Active stock-market investors looking to make a bit more from the idle money kept in the broker’s trading account can consider liquid ETFs (exchange-traded funds) as an option.

It’s a common strategy among direct equity investors and even traders to take profits off the table consistently. But many of us tend to keep our profits in our savings bank account. A better alternative is the liquid ETF. These ETFs are listed and traded in the cash segment of the NSE and the BSE. You can buy and sell the units during market hours on working days.

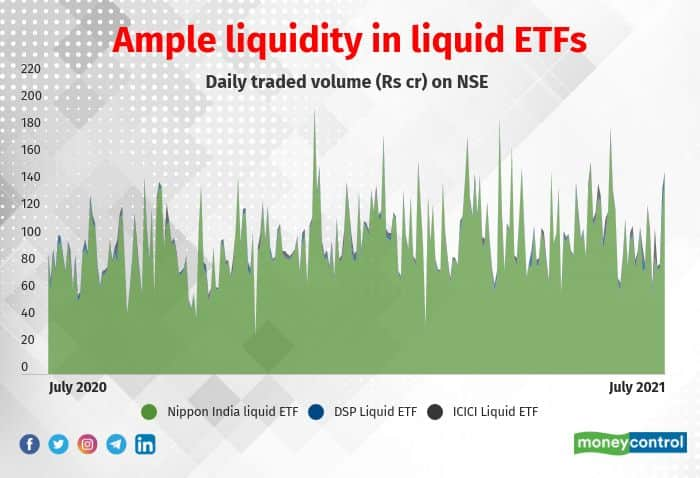

Three liquid ETFs – Nippon India ETF Liquid BEES (NSE symbol: LIQUIDBEES), DSP Liquid ETF (LIQUIDETF) and ICICI Prudential Liquid ETF (ICICILIQ) – are available currently. LIQUID BeES are the oldest and most actively traded in India, with a strong track record since July 2003. The Liquid ETFs of ICICI Prudential and DSP have a short history of around three years.

Efficient cash management tool

Liquid ETFs are passively managed debt mutual funds tracking the overnight rate as the benchmark. These funds are designed to provide you low-risk returns and high liquidity. “Liquid ETFs are convenient avenues for parking surplus funds in your account. You can pledge them any time and take a trade,” says Hemen Bhatia, Deputy Head-ETF, Nippon Life India AMC.

Investors gain two-fold benefits by investing in liquid ETFs. One, when an investor sells equity shares in the exchange, she can simultaneously instruct the broker to purchase the units of a liquid ETF for an equal amount. Most brokers allow 100 percent of the proceeds to invest in the liquid ETFs on the same day. Currently, the settlement happens in the cash market on a T+2 days basis. On the settlement date, the units of the liquid ETF are credited to the demat account.

You can continue holding your investments in your liquid ETFs till you get a new opportunity to deploy the money. This helps you earn some returns during the period. When you wish to buy some shares, just ask your broker to buy shares using your liquid ETFs.

Second, the units of liquid ETFs can also be used as a cash-equivalent margin in futures and options (F&O) trades. “Liquid ETFs are useful for investors who are transacting in derivative segments,” says Bhuvan, Analyst at Zerodha. The collateral margin received from Liquid ETFs is considered as cash equivalent by the exchanges with a 10 percent haircut.

Fairly liquid instruments

All the three ETFs are traded in the exchanges with ample liquidity. “Further, unlike other ETFs, for Liquid ETFs, buy / sell quotes are provided with very narrow margin. You will see most of the time that bulk orders are executed at Rs 1000.01 and Rs 999.99,” says Anil Ghelani, Head-passive investments and products at DSP MF.

Liquid BeES had a daily average traded amount of Rs 98 crore on the NSE in the last one year. ICICI and DSP liquid ETFs were traded with daily average levels of Rs 2.1 crore and Rs 2 crore, respectively.

Low returns

Liquid ETFs offer only one plan — daily dividend — which is compulsorily reinvested in the ETF. So, the returns accrue to investors in the form of a daily dividend. While Nippon India ETF and DSP liquid ETF provide the additional units for the dividend amount and credit to investors’ demat accounts once a week, ICICI liquid ETF credits the dividend amount directly in investors’ bank accounts once a month.

Though the dividends are in fractional units, they can be sold through brokers using StarMF and MFSS platforms.

AMCs constantly endeavour to keep the daily NAV at Rs 1,000. So, there is no capital gain is applicable. However, the dividends are taxable. “Unit holders are liable to pay tax on such dividend income at the normal applicable tax rates/slab rates, plus surcharge and cess thereon,” says Ghelani of DSP. Also, TDS shall be deducted on the dividend amount exceeding Rs 5,000 in a financial year.

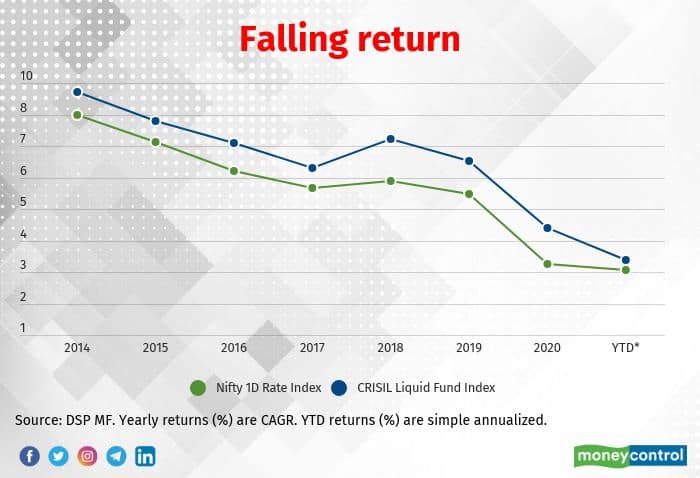

While Nippon India and DSP liquid ETFs follow Nifty 1D Rate Index as their benchmark, ICICI Prudential liquid ETF tracks the S&P BSE Liquid Rate. These benchmarks represent the returns generated by market participants lending in the overnight market. These indices use the “Triparty Repo Dealing System (TREPS)" overnight rate for computation of index values.

“TREPS carries very low credit and interest rate risks,” says Tushar Bopche, Product Head-AUM Business, YES Securities. Currently, the weighted average rate of TREPS is 3.3 per cent.

From an annualised return of 6-7 percent at one point, TREPS’ one-year return dropped to 3-4 percent due to RBI’s measures that eased liquidity conditions in the banking system. The returns from these ETFs are closer to these rates.

Higher charges

The expense ratio of these ETFs is around 60 basis points (bps). This is higher than the average expense ratio (18 bps) of the regular overnight mutual fund category. One basis point is one-hundredth of a percent point. The higher expense ratio is due to the infrastructure set up for the daily dividend option, fund managers say. As the return on Liquid ETFs is low, generally, brokers waive the brokerage and DP charges. There are no securities transaction tax (STT), custodian and transaction charges, resulting in a low costs. However, exchange fee and stamp duty are levied.

One cannot compare the performance of liquid ETFs with liquid/overnight mutual funds or bank FDs as they are operated for different purposes, and hence have separate mandates.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.