Google Pay will soon launch its service on UPI Circle, a new facility announced by the National Payments Corporation of India (NPCI) earlier this month.

The Reserve Bank of India at its August monetary policy committee meeting decided that UPI (Unified Payments Interface) would permit primary accountholders to add family members to their account, allowing the latter to make payments using the primary holder's bank account. The scheme is currently being piloted with a select group of users.

Helping hand for making UPI payments

In short, the feature allows two individuals to use one bank account to make UPI payments. For example, senior citizens (primary users) can delegate transaction authority to their children (secondary users), allowing them to make payments from their (primary users’) accounts.

Here's an easy-to-follow guide to help you navigate Google Pay UPI Circle, add secondary users and make payments.

What is UPI Circle?

The UPI Circle feature allows two individuals to use one bank account (the primary user’s) to make payments digitally. It aims to support those who currently rely on others for financial management, enabling them to take control of their own financial transactions.

Delegation options

Members must ensure that the primary user explicitly authorises the secondary user for either full or partial delegation, providing clear consent and defining the scope of transaction authority.

Full delegation

The primary user can set a monthly payment limit of up to Rs 15,000, enabling secondary users to make transactions within that predetermined threshold.

Partial delegation

The primary user maintains ultimate control, with the ability to review and approve each payment request initiated by the secondary user.

For both instances of delegation, the secondary user needs to accept the primary user’s request within 30 minutes to be added to UPI Circle.

Also read | How NPCI's new UPI Circle feature benefits users and what precautions to take

What are the requirements to add secondary users?

To set up and manage UPI Circle, primary users must have an active bank account or other payment methods linked to the digital payment service provider, in this case, Google Pay. Two, the secondary user's mobile number should be saved in the primary user's phone contact list. Lastly, the secondary users should have a valid UPI ID.

