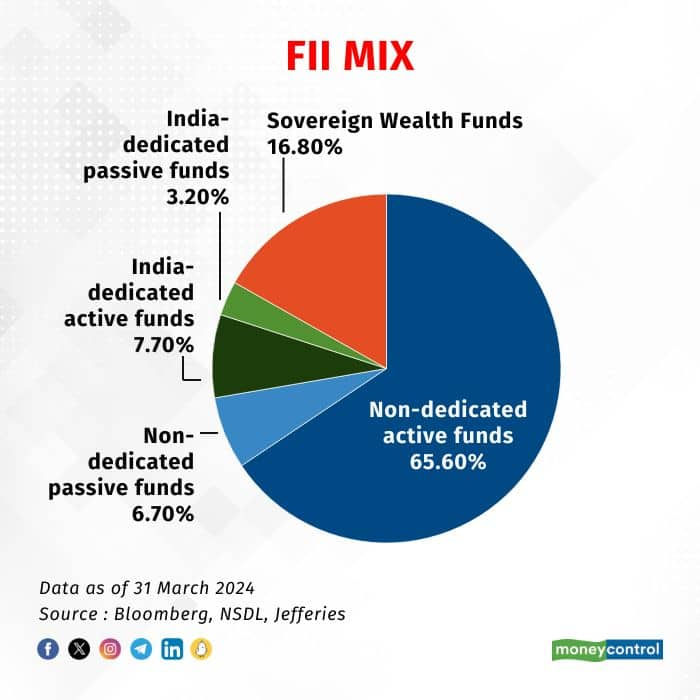

Further, the composition of FII ownership is changing. The latest mix, as of March 31, 2024, is as below:

The pool will continue to get diversified as we progress. Some of the funds (for instance, sovereign wealth funds) are much longer term in their investment horizon. Also, India's increasing weightage in global and emerging market indices (e.g., the MSCI Emerging Market Index, where its weightage has grown to 18.1 percent as of 31 March 2024) will further help FII inflows over time.

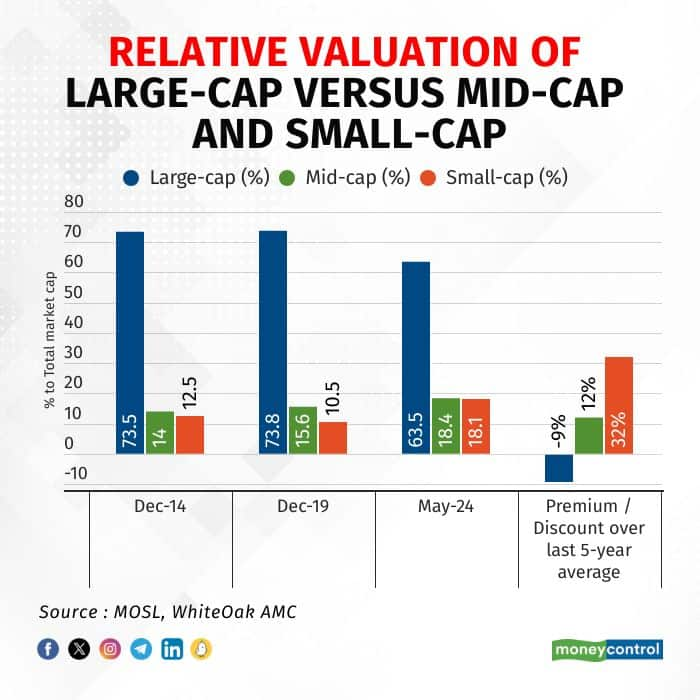

The market's breadth has also increased over the years. This indicates that smallcaps may have become relatively overvalued and largecaps relatively undervalued compared to long term averages, and that largecaps may be safer than other parts of the market.

RisksAccording to a Morgan Stanley research report dated June 5, among the risks India faces are capacity constraints in bureaucracy, the judiciary, healthcare, education, and skills training. Other risks include geopolitics, the effects of artificial intelligence on the tech industry, low farm productivity, climate change, and lack of adequate farm reforms.

Thus, while it does appear that some pockets of market are expensive, other parts of the market are not, and if growth can be sustained (with rural demand likely to go up because of a favourable monsoon, and a growth-oriented budget in July) we could still expect equity to be the best asset class in a three to five-year horizon.

However, it is important that we invest in equity as per our risk appetite, preferred asset allocation, and if the investment horizon is long and aligned to our goals. For one cannot rule out higher-than-normal volatility in the next few months.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.