The merger of Housing Development Finance Corporation (HDFC) – the housing finance behemoth and holding company of many HDFC group companies in banking, insurance and other financial services, with HDFC Bank may make many mutual fund managers revisit their portfolios.

If the two companies’ current weights in the Nifty 50 Index are anything to go by, the combined entity’s weight in the Nifty 50 Index may be over 10 percent. The merger should get finalised in the next 15-18 months. As diversified mutual fund schemes are not permitted to invest more than 10 percent in individual stocks, this can put active fund managers in a situation where they find it difficult to beat the market benchmark Nifty 50.

As of March 31, 2022, HDFC Bank and HDFC have 8.43 percent and 5.66 percent weight respectively in the Nifty 50 Index, which, when combined, works out to 14.09 percent.

“Based on the current market cap, the weight of the merged HDFC Bank in the Nifty 50 Index would be broadly equal to a simple sum total of the two individual companies -- approximately 14 percent,” said Anil Ghelani, Head of Passive Investments & Products, DSP Mutual Fund. “HDFC Bank has only about 79 percent free float market cap currently, which will increase to 100 percent after the merger. So, that will result in a large incremental amount. But against that the shares held by HDFC will get cancelled. Hence, the merged company would have a weight in the Index which would be broadly similar to the sum total of the two individual companies,” he added.

If a stock with more than 10 percent weight in the major indices outperforms, active fund managers find it difficult to beat the benchmark as they have a cap of 10 percent. Something like this happened back in 2020, as Reliance Industries’ weight in Nifty 50 rose to a record high of 14 percent.

Fund managers’ favouritesFund managers are positive on the merger and say this move should benefit the new entity - HDFC Bank - in the long-run. "Post-merger the new entity should see lower credit costs and lower operating costs, which is what HDFC Ltd. will bring in. On the other hand, there will be some impact on margins, as cash reserve ratio, statutory liquidity requirement will be applicable on the overall capital base of the new entity," said a fund manager, requesting anonymity. He added that post-merger, HDFC Bank will have a large economies of scale.

As on February 28, 2022, 454 mutual fund schemes held shares of HDFC Bank worth Rs 1.01 lakh crore, accounting for 5.35 percent of the overall equity assets of the mutual fund industry. As many as 328 mutual fund schemes own the shares of HDFC worth Rs 45,403 crore, accounting for 2.39 percent of the overall equity assets of the mutual fund industry, as per ACE MF data. Put together, around Rs 1.46 lakh crore worth of mutual fund investments are riding on HDFC Bank and HDFC.

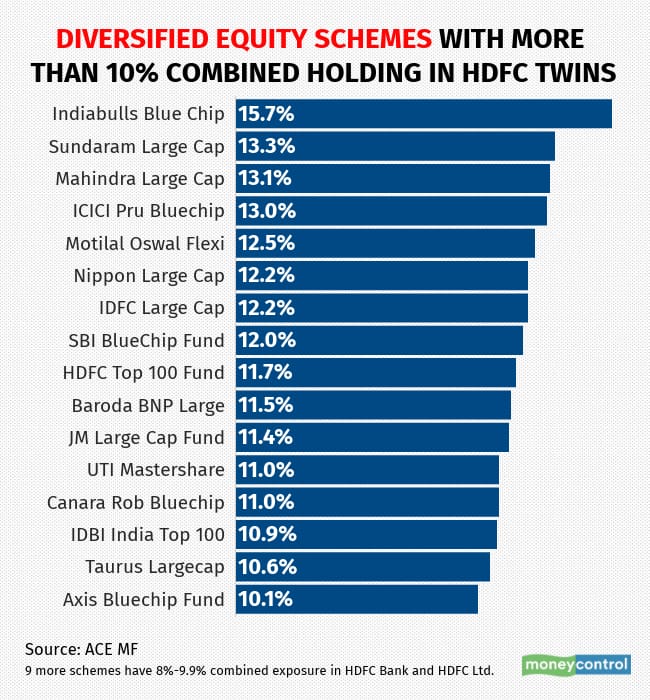

There are 16 equity schemes with more than 10 percent combined allocation to the HDFC twins.

“Earlier the asset managers had the opportunity to hold two jewels in the financial services industry, but post-merger they will be constrained to hold only one and that too, within the regulatory limits which will reduce the ability of the fund managers to take exposure in the combined entity,” said Umesh Kumar Mehta, Chief Executive Officer, Samco Mutual Fund.

“This merger will lead to (the formation of) a financial services company with a large balance sheet and operational efficiencies. This is value-accretive for shareholders,” said a second fund manager on condition of anonymity as he is not allowed to comment on individual stocks. “However, one must watch out for more restructuring in the group in the form of changes in stakes in some of the subsidiaries,” he added.

“The situation may change by the time the merger gets approved by all regulators and the two companies merge. The resultant entity and its weight in the index may change accordingly and also the relative attractiveness for the fund managers,” said third fund manager, again, on condition of anonymity.

The proposed merger prescribes issuing shareholders of HDFC as on record date, 42 shares of HDFC Bank of face value Re 1 each for 25 shares of HDFC of face value of Rs 2 each held. HDFC will own 41 percent of HDFC Bank - the resultant entity.

Active fund managers will act only when there is adequate clarity on the future of the merged entity, changes in the benchmark indices and relative attractiveness of investment opportunities in the market. However, passive funds can keep mimicking the underlying index and adjust their allocations as and when the new entity is included in the index.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.