Krishna Karwa

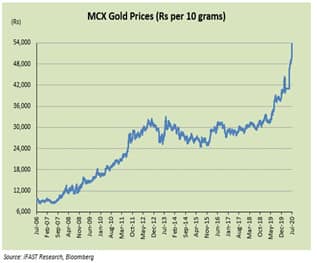

Amid the COVID-19-induced economic disruptions, gold has been the clear outlier with a year-to-date return of 37.2 percent. In an environment characterized by growth/earnings uncertainty, geopolitical tensions and large-scale liquidity infusion, gold is slated to continue its bull run in the near term. Gold has reclaimed its status as the ultimate safe haven investment globally, with a record-breaking six-month surge – the highest in this millennium. Central banks too seem to be trimming their forex reserve holdings in US dollars and substituting them with the precious metal.

Golden Trajectory

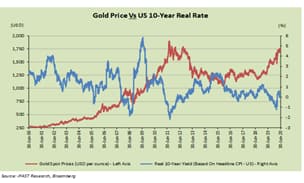

In India, gold prices are determined by trends in the international markets, especially the ones that impact developed markets. This movement makes it relevant to study the correlation between the US economy (the country with the highest gold reserves) and the price of gold.

As the world continues to grapple with an unprecedented slowdown, we believe interest rates will remain low. In the past two decades, whenever there has been a sharp reduction in real rates, gold prices have moved up noticeably. Additionally, we expect more stimulus packages to be announced in the near future to infuse liquidity into the system. This will work in favour of gold, as more often than not, gold and liquidity are positively correlated.

The US dollar appears to be weakening, and we may see more fluctuations in the currency markets. This volatility, again, will highlight gold’s advantages as a metal that cannot be printed at will, and whose supply is finite.

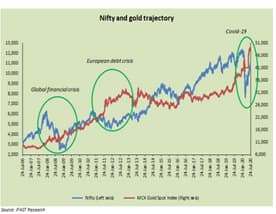

When it comes to equity, barring select stocks, we don’t expect broader equity markets to see a marked re-rating anytime soon. And historically, gold has done well whenever international equities have shown signs of stress. In the Indian context, we have seen this during the global financial crisis (2008-09) and European debt crisis (2011-13).

Notwithstanding the rally seen in recent months, we opine that there is room for a further rally in gold prices. That said, there could be nominal dips at regular intervals due to profit taking, hopes of a medical solution and sluggish demand.

How to Invest in Gold

As an asset class, gold is best looked at from a hedging mindset, and not an alpha generation one. Though it does well in turbulent times, by and large, it tends to trade in a range-bound fashion after the rally fizzles out and prices correct a bit.

Timing wise, our stance on gold is bullish from the short to medium horizon. Unless the economic damage is higher and continues for much longer than envisaged, we see downward price pressure in the long run from current levels. Some vaccines are already in stage 3 of the human trial process. As soon as a feasible vaccine for COVID-19 is announced, optimism about an economic comeback will cause money to flow back into equities and gold could lose its sheen. Keeping tabs on such developments will enable a timely exit.

The choice of product used for investing in gold is also important.

Physical gold can be purchased from jewellers, banks, designated post offices or through a commodity exchange. Furthermore, by depositing margin money, you can deal in gold derivatives through the multi-commodity exchange (MCX).

While India's love for physical gold is understandable, from an investment perspective, it is disadvantageous. It entails a high cash outflow even if a simple gold coin, weighing just a few grams, is bought. Making charges and storage costs (in bank vaults) are also on the higher side. Frauds linked to authenticity are common. And lastly, finding a buyer is difficult when prices are steep.

Sovereign gold bonds (SGBs) are issued by the Reserve Bank of India, on behalf of the government. The investment window is open only for a given number of days in specific months. You can invest an amount equivalent to a minimum of 1 gram and a maximum of 4 kilograms of gold in each financial year.

Since these are fixed-income instruments, a coupon interest at the rate of 2.5 percent per annum is received by investors at half-yearly intervals (i.e., 1.25 percent every 6 months). This interest is fully taxable, while repayment of principal, made at the end of 8 years, is fully tax-exempt. The redemption value is calculated as number of units held x price per unit on that day.

Gold funds and ETFs are becoming more popular by the day. Besides being assured of the quality of gold, investors can buy/sell units anytime. Furthermore, NAVs are pretty close to the actual gold prices in the domestic market, thereby ensuring that tracking errors are lower. Generally, there is no entry load in either case. Minimum initial investment is significantly lower vis-a-vis physical gold too.

Gold funds typically invest most of their assets under management (AUM) base in a gold ETF of the same fund house. A small portion may be invested in gold mining companies as well. The exit load is 1 percent if the units are sold within one year from the date of allotment.

In the present situation, timing of entry into and exit from gold rather than following a buy-and-hold approach may be needed. Only gold funds and gold ETFs allow you the flexibility to do so. But timing of investments is not easy for retail investors.

We would not recommend allocating more than 10-15 percent of your portfolio to gold.

(The writer is Senior Research Analyst, iFAST Financial India)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.