Parents prefer giving the best education to their children despite rising costs. They start investing early for a child’s bright future and education goals.

Several asset management companies have exclusive mutual fund schemes to invest for your child’s future goals such as foreign education, marriage among other things.

Children’s gift funds are solution-oriented schemes. They can be categorised as hybrid funds which invest in equity and debt instruments. They are particularly helpful for those investors who wish to create a children's education corpus through mutual funds but lack the skills required for taking decisions regarding fund selection, asset allocation, and portfolio re-balancing.

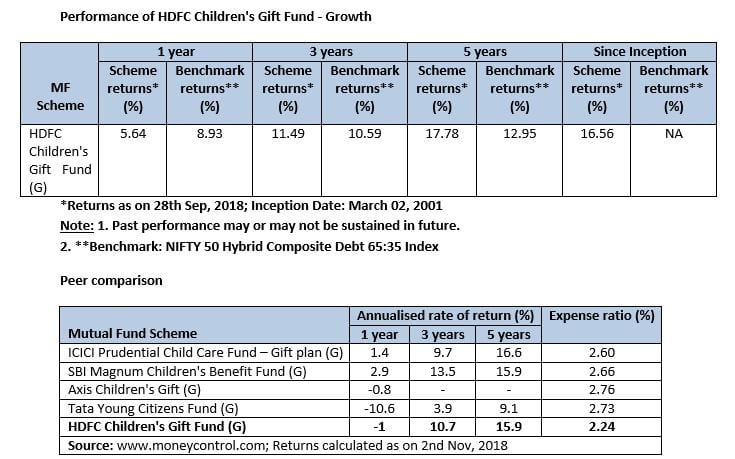

On that note, let’s study HDFC Children's Gift Fund, which has been through and has been tested in tough times well over the decade. This fund is a consistent performer in child plans compared to peers.

About the scheme

HDFC Children's Gift Fund was launched on 2nd March, 2001. The AUM of the scheme as on October 31, 2018 is Rs 2,326 Crore. This is an open-ended fund for investment for children having a lock-in for at least five years or till the child attains the age of majority (whichever is earlier).

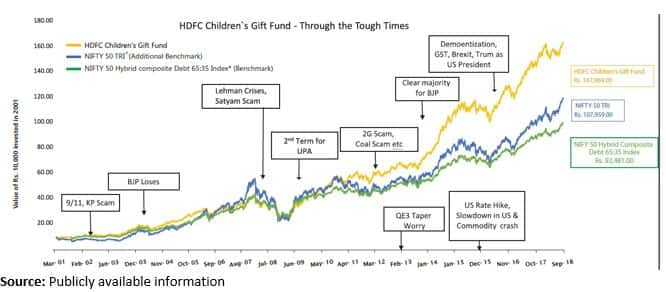

HDFC Children’s Gift Fund has seen various slump events over the decade but it has given strong returns if somebody remained invested from 2001 till date which is well represented in the below image:

Data as on 30th September, 2018

^The performance of the Scheme is benchmarked to the Total Return Index (TRI) Variant of the Indices (Equity Assets).

*NIFTY 50 Hybrid Composite Debt 65:35 Index is available from September 01, 2001

Note - All values have been rebased to Rs 10 from Sep 3, 2001 i.e. the inception date of NIFTY 50 Hybrid composite Debt 65:35 Index