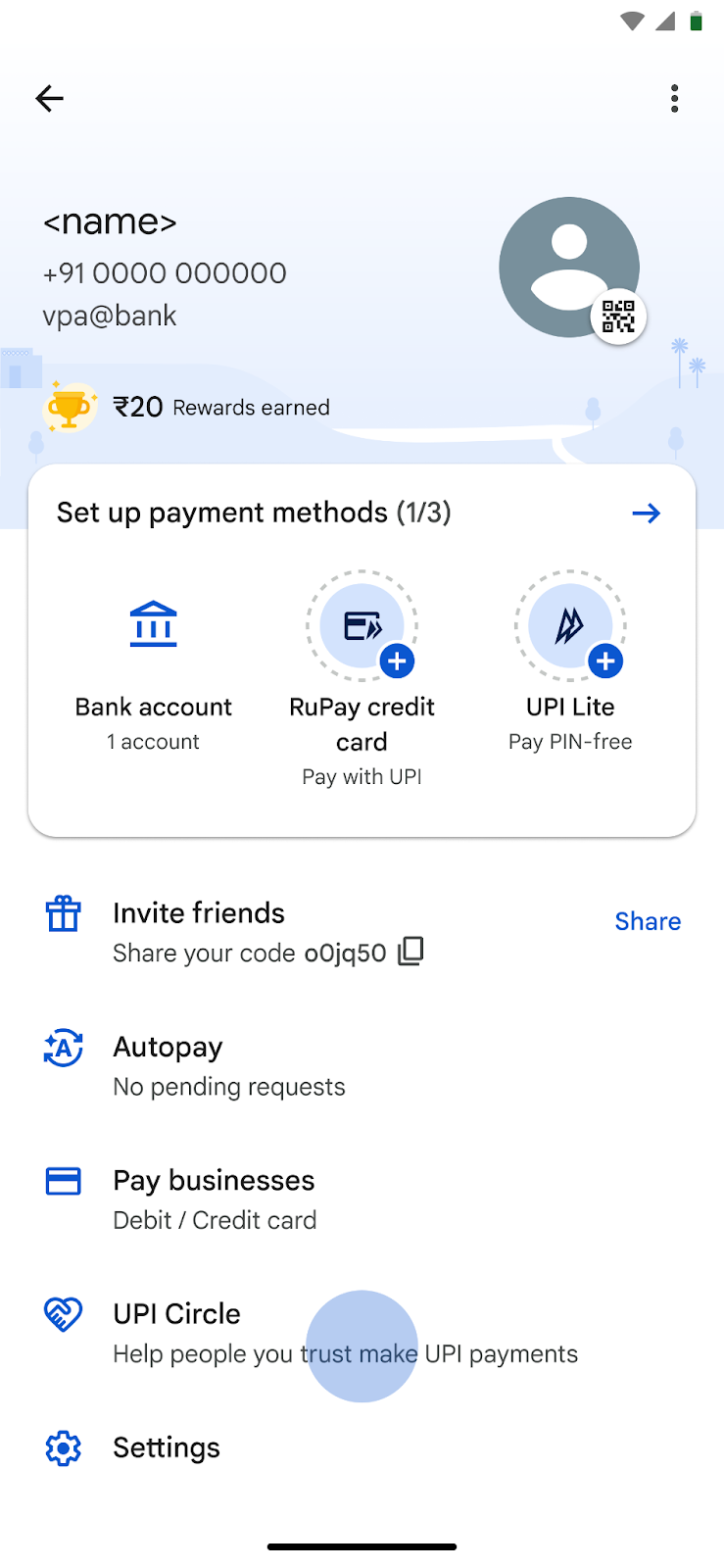

Step 1: Secondary shares QR code with primary user to scan and add a contact

To join UPI Circle, the secondary user must open their Google Pay UPI app, go to their profile section and tap the QR code icon. This will allow the primary user to scan the QR code shared by the secondary user and add them to UPI Circle.

Step 2: Primary user verifies the contact

As a primary user, you also need to confirm you are adding a trusted contact as a secondary user. Hence, you need to search for the secondary user’s contact in your contact list and verify the contact.

