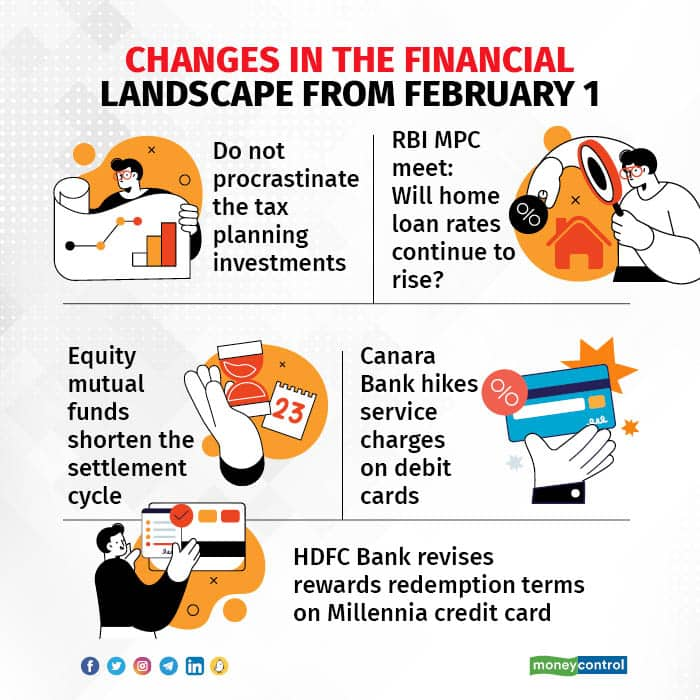

We are sometime away from the next financial year but there are several changes this month on the financial front along with tax planning on which you may need to act.

Whether you have an existing loan or plan to take one keep an eye on the Reserve Bank of India (RBI) policy announcement. Using debit and credit cards? Some banks have effected important changes this month that will pinch your purse.

Start your tax planning if haven’t startedTax optimisation should always be a part of your financial planning exercise and not a task to be completed towards the end of the financial year. If you haven’t started with your tax planning, then do it now as we are just two months away from March 31, the end of the financial year. Invest wisely, considering your financial goals. You can achieve your tax planning goals by investing in existing commitments, which might include your public provident fund (PPF), National Pension Scheme (NPS), Sukanya Samriddhi Yojana (SSY), monthly SIP in equity linked savings scheme (ELSS), employees provident fund (EPF) or life insurance premium.

Buy health insurance to get additional tax benefits under Section 80D of the Income-Tax Act, up to Rs 25,000 each for self, spouse and children. The same limit of Rs 25,000 is applicable for your parents as well, if they aren’t senior citizens, yet.

Another rate hike before taking a pause?The RBI’s next monetary policy announcement is scheduled for February 8.

The Monetary Policy Committee (MPC) increased the repo rate by 225 basis points in 2022 to 6.25 percent. One basis point is one-hundredth of a percentage point. The consecutive rate hikes were to control the rising inflation.

Economists expect the RBI may hike the repo rate by another 25 or 35 basis points in its February policy before taking a pause.

If there is another rate hike, banks will once again increase interest on home loans and other loans linked to the repo rate as an external benchmark, as per the terms of loan agreements.

Asset management companies in India will move to T+2 — short for "trade date plus two days" — redemption payment cycle for equity schemes from February 1. The move has come on the heels of Indian equity markets moving to a T+1 settlement cycle for all stocks, shortening the settlement cycle by a day and making the availability of funds a day sooner than at present.

Canara Bank hikes service charges on debit cardsEffective February 13, Canara Bank has hiked its service charges on debit cards. The bank has increased the annual fees from Rs 125 to Rs 200 for classic debit cards. Similarly, it has hiked the annual fees for platinum and business debit cards to Rs 500 from Rs 250 and Rs 300, respectively. The annual charges remain unchanged at Rs 1,000 for a select variant of the card. The bank has hiked the charges for card replacement to Rs 150 from Rs 50 charged earlier. For SMS alerts the bank was charging a flat fee of Rs 15 per quarter. Now, the SMS charges will be on actuals.

HDFC Bank revises terms for rewards redemption on Millennia credit cardMillennia credit card holders of HDFC Bank make a note of revised terms for rewards redemption. With effect from February 1, cardholders can redeem up to 70 percent of product value through reward points on selected products and pay the remaining amount via credit card. Also, reward points redemption for cashback is capped per calendar month to 3,000 reward points.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.