Fund Manager

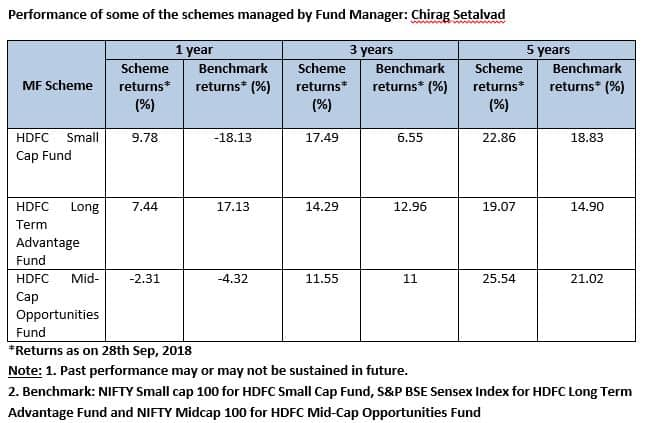

Chirag Setalvad is a fund manager who manages several schemes at HDFC Mutual Fund besides Children’s Gift Fund. Some of these schemes are HDFC Long Term Advantage, HDFC Hybrid Equity Fund, HDFC Multi-Asset Fund, HDFC MidCap Opportunities, HDFC smallcap fund etc.

Portfolio composition

Jeevan Kumar KC, Head- Investment Advisory at Geojit Financial Services points out, “Both equity and debt part of the portfolio is kept on a conservative front in terms of stock selection, maturity and credit rating.”

This gives one notch of benefit over other schemes in terms of performance during tough times in the market. So, the downside protection would be better in this scheme compared to peers.

The fund has allocated 65.42% of the total corpus to equity, 17.06% to debt, and 17.5% to cash as on September 29th, 2018.

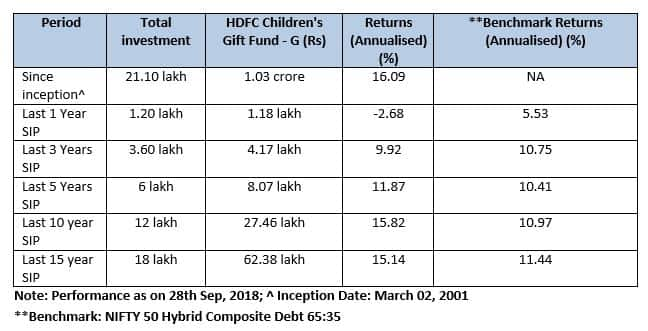

Growth in the invested amount

An SIP of Rs 10,000 since inception invested systematically on the first business day of every month Vs Benchmark

Should you invest in solution-oriented (children’s fund)?

If we associate the funds to any of our sacred life goals, then it becomes an indispensable obligation and solution-oriented schemes come into existence. Though the portfolio construction of a solution-oriented scheme is not so different from other aggressive hybrid schemes, the objective stands strong with the former. Kumar says, “Also due to the lock-in nature, the fund manager gains more control over the portfolio which is one great advantage in these schemes.”

Risks of investing in this scheme

The risk factors inherent in these schemes stay almost similar to other comparable products. Kumar advises, “One should have a long-term view while investing in this product to extract the best results out of the investment.”

Both equity, as well as debt part of the portfolio, attracts risks in its own way and investor should learn the basic characteristic and behavior pattern of returns before investing.

One should exit the scheme as soon as the corpus objective is met. The corpus could then be parked in any capital protected scheme till the goal date.

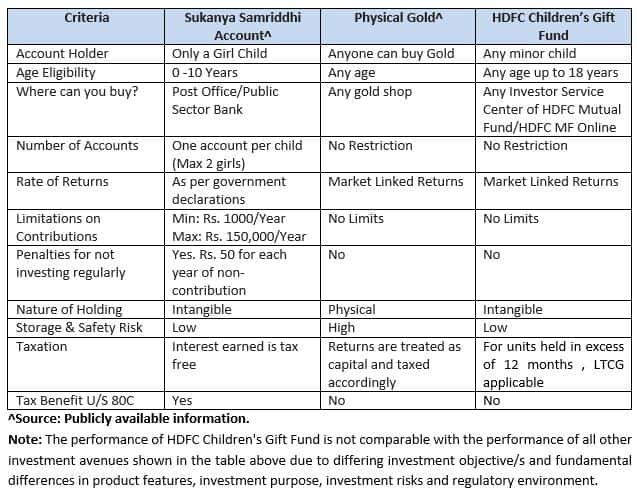

Comparative analysis of HDFC Children’s Gift Fund vis-a-vis others

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.