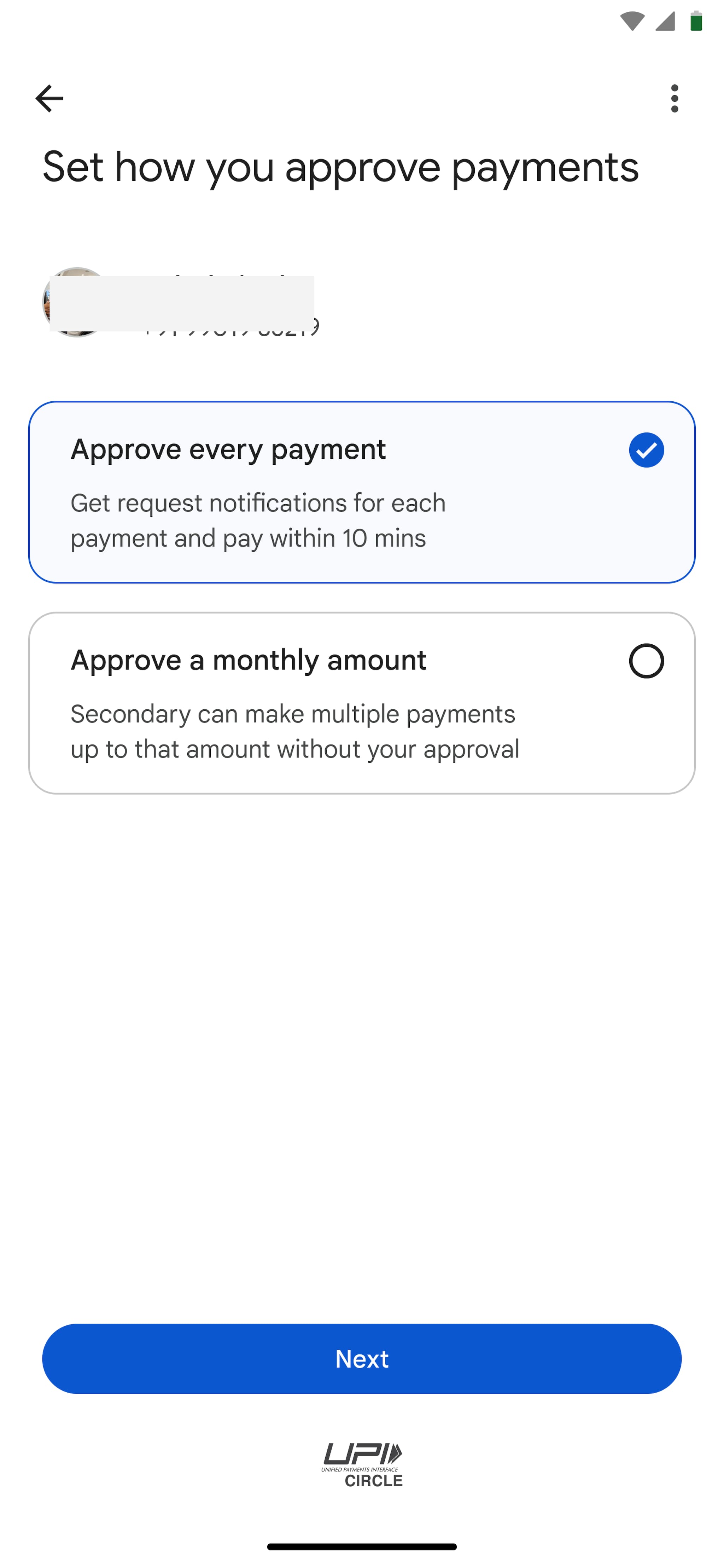

Step 3: Primary user chooses between full or partial delegation options

Primary users need to select whether they want to approve every payment (partial delegation) or approve a monthly amount (full delegation).

In partial delegation, the primary user receives a notification for each payment request from the secondary user. They must approve the transaction within 10 minutes for the payment to go through.

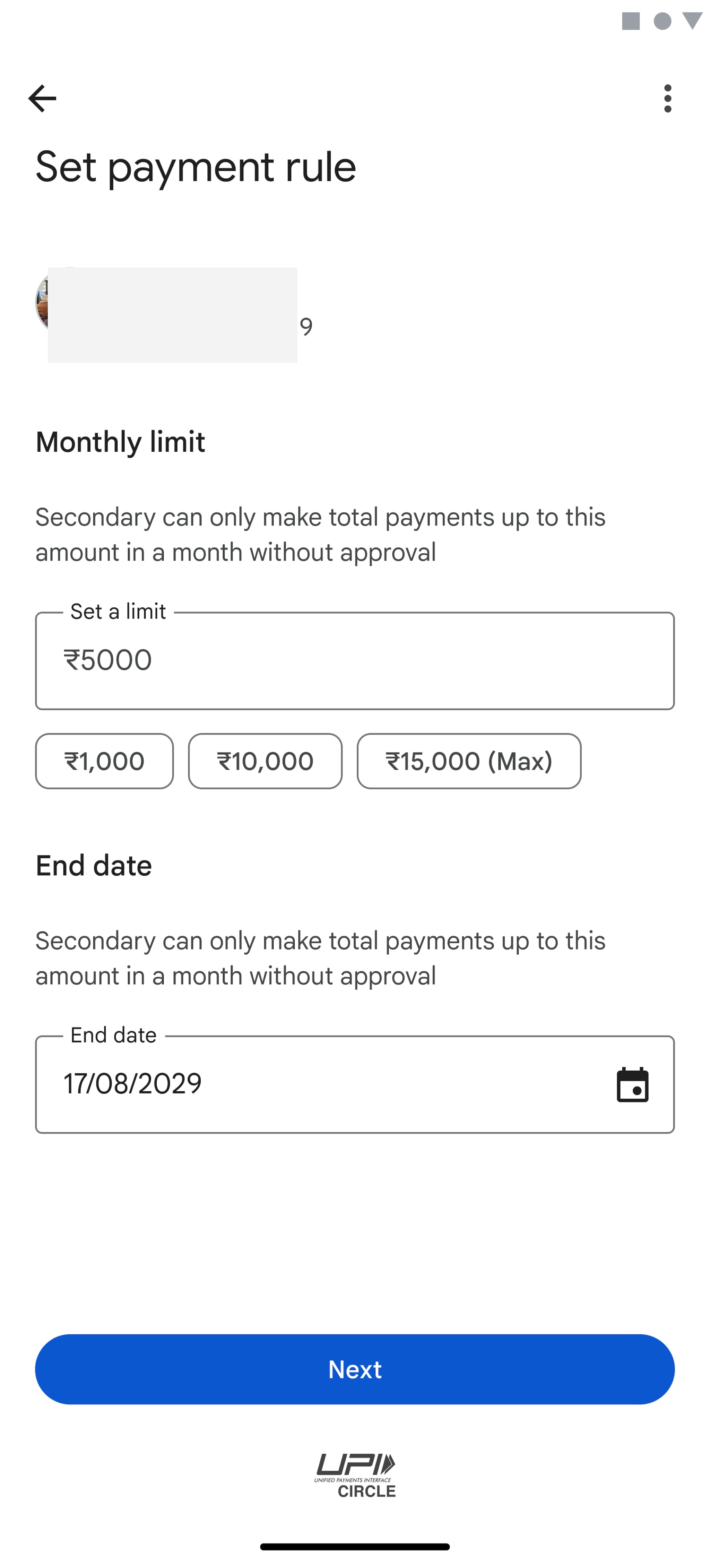

In the case of full delegation, as a primary user, you can set a monthly payment limit for secondary users, allowing them to make multiple transactions up to that amount without requiring further approval. For example, if the primary user sets a monthly limit of Rs 5,000, the secondary user can initiate multiple payments within that limit with no need for additional approval from the primary user. Primary users can also mention the end date in the full delegation payment rule.

