Step-up SIP, also popularly known as top-up SIP, is an automated facility through which SIP contribution can be increased by a predetermined fixed amount, or a fixed percentage, at periodic intervals in line with your financial goals and level of income.

"The investor has to opt for this facility - increasing amount/percentage and intervals - right at the time of enrolling for the SIP," said Manish Kothari, Director of Mutual Funds, Paisabazaar.com.

The periodic intervals can be quarterly, half-yearly, or annual.

"Few AMCs still don't have an option of automatically increasing the SIP amount, so you have to manually make a transaction of increasing the SIP amount," said Gajendra Kothari, MD & CEO, Etica Wealth Management.

Difference between Conventional SIP and Step-up SIPConventional SIPs do not allow investors to increase their contribution during their SIP tenure. The only alternative is to start a fresh SIP or make lump-sum investments.

If you do not have financial discipline, you will not increase the amount of SIP though your income rises. That is where step-up SIPs come into the picture.

"Step-up SIPs allows investors to automate their SIP contribution and increases in sync with their expected growth of income. With automated incremental investing, SIP investors can derive greater benefit from the power of compounding and thereby reach their financial goals sooner," said Manish Kothari.

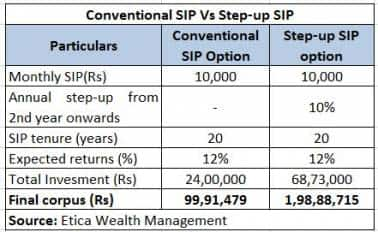

IllustrationAn investor named Raman starts a conventional SIP of Rs 10,000 and another one named Mohan starts a step-up SIP with the same amount, increasing investment by 10 percent a year from the second year onward for 20 years.

At the end of an investment term, the total corpus built by Raman will be Rs 99.91 lakh, which is barely half of the Rs 1.98 crore accumulated by Mohan (refer to table).

"Step-up SIP is especially beneficial for those who lack sufficient surplus to invest for their financial goals. With this option, they can start SIPs with lower contribution and then gradually increase their investments along with their increasing income," said Manish Kothari.

It is also beneficial for those who lack the financial discipline to increase their investments with growing income.

Benefit of step-up SIP: Built-up corpus takes care of rising inflation"An investor needs to step up any investment on the fact that the value of money is eroding with time due to rising inflation," said Gajendra Kothari.

In the last 20 years, the average rate of inflation has been 6.54 percent. The value of currency erodes with time.

"If you invest Rs 3,000 a month, it would be the same as investing Rs 10,500 in 20 years. So, an investment target that seems worthwhile today, say Rs 1 crore by 2037, might actually become Rs 3.5 crore by the time you get there, assuming the same inflation rate of 6.54 percent per annum," said Navin Chandani, CBDO, BankBazaar.com.

So, stepping up your investment every year can help you create more wealth.

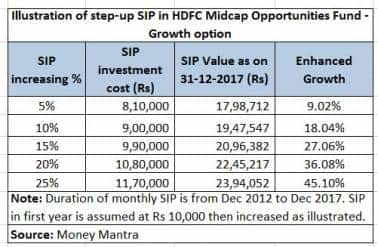

Challenges in step-up SIP:The illustration in the table below should persuade you to increase monthly SIP investments every year into mutual fund schemes you are holding, as per your goals and rise in income.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.