Then, for secondary user payments, the primary user selects the payment method (savings bank account linked to UPI or a RuPay credit card linked with Google Pay).

Step 4: Secondary user accepts request to be added to UPI Circle

Once the primary user sends the request, the secondary user receives the invitation to join UPI Circle, accepts the request and becomes a part of the primary user's UPI Circle.

How to make payments using Google Pay UPI Circle

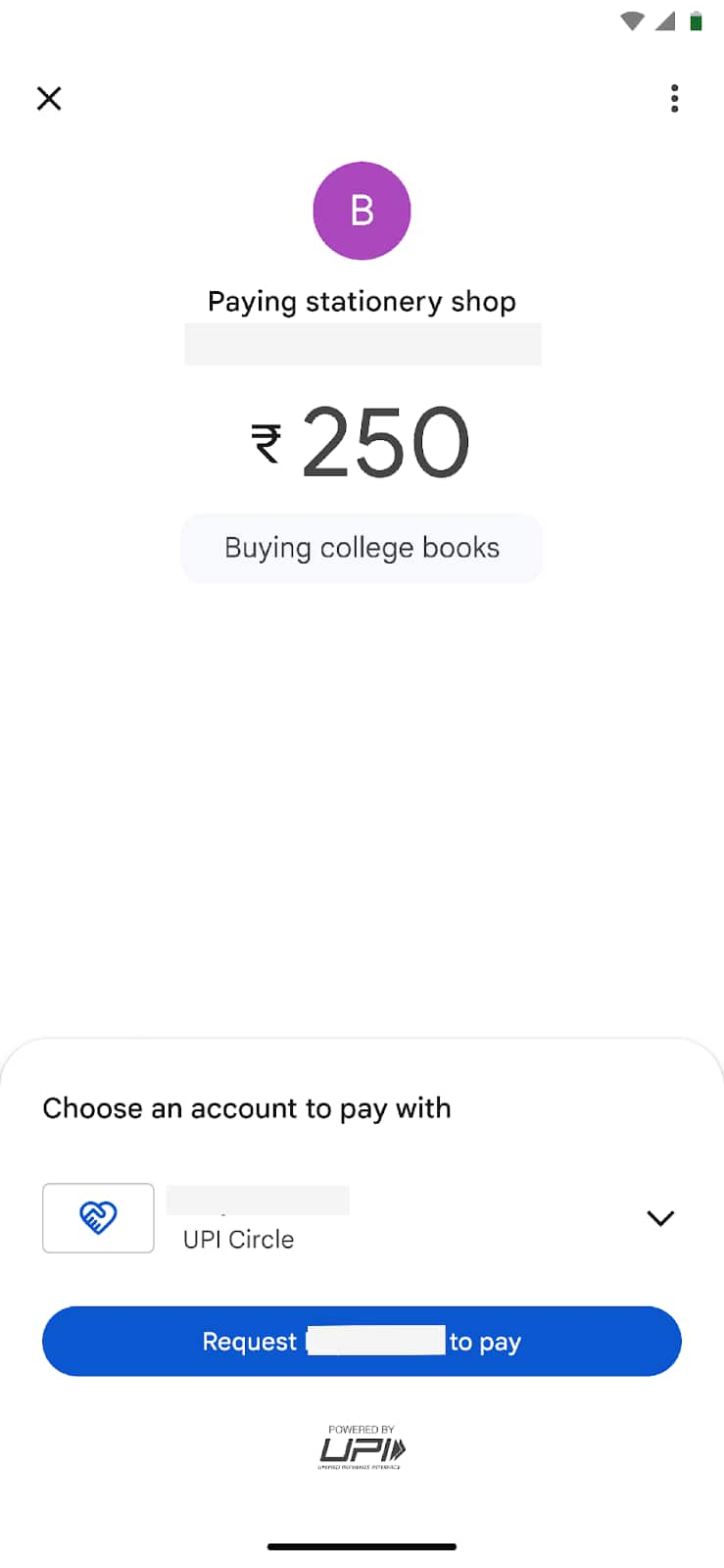

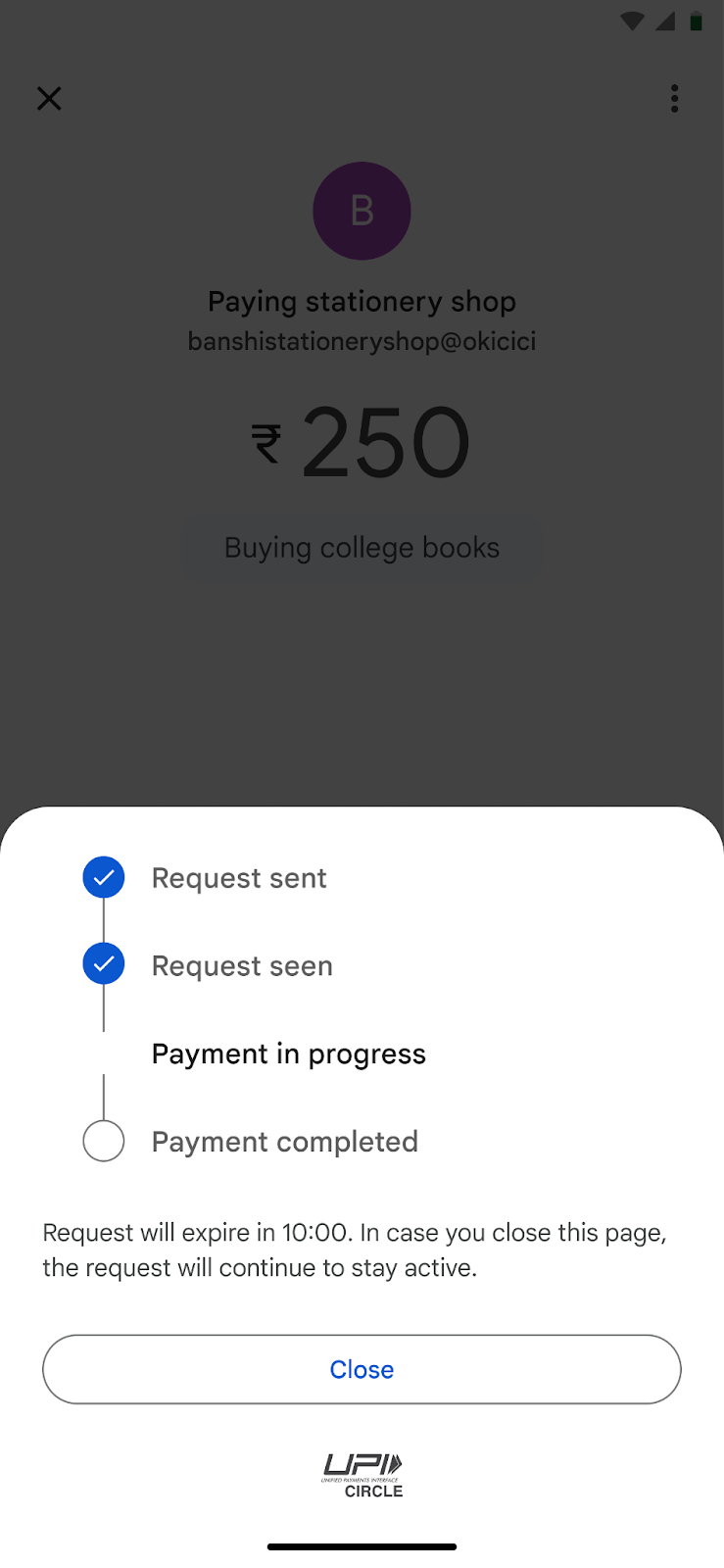

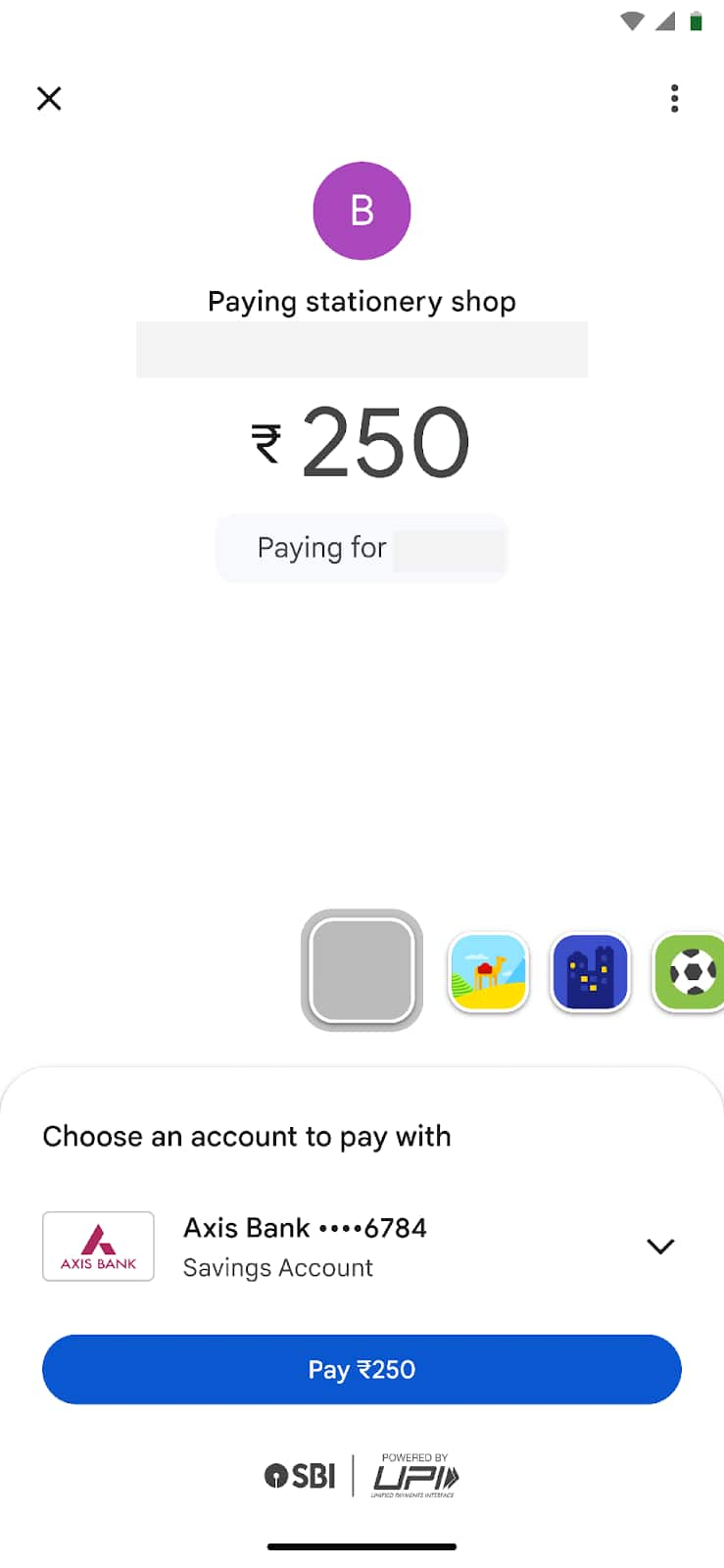

Step 1: Secondary user sends payment request to the primary user

As an example, let’s say the secondary user makes a purchase at a physical store. She can scan the store's QR code, initiate a payment request with the amount, add a note with brief details of the transaction and send the request to the primary user for approval (in the case of partial delegation).

The primary user receives the request and can approve or decline the payment. By approving the request, the primary user authorises the secondary user to complete the transaction.

Secondary users can monitor the status of their payment requests in real time within the UPI Circle page. This allows them to view the payment request status, track the progress of their payment requests and stay informed about the primary user's actions on their requests.

Step 2: Payment confirmation by the primary user

To approve a payment request, the primary user opens the payment request message, taps on ‘Continue to Pay’ and confirms the payment amount.

By confirming the amount, the primary user authorises the payment, enters the PIN and completes the payment. Primary users need to accept the payment request within 10 minutes.

How will the payment process work under the full delegation option?

For full delegation, the following payment limits apply: a maximum monthly payment limit of Rs 15,000 and maximum single transaction limit of Rs 5,000.

Within these limits, secondary users can make PIN-free payments, providing a convenient and seamless payment experience.

After successfully completing a payment through partial or full delegation, secondary users will see a confirmation message in their app, indicating that the payment has been processed successfully.

Also read | Credit on UPI: Convenient loans at your fingertips, but watch for pitfalls

How can a user make her transactions more secure?

To add an extra layer of protection for payments made through partial or full delegation, secondary users are required to have an app lock enabled for Google Pay. This ensures that their payments are secure and protected from unauthorised access.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.